Proactive Liquidity for Peak Season – Financial Advantage for Large-Scale Ticket Agencies

The peak tourism season is in full swing across the country, bringing a surge in travel, accommodation, and leisure activities. According to the latest figures from the Statistics Bureau, Vietnam welcomed a record-breaking 12 million international arrivals in the first seven months, a nearly 23% increase from the previous year. Domestic travel also saw impressive growth of 18.1%, especially in coastal cities and integrated resorts.

To meet this increased demand, large-scale travel agencies, and tourism service distributors are accelerating their expansion, enhancing service quality, and capturing market share. However, managing cash flow becomes a significant challenge as the need for advance payments and ticket settlements rises while the recovery period elongates.

Understanding the challenges faced by growing businesses, the National Commercial Joint Stock Bank (NCB) has launched a specialized funding program for airlines, travel, entertainment, and resort agencies through overdraft and working capital financing solutions. NCB’s tailored approach empowers agencies to access funds for ticket payments and operational expenses during peak seasons, enabling them to seize large-volume orders, maintain continuous operations, and execute effective sales campaigns.

NCB provides overdraft and working capital financing to support ticket agencies’ liquidity during peak demand.

|

In parallel, NCB offers a range of specialized financial solutions, including flexible advance ticket loan repayment terms that align with seasonal revenue fluctuations, and payment guarantee services to expedite debt collection and improve capital turnover. Complementary foreign exchange and insurance services further mitigate peak-season risks, control costs, and enhance financial management efficiency.

Fortifying Financial Strength for Securities Companies Riding Market Waves

Securities companies are also undergoing a transformative phase, particularly in their quest to invest in digital transformation and expand their ecosystem of products and services. However, the primary obstacle for businesses in this sector is the lack of suitable collateral to access traditional credit facilities.

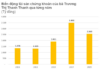

Recognizing this need, NCB has tailored a credit program offering up to 90% financing with interest rates as low as 2.9% annually for government bond investments by securities companies. This solution is meticulously crafted for securities companies with annual financial revenues of VND 100 billion or higher, empowering them with financial agility, optimized investment efficiency, and strengthened market competitiveness.

NCB offers up to 90% funding for large-scale securities companies to bolster their financial prowess.

|

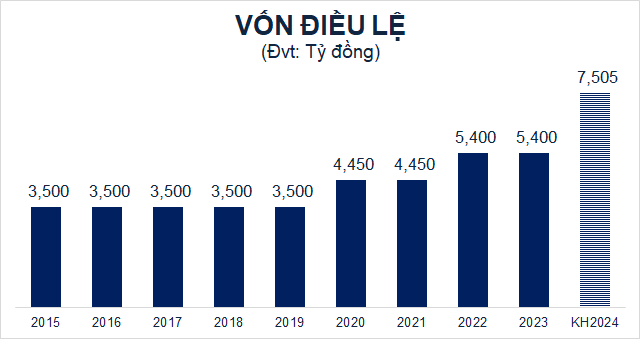

In 2025, with a comprehensive strategic business overhaul, NCB has consistently enhanced its operational efficiency and financial strength. As of June 30, 2025, the bank’s total assets exceeded VND 144,054 billion, reflecting a 21.6% increase from the end of 2024 and surpassing the full-year plan by 6.3%. NCB also received approval from the State Securities Commission to increase its charter capital to VND 19,280 billion, marking the third consecutive capital increase in four years.

With its robust financial foundation and industry-specific credit solutions, NCB solidifies its position as a trusted strategic partner for large-scale enterprises in key economic sectors. NCB empowers businesses to enhance their competitive edge and be poised for accelerated growth in this new era.

For detailed information, customers can visit NCB’s website at https://www.ncb-bank.vn/, contact NCB branches/transaction offices nationwide, or call the hotline (028) 38 216 216 – 1800 6166.

– 17:21 21/08/2025

The Bank that Goes Beyond Wealth: MB Priority Redefines “Happiness” for Premium Finance

MB has unveiled its new brand message, “MB Priority – Happiness in Every Moment,” through a thought-provoking discussion titled “Naming Happiness.” The campaign, centered on a survey that garnered thousands of responses, reflects MB’s unique philosophy. Instead of solely focusing on financial gains, the bank chooses to prioritize happiness as the cornerstone of its connection with customers.

What Foreign Investor-Owned Banks Are Selling Off?

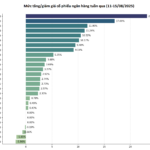

Last week (August 11-15, 2025), bank stocks surged amid a wave of positive news, sparking a buzz in the financial world.

Market Beat: Foreigners Maintain Heavy Sell-off, VN-Index Retreats to 1,630 Points

The trading session concluded with the VN-Index dipping 10.69 points (-0.65%), settling at 1,630 points. Likewise, the HNX-Index witnessed a decline of 2.81 points (-0.99%), closing at 282.34 points. The market breadth tilted towards decliners, as 609 stocks closed in the red, while 242 stocks ended in the green. The VN30 basket mirrored this trend, with 19 stocks losing ground against 9 gainers and 2 stocks remaining unchanged.

The Stock Market Soars to New Heights

“An array of stocks with impressive returns, often exceeding multiples of the initial investment, has captivated the attention of many individuals, enticing them to channel their funds into this lucrative avenue.”