“**VNBA Discusses Strategies for a Robust and Transparent Credit Information Market with CIC and Industry Players**”

On August 19, 2025, in Hanoi, the Vietnam Banks Association (VNBA) held a meeting with the National Credit Information Center (CIC) and several member credit information companies to discuss strategies for fostering a transparent and efficient credit information market, in line with the government and State Bank of Vietnam’s directives.

Ms. Nguyen Thi Tuyet Nhung, CEO of KCI Joint Stock Credit Information Company, shared her insights at the meeting, emphasizing the need for a more robust development of the credit information market in several aspects. These include a comprehensive and diverse database, a wider range of products and services catering to diverse customer segments, and a more refined legal framework that aligns with international standards to ensure sustainable growth.

To achieve these goals, Ms. Nhung proposed that in addition to data from banks and financial institutions, there should be a mechanism to leverage data from fintech companies, pawnshops, national data centers, and behavioral and digital data. By sharing data among credit information companies, a comprehensive shared database could be established within the next three years.

In terms of products, Ms. Nhung suggested that in addition to traditional credit reports, the market should develop new products based on big data analytics to cover a broader range of customers. Regarding legal aspects, she pointed out current limitations on the scope of credit information companies’ operations and emphasized the need for stricter regulations to prevent the mere collection of raw data while providing services, which could lead to unnecessary costs for banks and potential legal risks.

Ms. Nhung expressed her desire to foster long-term collaboration in three key areas: data, products, and legal framework. This, she believes, will lay the foundation for a transparent, efficient, and internationally integrated credit information market in Vietnam.

During the discussion, the credit information companies, along with the CIC, shared their experiences and affirmed their willingness to cooperate in developing a national credit ecosystem. They aim to create more value-added products, enhance risk management, and improve the quality of credit services.

Some participants suggested that mandating the sharing of all customer data in the current legal framework might not be feasible due to insufficient enforceability. Instead, they proposed a pilot mechanism with a limited scope as a practical solution. This approach aligns with the current legal framework and sets the stage for future upgrades to more potent legal instruments.

Ho Chi Minh City Proposes Data Collaboration for Forthcoming Motorcycle Emission Tests

The data shared by the Vietnam Registry has proven to be a valuable asset for Ho Chi Minh City authorities. By leveraging this information, the city has been able to promptly identify irregularities and evaluate vehicle inspection activities at designated inspection facilities. This collaborative effort ensures the maintenance of road safety standards and the efficient management of vehicle inspections in Ho Chi Minh City.

“Regulator and Large Financial Institutions’ Involvement Makes the Digital Asset Market More Efficient, Says SSI’s Director.”

“The crypto market in Vietnam is currently dominated by individual investors, with almost 100% of transactions originating from this demographic. Major institutions like Dragon Capital, VinaCapital, and SSI have yet to fully engage in asset management roles within this space. ‘When this changes, the market will mature and become more regulated,’ says Thomas Nguyen, SSI Securities’ Overseas Markets Director.”

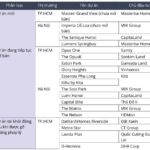

“The Avison Young CEO on 2024: A ‘Year of Change’ and the Real Estate Market’s Readiness for a New Cycle”

David Jackson, Managing Director of Avison Young Vietnam, emphasizes that the significant changes in 2024 regarding policies, investment trends, and the business landscape form the basis for maintaining an optimistic outlook for the Vietnamese real estate market in this new growth cycle.