“VPBank Strengthens Its Internal Position and Significantly Improves Asset Quality”

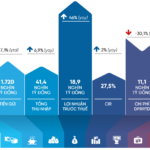

In a context where the asset quality of the entire banking sector continued to deteriorate in the first half of the year, Vietnam Prosperity Joint-Stock Commercial Bank (VPBank, HOSE: VPB) went against the trend, recording a notable improvement. According to a summary of the financial reports of 29 banks, VPBank was among the eight banks that reported a decrease in bad debt ratio in Q2 2025 compared to the beginning of the year.

Specifically, VPBank’s individual bad debt ratio as per Circular 31 had dropped to 2.31% by the end of June 2025. Notably, Group 2 debt continued its downward trend for the fourth consecutive quarter, indicating positive prospects for enhancing asset quality. In the first half of the year, the recovery from consolidated risk-handled loans exceeded VND 1,700 billion. Thanks to effective credit risk management and enhanced debt collection efforts, VPBank’s individual credit costs fell below 2%, in line with the orientation set at the beginning of the year.

These positive results reflect VPBank’s strategic thinking and proactive approach, as early as 2024, the bank established the Debt Collection and Handling Block (DCD) to specialize in asset management. As the credit portfolio expanded, the product portfolio diversified, and the customer base widened, this move has helped VPBank improve risk management efficiency, thereby sustainably enhancing asset quality.

At the recent Investor Conference, Mr. Phung Duy Khuong, Vice Chairman of the Board of Directors in charge of the Southern Region and Head of VPBank’s Retail Banking Division, in charge of managing the DCD Block, said that VPBank continues to improve the operations of the DCD Block towards deeper specialization and professionalism. The bank also implements customized debt collection strategies for each customer group and specific products to enhance productivity and effectiveness.

Along with upgrading its organization, VPBank also accelerates the digitization of debt collection activities, especially in the personal unsecured loan segment, which currently accounts for about 20% of total outstanding loans. According to Mr. Khuong, using human resources to handle low-value loans or loans overdue for more than 540 days is no longer optimal. Therefore, the bank has proactively invested in artificial intelligence (AI) and automation tools such as callbots and chatbots to expedite the collection process, optimize costs, and reduce the workload on the personnel.

Legalization of Resolution 42 – A Legal Boost for VPBank’s Asset Quality

In addition to its proactive debt management strategy, VPBank’s asset quality is expected to improve significantly due to a boost from the legal corridor. Specifically, the legalization of Resolution 42 in the Law on Credit Institutions (amended) will empower banks, including VPBank, with the right to seize collateral when customers violate their payment obligations.

VPBank’s Executive Vice President forecasts that the new regulation will create a more favorable, transparent, and clear legal corridor, positively impacting the bank’s debt collection and handling process in four crucial ways. First, the legalization of the right to seize collateral provides a solid legal basis, allowing the bank to proactively implement recovery measures without solely relying on complex, lengthy, and costly litigation procedures.

Second, the simplification of legal procedures helps shorten debt handling time, thereby quickly releasing frozen capital for reinvestment in more efficient business activities. Third, a clear legal framework reduces costs and legal risks throughout the debt handling process, which has been a barrier that made many banks hesitant to implement forceful measures.

Lastly, according to Mr. Khuong, when effective asset seizure measures are in place, customers will be more conscious of their financial obligations, leading to better coordination with the bank in restructuring or handling debts instead of deliberately prolonging the process, causing losses for both parties.

Thanks to its well-prepared internal strengths, VPBank is currently assessed by many organizations as one of the banks best positioned to take advantage of this new legal framework.

“We believe that large banks with high provisioning costs, such as VPB, CTG, and small-sized banks like OCB, MSB, and VIB, will benefit more than the rest if this draft is passed,” said MBS Securities in its assessment of the banking outlook with the legalization of Resolution 42.

Dragon Capital Securities (VDSC) also assessed that the legalization of Resolution 42 would bring significant benefits to the entire industry, especially for banks with a high proportion of retail credit like VPBank. The reason is that the process of seizing and handling collateral for retail loans is often less complex than for corporate customers. Moreover, the new regulation helps banks significantly reduce bad debt handling costs, as they no longer need to spread their resources across many provinces to carry out the litigation procedure for seizing collateral as before.

Additionally, Vietcap Securities and KB Vietnam Securities (KBSV) both appraised that Resolution 42 would positively impact VPBank’s prospects. Specifically, Vietcap Securities expected VPBank’s debt collection efficiency in 2025 to improve significantly, thereby reducing pressure from funding costs and competitive interest rates.

KBSV anticipated that VPBank could shorten the time for handling collateral with the new regulation, increasing income from bad debt recovery. With the current off-balance-sheet loan portfolio, KBSV estimated that the bank’s bad debt income would be “not insignificant, contributing to total operating income.”

Minh Tai

– 13:11 18/08/2025

The First Vietnamese Bank to Hit the 3-Million-Billion-Dong Mark: A Monumental Achievement

“This bank currently leads the banking system in all three financial indicators: asset scale, customer loan balance, and bank deposits. With an impressive performance, it has solidified its position as a top financial institution, outperforming its competitors and establishing itself as a powerhouse in the industry.”

The Banking Giant Slashes Its Physical Presence: Shuttering 66 Branches in an Unprecedented Move

The recent wave of layoffs in the second quarter of 2025 has been a challenging time for many. With a focus on streamlining and cost-cutting measures, organizations across industries have had to part ways with valuable talent. As we move forward, it’s essential to reflect on the impact of these decisions and the potential consequences they may have on the future landscape of various sectors.

Are Bank Stocks a Bargain Buy?

The banking sector is currently undervalued, trading at around -0.5std according to Mirae Asset. This presents a prime opportunity for investors to gradually accumulate bank stocks.