“VPBank Surges Ahead: A Comprehensive Overview”

VPB, the stock symbol for VPBank, witnessed a remarkable surge during the August 20 trading session, closing at a substantial price of over 36,550 VND per share. This follows a similar dramatic increase during the previous day’s trading on August 19. Since the beginning of August, VPB has skyrocketed by an impressive 41.6%.

Today’s closing price translates to a market capitalization of 290 trillion VND for VPBank, which equates to nearly 11 billion USD. This positions VPBank as the second-largest bank in terms of market capitalization on the stock exchange, closely following Vietcombank, which boasts a capitalization of 526 trillion VND.

VPBank is currently at the center of investors’ attention as its subsidiary, VPBank Securities Joint Stock Company (VPBankS), recently announced a resolution by its Board of Directors to seek the approval of existing shareholders through a written vote. While VPBankS has not disclosed the specific agenda items, sources indicate that one key matter is the company’s plan to conduct an initial public offering (IPO) in the upcoming fourth quarter.

As part of VPBank’s financial ecosystem, the anticipated IPO of VPBankS is expected to generate significant revenue for the parent bank and provide a boost to its long-term growth prospects.

Furthermore, another supportive factor for VPB’s stock performance is the recent issuance of Circular No. 23/2025/TT-NHNN by the State Bank of Vietnam, which will come into effect on October 1, 2025. This circular reduces the mandatory reserve ratio by 50% for credit institutions that are subject to compulsory transfer and support under approved plans. Vietcombank, HDBank, MB, and VPBank are among the banks that stand to benefit from this new regulation.

In related news, Ms. Bui Cam Thi and Ms. Bui Hai Ngan, daughters of Mr. Bui Hai Quan, Vice Chairman of VPBank’s Board of Directors, have recently registered to purchase a total of 40 million VPB shares. The transactions are expected to take place between August 25 and September 23, 2025, through either order matching or negotiated contracts. Prior to this, neither Ms. Thi nor Ms. Ngan held any VPB shares.

Unlocking VPB’s Stock Potential: The CASA Advantage

In the first half of 2025, VPBank witnessed an impressive growth in its CASA, reaching a scale of nearly VND 100,000 billion, thanks to a series of breakthrough initiatives. This remarkable achievement has played a pivotal role in sustaining the bank’s robust profit growth. As a testament to its success, the bank’s stock, VPB, has consistently reached new heights, attracting significant foreign investment.

Market Beat: Profit-Taking Pressure Mounts, VN-Index Retreats.

The selling pressure intensified, causing key indices to sink into the red by the end of the morning session. At the mid-session break, the VN-Index hovered near the reference level, settling at 1,639.45 points; while the HNX-Index stood at 282.49 points, a decline of 0.93%. The number of declining stocks is gradually gaining the upper hand, with 540 losers versus 207 gainers.

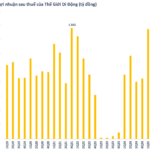

The Magic Formula to Boosting The Gioi Di Dong’s (MWG) Profit Margins

VCBS estimates that approximately 800 MWG stores will reach the end of their depreciation life this year, resulting in a significant cost saving of nearly VND 900 billion for the company and a positive boost to its profit margin.