On August 29, the Southern Waterway Joint Stock Company (Sowatco, code: SWC) will finalize its list of shareholders to distribute 2024 dividends in cash. The payout ratio is 35%, meaning that for every share owned, shareholders will receive VND 3,500. The expected payment date is September 15, 2025.

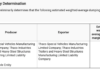

With 67.1 million shares circulating, Sowatco will need to allocate approximately VND 235 billion for this dividend payment. In 2024, Sowatco recorded a revenue of over VND 1,151 billion, a nearly 40% increase compared to the previous year. Net profit rose by 20% to VND 274 billion, resulting in an EPS of VND 4,086. The company has set aside nearly 86% of its 2024 net profit for dividend distribution.

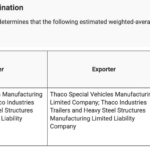

The Southern Waterway Joint Stock Company, formerly known as the Southern Waterway Corporation, has been operating as a joint-stock company since June 9, 2009. Its primary business activities include shipbuilding and floating structures, repair and maintenance of transport vehicles (excluding automobiles, motorcycles, and other motor vehicles), and inland waterway transportation.

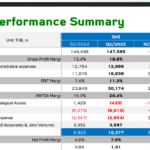

In terms of Q2 2025 performance, revenue witnessed a slight decrease of nearly 2%, settling at VND 275 billion. However, a more substantial reduction in cost of goods sold resulted in a 17% surge in gross profit compared to the same period last year, reaching nearly VND 63 billion. Net profit for the quarter stood at nearly VND 80 billion, marking an impressive 28% increase year-over-year.

For the first half of the year, the company posted a revenue of VND 535 billion and a net profit of VND 143 billion, reflecting a 5% and 23% growth, respectively, compared to the previous year. As of June 30, 2025, SWC’s retained earnings amounted to nearly VND 1,348 billion.

On the stock market, SWC shares are currently trading at VND 36,400 per share, approaching their all-time high of VND 37,300 set in September 2021.

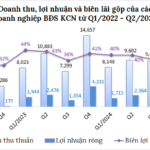

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.

“Real Estate Firms’ Profits Soar: First-Half Yearly Earnings Up 150%”

The Vietnamese real estate market witnessed significant fluctuations and a strong segmentation across segments and regions in the first half of 2025. Amidst these dynamics, listed real estate enterprises surprisingly reported a 50% surge in net profits compared to the same period in 2024, showcasing their resilience and adaptability in a challenging environment.

“Agri-Giant C.P. Vietnam Takes a Hit: Revenue Down 21% Post Sick Pig Scandal”

Charoen Pokphand Foods (C.P. Foods), a leading Thai conglomerate, witnessed a slight dip in its global revenue for Q2 2025, with Vietnam being the primary contributor to this decline.