Digital assets are gaining traction as a prominent investment topic in Vietnam recently. On the stock market, the shares of a company somewhat related to this field, Joint Stock Company Investment HVA (code: HVA), have also surged. After two consecutive ceiling sessions, HVA reached a new peak with a market price of 18,900 VND per share, triple the price at the beginning of the year.

According to the company’s website, HVA operates in various fields, including (1) Banking and Investment Services; (2) Investment in Innovation; (3) M&A Advisory and Consulting Services; (4) Financial Support Services; (5) Wholesale of precious metals and raw gold; (6) Investment in Franchising; (7) Investment in Industrial Real Estate; and Technology Products for Investment Support.

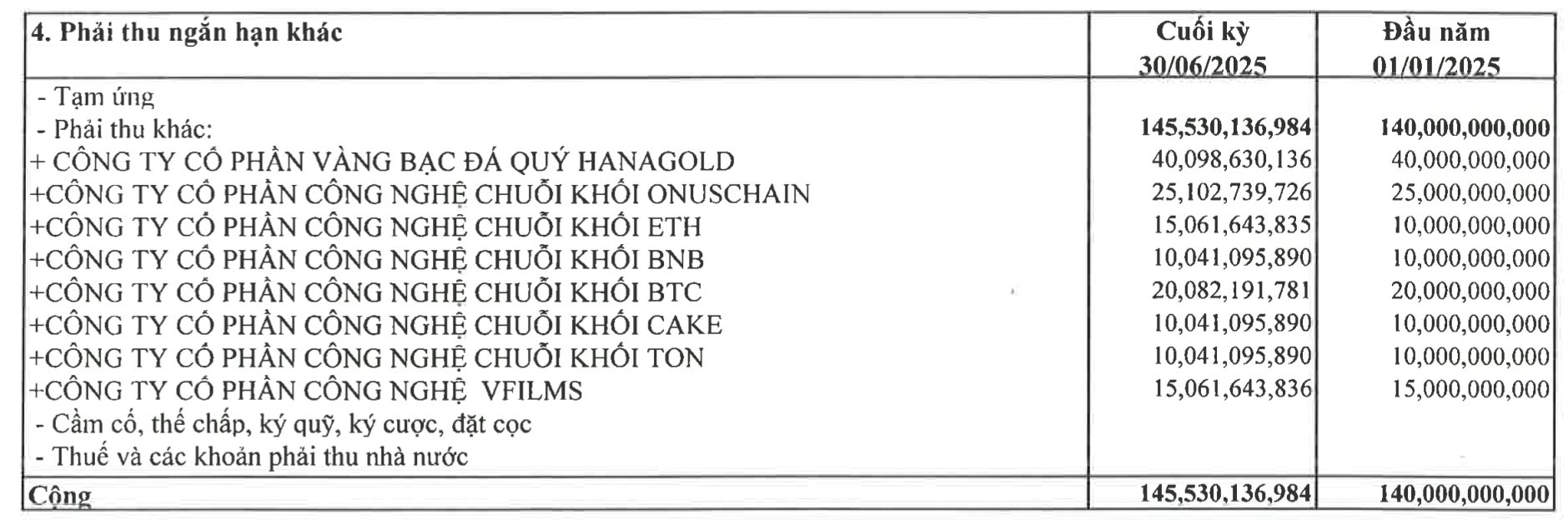

Notably, HVA’s disclosed investment portfolio includes BCC contracts on various assets, such as gold, cash, and notably, digital assets. Their partners include Joint Stock Company Blockchain Technology ETH, Joint Stock Company Blockchain Technology BTC, and Joint Stock Company Blockchain Technology BNB, among others. The names of these entities easily evoke associations with popular digital assets like Bitcoin, Ethereum, and Binance.

As per the company’s website, HVA’s total investment capital is nearly 141 billion VND, with a provisional profit of 98.25%. All component investments initiated in 2024 are currently yielding profits ranging from tens to hundreds of percent. Interestingly, the APY (Annual Profit Rate) disclosed by HVA is only 5%, which is on par with the current 12-month deposit interest rate offered by banks.

According to the second-quarter 2025 financial report, as of June 30, HVA’s equity was nearly 151 billion VND, and total assets exceeded 157 billion VND, a slight increase from the beginning of the year. The BCC contracts are recognized under other short-term receivables and are not direct investments made by HVA.

In the second quarter, HVA recorded financial revenue of nearly 1.8 billion VND, mainly from business cooperation contract profits. The cumulative figure for the first six months was nearly 3.5 billion VND. This income generated profits for HVA, while the gross profit barely covered the enterprise management expenses.

Specifically, in the second quarter of 2025, HVA recorded a gross revenue of over 20 billion VND, 70 times higher than the same period last year, but the gross profit was only 1.4 billion VND, while enterprise management expenses reached nearly 1.9 billion VND. Thanks to financial revenue, HVA’s after-tax profit exceeded 1 billion VND, 2.5 times higher than the previous year.

For the first six months, HVA recorded a gross revenue of nearly 41 billion VND and a post-tax profit of 3.3 billion VND, 87 times and 18 times higher than the same period in 2024, respectively. Financial activity revenue (mainly business cooperation contract profits) stood at 3.5 billion VND, more than four times higher than in 2024.

With a capital of approximately 140 billion VND, the six-month profit of 3.5 billion VND translates to an annual profit rate of 5% – matching the APY advertised on the company’s website. Despite their partners reaping substantial profits from digital asset investments, HVA only retains a modest profit relative to its invested capital.

Overall, digital assets are a trending investment choice, especially as popular cryptocurrencies like Bitcoin and Ethereum continuously reach new highs, fostering growing confidence. Globally, many struggling companies are betting on digital currencies to attract investors, raise capital, and boost stock prices. This trend partly stems from investors’ demand to indirectly invest in digital assets without directly holding them.

In Vietnam, the National Assembly officially passed the Law on Digital Technology Industry at its 9th session in mid-June, marking the first time that the concepts of digital and encrypted assets were incorporated into legislation. The International Financial Center being established in Danang is an integral part of developing the digital asset market. Additionally, prominent financial institutions like MB, SSI, and TCB have made moves to enter this promising market.

A BCC (Business Cooperation Contract) is a form of investment where parties collaborate without forming a new legal entity, sharing profits or products from their joint business activities.

“Vingroup: A Testament to the Visionary Leadership of Billionaire Pham Nhat Vuong”

Vingroup Group was bestowed with the First-Class Labor Order for its exceptional achievements in constructing and preponing the operation of the National Fair and Exhibition Center by 15 months.

“Agri-Giant C.P. Vietnam Takes a Hit: Revenue Down 21% Post Sick Pig Scandal”

Charoen Pokphand Foods (C.P. Foods), a leading Thai conglomerate, witnessed a slight dip in its global revenue for Q2 2025, with Vietnam being the primary contributor to this decline.