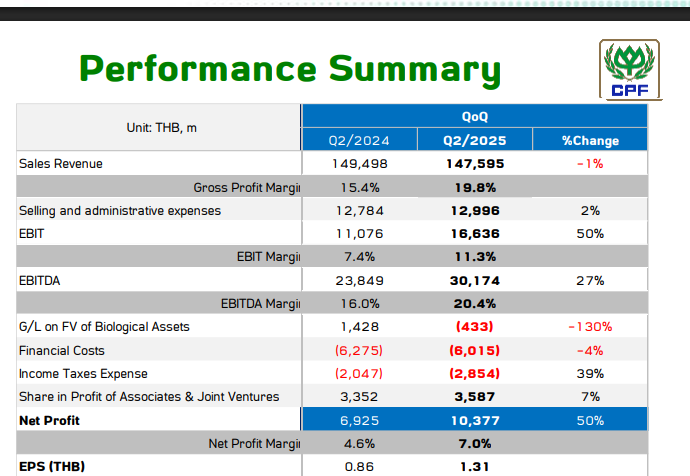

In Q2 2025, Thailand’s livestock giant recorded a total revenue of nearly THB 147.6 billion, a 1% decrease compared to the same period. However, net profit surged 50% to THB 10.4 billion, mainly due to improved margins from rising pork and poultry prices.

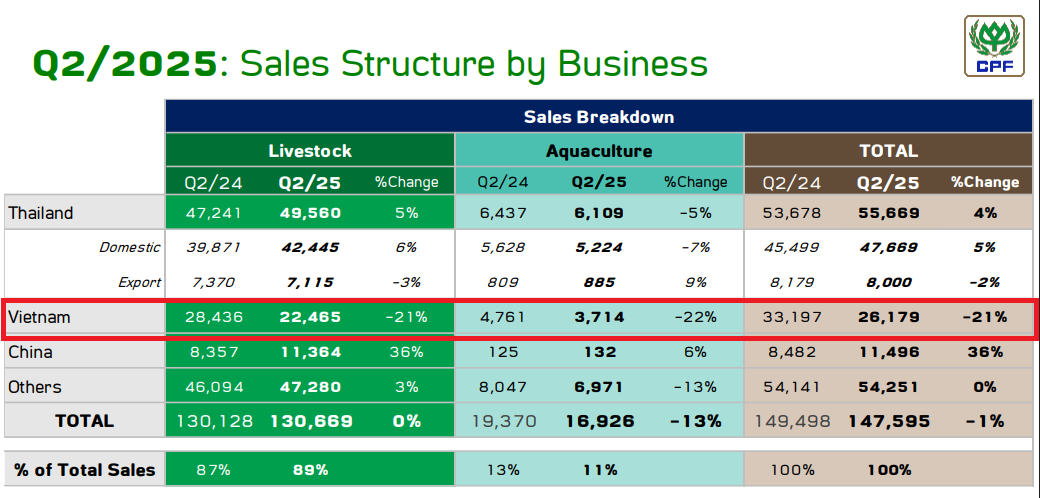

Vietnam – the only market in decline

The main reason for the decline in total revenue was the performance in Vietnam. The Vietnam branch recorded a 21% drop in revenue compared to the previous year, falling to THB 26.2 billion. In contrast, the other two large markets, Thailand and China, saw positive growth of 4% and 36%, reaching THB 55.7 billion and THB 11.5 billion, respectively.

C.P. Foods did not provide a specific explanation for this decline, although there could be several contributing factors such as exchange rate fluctuations with the strengthening of the Thai baht against the Vietnamese dong, or the group’s recent increase in ownership in C.P. Vietnam to 100% after buying back shares from Itochu in April.

The disappointing Q2 results come as CP Vietnam faces one of the most serious media crises in its history of operations in Vietnam.

In late May, social media was abuzz with images of suspected diseased pigs, shocking the public and raising questions about the quality of products from the Thai giant.

C.P. Vietnam quickly explained that the images were taken in the post-slaughter animal control area of an outsourced processing facility, asserting that the abnormal batch had been discarded and not released to the market.

The situation escalated when the Ministry of Agriculture and Environment requested the intervention of the Ministry of Public Security. The Inspectorate of the Soc Trang Provincial Agriculture Department also fined more than VND 100 million to three CP Fresh Shops for violations regarding food safety certificates.

In July, the Soc Trang Provincial Police concluded that C.P. Vietnam had not violated food safety regulations. The company considered this a testament to its efforts to comply with the law and ensure product quality throughout its production and business chain. Nevertheless, the damage to C.P. Vietnam was evident.

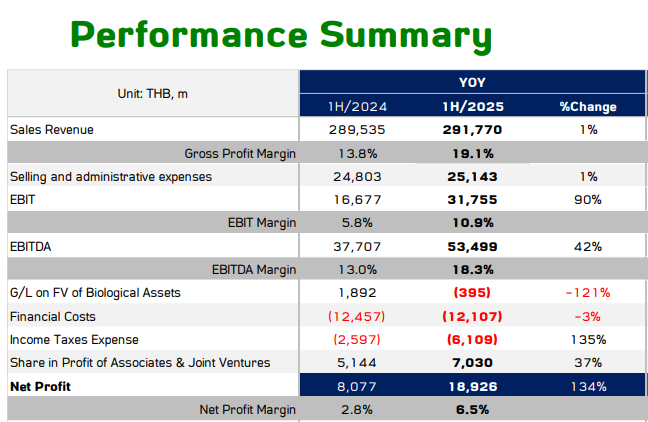

Still Profitable in the First Half

Despite the setbacks, the Thai conglomerate’s business picture remains positive. In the first half of 2025, C.P. Foods garnered THB 291.8 billion in revenue, a slight 1% increase compared to the same period last year. Vietnam, its subsidiary, contributed THB 53.8 billion, a 15% decrease year-on-year.

Notably, net profit surged 134% year-on-year to over THB 18.9 billion, attributable to a significant rise in net profit margin from 2.8% to 6.5%.

According to CP Foods, the substantial profit increase was supported by higher poultry and pork prices in multiple markets due to tighter global meat supply amid widespread animal diseases, including avian influenza in over 40 countries and African swine fever in Asian regions. Lower feed costs, coupled with disciplined cost management, further bolstered profit margins.

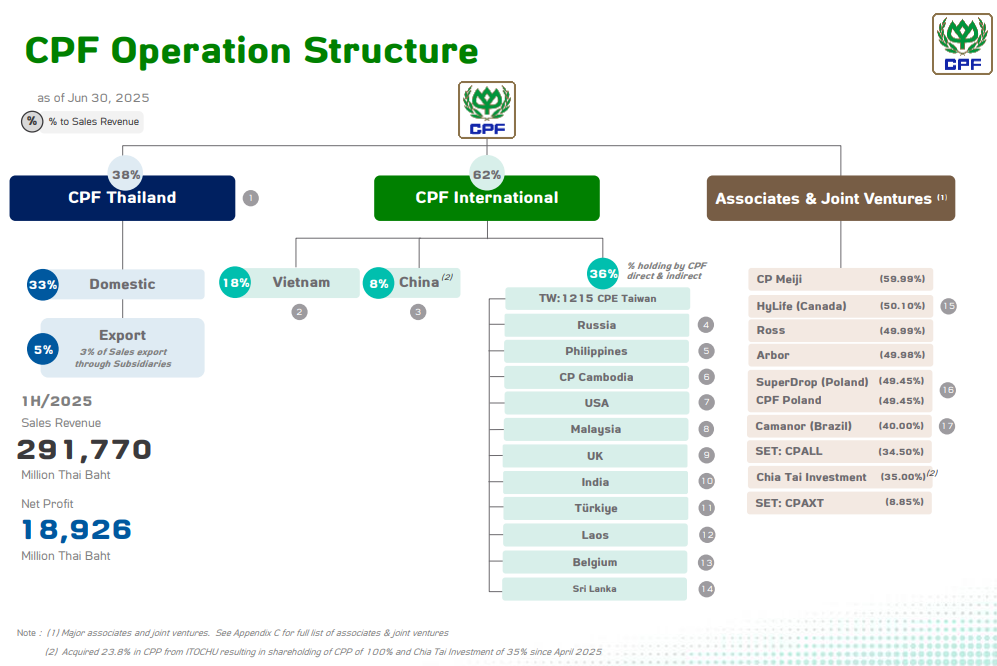

During this period, international operations accounted for 62% of sales, exports contributed 5%, and domestic sales made up the remaining 33%. The company, along with its joint ventures in 16 countries, exports food products to over 50 countries worldwide.

|

C.P. Foods’ Markets

Vietnam contributes 18% of C.P. Foods’ revenue

|

– 10:59 18/08/2025

The Economic Powerhouse: Generating the Nation’s Highest Revenue Post-Provincial Merger

The initial figures from the 34 merged provinces and cities paint an intriguing picture of fiscal revenue trends. Ho Chi Minh City, bolstered by the inclusion of Binh Duong and Ba Ria-Vung Tau, has surged ahead to become the nation’s top earner, boasting an impressive revenue of over VND 465 trillion. Notably, a significant spike in land-related revenues has provided a substantial boost to the city’s coffers, presenting both opportunities and challenges in terms of market stability and efficient resource utilization.