“The Evolution of CASA Strategies in Vietnam’s Banking Sector: A Competitive Analysis”

As competitive interest rates on term deposits continue to squeeze banks’ profit margins, there’s been a strategic shift towards building CASA – a low-cost funding base. In the first half of 2025, the battle for CASA intensified with myriad creative strategies. One of the most notable approaches has been the introduction of “Auto-Yield” products by commercial banks, offering attractive returns and maximum convenience, quickly becoming a market trend.

By the end of Q2 2025, the CASA landscape among banks exhibited a clear differentiation, reflecting their unique strategies and characteristics. Private banks asserted their leadership with innovative digital products, while state-owned banks maintained stable growth, leveraging their established reputations and extensive branch networks. These numbers not only represent the intense competition among banks but also highlight the stories behind each institution’s strategy, from technology investments to ecosystem development and product innovation.

Among the myriad strategies, the “Auto-Yield” product stands out as a breakthrough solution, effectively attracting CASA for banks. This innovative offering allows idle funds in transaction accounts to automatically generate yields of up to 4.1% – 4.3% annually, a significant improvement over regular account interest rates. Moreover, customers can still freely use their entire balance for spending and transfers 24/7 without any hurdles.

Recognizing the convergence of digital banking, savings, and investment needs, several banks have crafted distinctive products. Techcombank took the lead with its “Auto-Yield” offering, attracting nearly 4 million customers. MSB and LPBank followed suit with similar products, offering competitive yields ranging from 4.5% to 5.0% per annum. VIB introduced the “Super Yield Account,” featuring flexible interest rates, while VPBank stood out with its “Super Auto-Yield” solution, becoming the first bank to offer daily principal and interest payments. The emergence and popularity of these products signify a paradigm shift in the CASA race, where customer financial benefits take center stage in the competitive landscape.

The implementation of auto-yield products is more than just a service offering; it’s a strategic move by banks. Firstly, it helps attract and retain customers more effectively in a highly competitive market. A unique product that enables automatic yield generation sets the bank apart and fosters long-term customer loyalty. Secondly, it boosts CASA by encouraging customers to maintain higher balances in their transaction accounts, thereby providing banks with a low-cost source of funds, optimizing lending and investment operations.

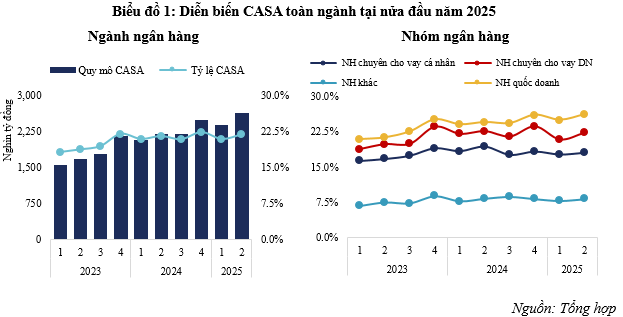

As of Q2 2025, the industry-wide CASA scale reached VND 2,626.4 thousand billion, a 6.1% increase compared to the end of 2024. This impressive figure pushed the industry-wide CASA ratio to 21.8%, the highest in history. Compared to the 10-year average of 18.8%, the 5-year average of 20.5%, and the latest 3-year average of 21%, maintaining a ratio above 20% since 2021 underscores the relentless efforts of banks to attract idle funds. Notably, the trend of “Auto-Yield” products has become a creative tactic, enabling banks to optimize their CASA ratios, reduce funding costs, and effectively counter the recent trend of rising term deposit interest rates.

Delving deeper into the CASA dynamics, we analyzed the performance of different bank groups, each with its unique cash flow characteristics. State-owned banks continued to showcase stability and leadership in CASA, leveraging their extensive branch networks and longstanding reputations. Their CASA ratio of 26.1% as of Q2 2025 highlights their ability to attract a substantial amount of non-term deposits from both corporate and individual customers. Over the past three years, this group has consistently demonstrated the most stable improvement in CASA ratios, partly attributed to their focus on extending credit to large economic groups.

In contrast, the group specializing in corporate lending exhibited volatile CASA ratios, with fluctuations of up to VND 100,000 billion from one quarter to the next. Their CASA performance is closely tied to the credit disbursement activities of large enterprises within their ecosystems, resulting in variability aligned with the cash flow cycles of these corporations. After a dip earlier in the year, their CASA ratio rebounded to 22.2% in Q2.

Meanwhile, the group focusing on consumer lending maintained a more stable CASA ratio but without significant improvements. Following a decline at the end of 2022, their CASA ratio hovered around 18% in Q2 2025, indicating a slower pace in attracting non-term deposits compared to other groups. Notably, small-scale banks continued to lag, with a CASA ratio of only 8.2% in Q2, reflecting their challenges in the competitive race for low-cost funds.

CASA dynamics are intricately linked to the unique strategies employed by each bank, and the following section delves into these nuances.

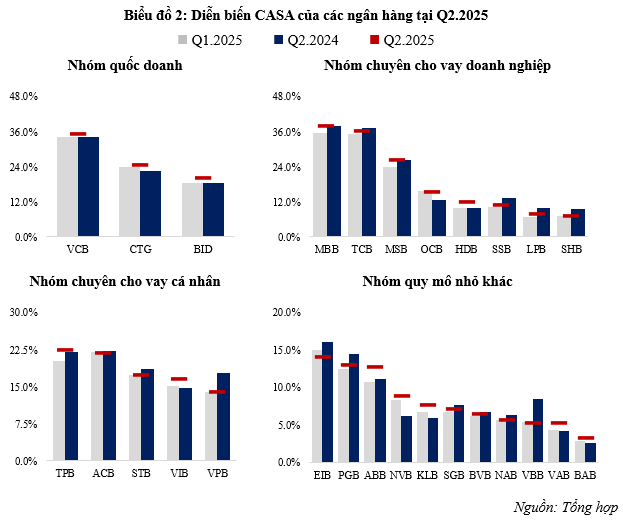

The Q2 2025 financial reports unveiled intriguing developments in the CASA race, especially after a year of introducing “Auto-Yield” products. The CASA ratios of banks displayed a clear divergence, underscoring the varying effectiveness of their strategies. State-owned banks maintained their stronghold, with VCB retaining its top position, boasting a CASA ratio of 35.5%, a nearly 20% increase year-over-year. CTG also impressed with a CASA ratio of 24.6%, a remarkable 27.8% surge from the previous year. This success stems from their strategic focus on enhancing CASA and leveraging their extensive network of large corporate clients (contributing nearly 55% of CASA), coupled with robust credit flows.

Banks specializing in corporate lending continued to excel in CASA performance. MBB and TCB stood out with impressive ratios. MBB solidified its leading position, achieving a CASA ratio of 37.7%, a 6% increase from the end of 2024. TCB followed closely with a ratio of 36.4%, slightly lower than before but still impressive. Other banks in this group, such as MSB and OCB, also witnessed significant CASA improvements, reaching 26.3% and 15.5%, respectively, attesting to the success of their “Auto-Yield” product push.

Over the past two years, the retail banking group has witnessed notable shifts in CASA dynamics. TPBank, with its youth-centric and technology-driven strategy, built a diverse digital ecosystem, resulting in a CASA ratio of 22.5% in Q2 2025, a 23.4% year-over-year increase. Conversely, ACB’s overall CASA performance remained stagnant, with growth primarily driven by corporate clients, achieving a CASA ratio of 44.1% in this segment, while the individual customer segment lagged with a ratio of only 16.8%.

VIB, on the other hand, stood out with its remarkable growth, achieving a 38.7% year-over-year increase in CASA scale. With a high proportion of personal deposits (nearly 70%), VIB introduced the “Super Yield Account,” offering an attractive interest rate of up to 4.3% per annum, effectively retaining idle funds and improving its CASA ratio from 14.1% to 16.7%. Conversely, VPBank, despite offering an “Auto-Yield” product, lagged with a less competitive yield of 3.5% per annum, resulting in a declining CASA ratio of 13.9%, despite strong overall deposit growth in the first half of the year.

Small-scale banks continued to face challenges, with their CASA ratios remaining relatively low and less competitive compared to larger peers. More than half of the banks in this group experienced declines in CASA ratios year-over-year, with VBB witnessing the most significant drop from 8.5% to 5.3%. While EIB and PGB boasted the highest CASA ratios in the group, at 14.2% and 13.0%, respectively, they also experienced slight decreases. However, a few banks, such as ABB and NVB, managed to improve their CASA positions significantly, with ratios increasing from 11.1% to 12.8% and 6.3% to 8.9%, respectively. The common thread among these banks was their above-average credit growth in the first half of the year, which facilitated higher disbursements and, consequently, improved CASA performance.

As we move through 2025, the CASA landscape in Vietnam’s banking sector has evolved with new dynamics. The introduction of non-term deposit products with attractive interest rates has escalated the competition to new heights, where the focus is not just on service but also on financial returns. However, the impact of these products varies across banks, making it intricate and challenging to analyze each institution’s CASA strategy. Overall, maintaining and improving CASA ratios demand constant innovation, technology investments, and groundbreaking solutions from banks to retain and attract customers’ funds in an increasingly competitive market.

Lê Hoài Ân, CFA

“The Rise of Non-Performing Loans Stalls, Many Banks Improve Loan Quality”

The silver lining in the cloud of non-performing loans is that the upward trajectory of total bad debt at the end of the second quarter showed signs of abating. This improvement can be attributed to a combination of factors: prudent monetary policies, a cautious approach to credit strategies, and the gradual recovery of the economy. As a result, many banks have successfully enhanced their loan quality and mitigated bad debt risks.

Captivating Capital: Unleashing Funds for Market Dynamism

As we near the midpoint of 2024, credit growth has yet to reach even a third of the annual target. This sluggish pace underscores the need for a strategic rethink to invigorate the credit market and spur economic activity.