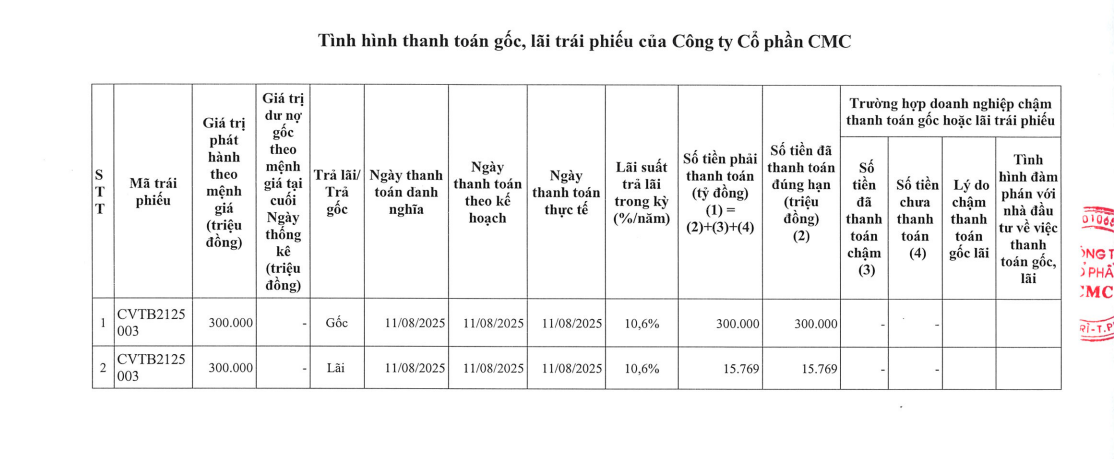

According to a recent announcement by the Hanoi Stock Exchange (HNX), CMC Joint Stock Company (CMC, stock code: CVT) has provided an update on its bond principal and interest payments.

On August 11, 2025, CMC made payments totaling over VND 300 billion in principal and nearly VND 16 billion in interest for the CVTB2125003 bond, thereby fully redeeming this bond issue.

Source: HNX

The CVTB2125003 bond was issued by CMC on August 11, 2021, with a term of 48 months and a scheduled maturity date of August 11, 2025.

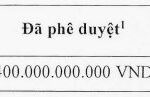

On the same day, CMC also issued three other bond series, namely CVTB2122001, CVTB2123002, and CVTB2126004, with a total issuance value of VND 400 billion.

The CVTB2122001 and CVTB2123002 bonds were fully redeemed in 2022 and 2023, respectively. The CVTB2126004 bond, with an issuance value of VND 200 billion and a 60-month term, is expected to mature on August 11, 2026.

Regarding CMC, the company was formerly known as Viet Tri Concrete Factory, established in 1958. CMC operates in the manufacturing of building materials, tiles, decorative bricks, and construction of civil and industrial projects.

In 2006, CVT officially transitioned to a joint-stock company model. Its head office is located in Thuy Van Industrial Park, Nong Trang Ward, Phu Tho Province.

As of June 2018, the company’s charter capital stood at nearly VND 367 billion. Ms. Nguyen Thi Huyen currently serves as the General Director and legal representative of CMC, while Mr. Tran Duc Huy holds the position of Chairman of the Board of Directors.

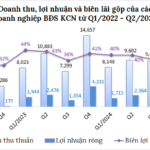

In terms of financial performance, according to the consolidated financial statements for the second quarter of 2025, the company recorded a revenue of over VND 593 billion, a 37% increase compared to the same period last year. The cost of goods sold also increased significantly to over VND 533 billion, resulting in a gross profit of VND 60 billion, a 22% decrease from the second quarter of 2024.

Finance income saw a substantial rise from VND 27 billion to VND 43 billion, while finance costs decreased from nearly VND 42 billion to almost VND 37 billion (mainly comprising interest expenses). The net profit from business operations showed a slight decrease compared to the second quarter of 2025, amounting to over VND 29 billion.

After accounting for taxes, fees, and other expenses, CMC’s net profit for the second quarter of 2025 stood at VND 21.5 billion, a VND 1 billion decline compared to the same period in the previous year.

For the first half of 2025, the company achieved a consolidated revenue of VND 1,064 billion and a net profit of over VND 42.5 billion, representing a 46% and 6% increase, respectively, compared to the same period in 2024.

As of June 30, 2025, CMC’s total assets amounted to VND 3,327 billion, with current assets comprising the majority at VND 2,640 billion. This included cash and cash equivalents of nearly VND 492 billion, short-term receivables of VND 1,412 billion, and inventories of almost VND 661 billion.

On the liabilities side of the balance sheet, the company’s total liabilities as of the end of the second quarter of 2025 stood at VND 2,315 billion. Short-term bank loans accounted for nearly VND 793 billion, long-term bank loans due within one year amounted to VND 65 billion, and long-term bonds due within one year totaled nearly VND 300 billion.

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.

“Real Estate Firms’ Profits Soar: First-Half Yearly Earnings Up 150%”

The Vietnamese real estate market witnessed significant fluctuations and a strong segmentation across segments and regions in the first half of 2025. Amidst these dynamics, listed real estate enterprises surprisingly reported a 50% surge in net profits compared to the same period in 2024, showcasing their resilience and adaptability in a challenging environment.

The Dragon’s $2.8 Million Venture: FlexOffice Expansion in the Philippines

The once export-focused TLB Shareholding Group Corporation (HOSE: TLG) is taking a bold step forward by establishing a separate legal entity to introduce their FlexOffice brand as a domestic enterprise in the Philippines. This move underscores the company’s confidence in having established a strong foothold in the Philippine market, with their ballpoint pens already recognized and well-regarded by consumers in the region.