This is not just an immediate capital support measure, but also considered a policy “carrot” for organizations shouldering important responsibilities.

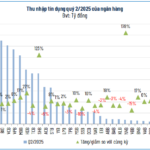

Rapid credit growth, mounting interest rate pressure

According to the State Bank of Vietnam (SBV), as of July 28, 2025, the credit growth of the entire system increased by approximately 9.68% compared to the end of 2024, higher than the same period last year. The surge in capital demand stems from consumption, trade, and investment in both the public and private sectors, driving credit growth across all sectors. According to the General Statistics Office (GSO), total retail sales of goods and services in the first half of the year rose by 9.3% year-on-year, while total social investment increased by 9.8%. Public consumption expanded, and trade activities remained robust despite the uncertain tariff environment.

Meanwhile, capital mobilization growth during the same period only increased by 6.72%, lower than credit growth by about 3%. In absolute terms, the gap has widened to VND 1.4 quadrillion, nearly double the VND 760 trillion recorded in the same period last year. This disparity signals mounting pressure on liquidity management, putting the banking system in a challenging position as it strives to achieve high credit growth while maintaining safe capital ratios.

|

The government has also recently raised the economic growth target for this year to 8.3%, implying a credit growth requirement of 18-20%. With credit growth reaching only about half of this target in the first seven months of the year, the pressure on the remaining months is immense. Maintaining low lending rates to support economic recovery has put banks in a bind, forcing them to reduce lending rates while deposit rates can hardly decrease further, thus sacrificing net interest margins (NIMs), which have already declined significantly from 3.31% in Q4 2024 to 3.12% in Q2 2025. In the long run, to balance capital supply and demand, banks have to narrow the gap between mobilization and lending rates by enhancing the attractiveness of deposits through rate adjustments and increasing bond issuance to maintain a sustainable structure.

The challenge of managing interest rates and exchange rates

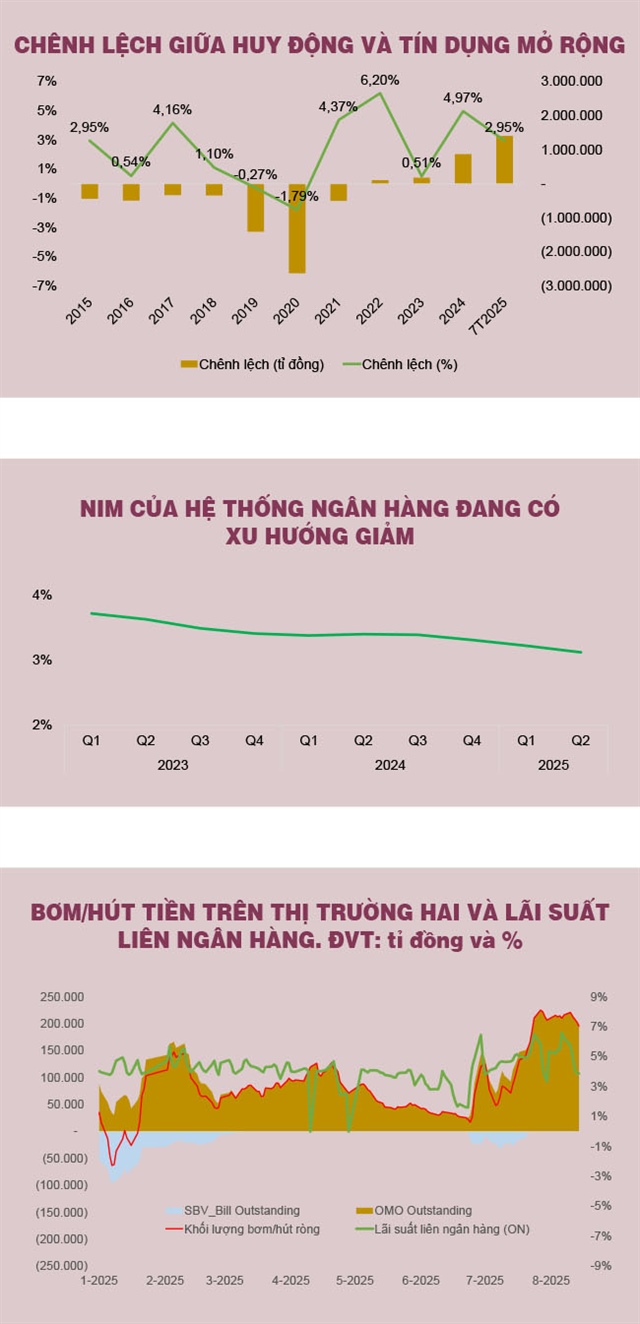

The most significant challenge in monetary policy implementation today is ensuring credit growth to support economic growth targets while maintaining reasonable interest rates and stabilizing exchange rates. This challenge is amplified as the US Federal Reserve (Fed) maintains higher interest rates longer than expected, while foreign exchange reserves remain low due to slow trade and investment inflows into Vietnam because of unresolved tariff issues. Consequently, stabilizing the USD/VND exchange rate has been a constant challenge in the first half of the year, requiring the SBV to be highly agile in its policy implementation.

Faced with liquidity pressure, the SBV has continuously injected and withdrawn money through the open market operation (OMO) channel and bill issuance, with net positions reaching up to nearly VND 250 trillion at various tenors. Nonetheless, to control the exchange rate, the SBV has adeptly regulated interest rates, maintaining appropriate levels to minimize the gap with external rates, particularly those of the US dollar. Analysts now anticipate that the Fed will cut rates in September 2025 and again in December 2025, gradually easing pressure on the Vietnamese dong. However, uncertainties remain, and the SBV will continue its cautious and flexible approach, ensuring high liquidity while maintaining interbank rates around 4% to stabilize the exchange rate.

In this context, the SBV has recently issued Circular No. 23/2025/TT-NHNN, halving the statutory reserve requirement ratio for four banks that are mandated to acquire four commercial banks under special control. This policy releases VND 50-60 trillion in reserves, boosting liquidity and lending capacity for the acquiring banks. More importantly, it signals the regulator’s willingness to share the burden with banks undertaking state-assigned missions.

A “carrot” for banks undertaking special missions

The acquisition of weak banks for restructuring has long been a cumbersome task due to the need to address large bad debts, overhaul governance systems, and accept extended opportunity costs. In addition to the legal frameworks previously issued to support banks undertaking the restructuring of weak banks, the recent reduction in the reserve requirement ratio can be seen as a tangible “carrot,” equivalent to saving thousands of billions of dong in opportunity costs annually. This advantage enables these banks to continue expanding credit, ease mobilization pressure, adjust lending rates more flexibly, and enhance their competitive position.

Moreover, banks undertaking restructuring missions are prioritized for higher credit limits, access to refinancing, and benefits from specific support packages. As a result, they gain a distinct position within the system and can leverage their liquidity advantage to provide capital at lower costs.

Naturally, privileges come with significant responsibilities. The effectiveness of restructuring depends not only on supportive policies but also on the management capabilities and financial resilience of each bank. Therefore, the reduction in the reserve requirement ratio should be viewed as both an incentive and a commitment to organizations willing to take on substantial responsibilities—they will have the accompaniment and risk-sharing of the state.

Trinh Lao

The Soaring Price of Gold: USD Hits All-Time High

This morning (August 20th), the price of SJC gold soared to a staggering peak of VND 125 million per tael, firmly establishing a new high. In tandem with this ascent, the value of USD in Vietnam’s banking system breached the threshold of VND 26,500 per USD, marking yet another record in its own right.

The Capital Conundrum: Unlocking the Private Investment Boom of 2025–2030.

The private equity market in Vietnam is witnessing a robust recovery, with transaction values rebounding to 2.3 billion USD in 2024 after a sharp decline from its 2019 peak of 4.8 billion USD. Industry experts forecast that the period from 2025 to 2030 will present significant opportunities for businesses to access this capital, but stress that heightened emphasis will be placed on financial transparency and robust legal preparation.

“High Interest Rates on Short-Term Deposits: Implications for Vietnam’s Economy”

The private sector in Vietnam is currently dominated by banking and real estate enterprises. This, according to Dr. Le Xuan Nghia, former Vice Chairman of the National Financial Supervisory Commission, is an inevitable phase of accumulation that many nations have gone through on their path to industrialization and the development of science and technology.

The Profit Sprint: Unlocking Banking’s Q2 Success

The latest Q3 business trend survey by the Forecasting and Statistics Department – Monetary and Financial Stability (SBV) revealed that credit institutions have slightly raised their credit growth expectations for the year to 16.8%, surpassing the actual figure for 2024. This growth forecast is considered a significant impetus, promising to maintain the upward trajectory of profits for the entire banking sector compared to the previous year.