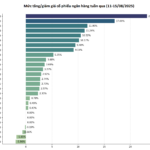

In recent months, the Vietnamese stock market has witnessed an impressive growth spurt. Since the confirmed tariff bottom on April 9, the VN-Index has surged by nearly 550 points, equivalent to almost 50%. During this period, Vietnamese stocks have seen numerous spectacular breakthroughs, ranking among the top performers in the region and globally. In fact, if we consider the past four months, no stock market index in the world has outperformed the VN-Index.

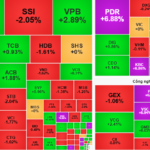

Blue-chip stocks, particularly those in the banking sector such as VPB, TCB, HDB, SHB, STB, and MBB, have all recorded growth rates of 30-50%. Moreover, some mid-cap stocks have even doubled in value within the same four-month period.

In contrast, bank savings interest rates remain at record lows. In the market, the 12-month term deposit rates at commercial banks typically range from 5-6% per annum, with state-owned commercial banks offering rates as low as 4.7-4.8%. With inflation hovering around 4%, the real profits from savings are negligible, leaving many feeling underwhelmed when compared to the potential gains in the stock market.

Given these developments, many people, especially office workers, regret their decision to opt for savings accounts instead of investing in stocks.

Mr. Nguyen Van Hung (32 years old, a bank employee in Hanoi) shared, “At the beginning of the year, I had VND 500 million in savings and chose to deposit it in a 12-month term account with a 5.5% interest rate. This amounts to only about VND 25 million in annual interest, excluding inflation. Lately, seeing my friends invest in stocks, some of whom have made 50-70% returns in just six months, I feel regretful. If I had invested in stocks like VPB, SHB, or TCB, my money could have grown to nearly VND 800 million by now, enough to buy a car.”

Ms. Tran Thi Mai (28 years old, a marketing employee in Ho Chi Minh City) expressed similar sentiments. “I always thought that stock investing was risky, so I stuck to savings accounts. My total savings of VND 300 million have only increased by about VND 50 million. Meanwhile, a colleague who invested in stocks over the past few months has made profits of over 40%. Seeing her earn hundreds of millions of dong from stocks makes me feel like I’ve missed out on a great opportunity because of my fear of risk.”

Unlike Mr. Hung and Ms. Mai, Mr. Le Quang Minh (35 years old, an import-export employee) started exploring the stock market at the beginning of 2025. He shared, “I used to think that stock investing was only for those with substantial capital and deep knowledge. But when the VN-Index surpassed 1,600 points, I, along with my colleagues who are regular office workers, still managed to make good profits from stock investments. I wish I had started earlier, but now I’m learning how to analyze stocks for long-term investing.”

While the Vietnamese stock market is currently in a strong growth phase with record-high liquidity, it may not be the right investment avenue for everyone. New investors, especially non-professional ones, should exercise caution and avoid following the herd mentality.

Financial experts advise that those new to stock investing should equip themselves with knowledge about fundamental analysis, technical analysis, and risk management. Otherwise, savings accounts remain a stable option. For those willing to take the plunge, starting with a small capital and focusing on blue-chip stocks or ETFs can help minimize risks.

For individual investors, especially office workers with limited capital, it is advisable to build a diverse investment portfolio and adopt a patient, long-term strategy. Additionally, keeping abreast of corporate financial reports and macroeconomic news is crucial for making informed investment decisions.

The Stock Market’s Stealthy Strategists: In-House Traders Unveil their Tactics with a $9 Million Shopping Spree on August 18th.

The proprietary securities firms continued their net buying streak on the HoSE, with a total value of 208 billion VND. The focus was on the leading technology stock, which saw a significant boost in trading volume and value. This strategic move by the proprietary firms showcases their confidence in the tech sector’s potential and strengthens their position in the market.

Stock Market Update: Mid and Small-Cap Stocks to Attract Investors’ Interest

The August 18th session concluded with a robust buying spree as investors sought to take advantage of discounted stock prices. For the upcoming August 19th trading day, we anticipate a shift in focus towards mid and small-cap stocks, presenting a strategic opportunity for savvy investors to diversify their portfolios and potentially capitalize on the momentum of these dynamic segments of the market.

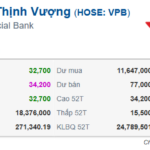

Is VPBank Ready for an IPO?

On August 18th, the Board of Directors of VPBank Securities Joint Stock Company (VPBankS) passed a resolution to seek shareholder approval via written consent. According to multiple sources, the securities firm is preparing to submit an IPO proposal as soon as the fourth quarter of 2025.