This result not only affirms the effectiveness of the expansion and operational optimization strategy but also becomes an important driving force supporting the upward trend of MSN stock, which has just peaked in the past year and attracted strong capital inflows in the market.

On the weekly chart, MSN stock just had a breakout trading week as it closed above the highest peak in 12 months, breaking through the strong resistance of 76,000-80,000 VND after a long accumulation period. This upward momentum was accompanied by a surge in trading volume to the highest level in many years, reflecting the market’s strong interest.

Image: Chart showing upward trend of MSN stock

Technical indicators support the bullish trend: the Bollinger Bands widened with the price hugging the upper band, reflecting strong upward momentum; the rising 20-week moving average (MA20) acts as dynamic support; the 76,000-80,000 VND region has turned into a significant support area according to volume-weighted average price (VWAP). Notably, the moving average convergence divergence (MACD) indicator has crossed above the signal line and remained above the zero line, indicating that the uptrend is being reinforced.

Retail Segment Accelerates

Experts opine that as Vietnam’s GDP per capita approaches the $5,000 mark, the market will enter a phase of accelerated consumption, with a surge in demand for modern products and services. The growing middle class will prioritize convenient shopping experiences that ensure quality and safety, hastening the shift from traditional to modern retail channels. This presents an opportune moment for enterprises with extensive distribution networks and optimized operations like WinCommerce (WCM) to expand their market share, seize the initiative, and solidify their leadership in the industry.

Image: Chart showing WCM’s performance

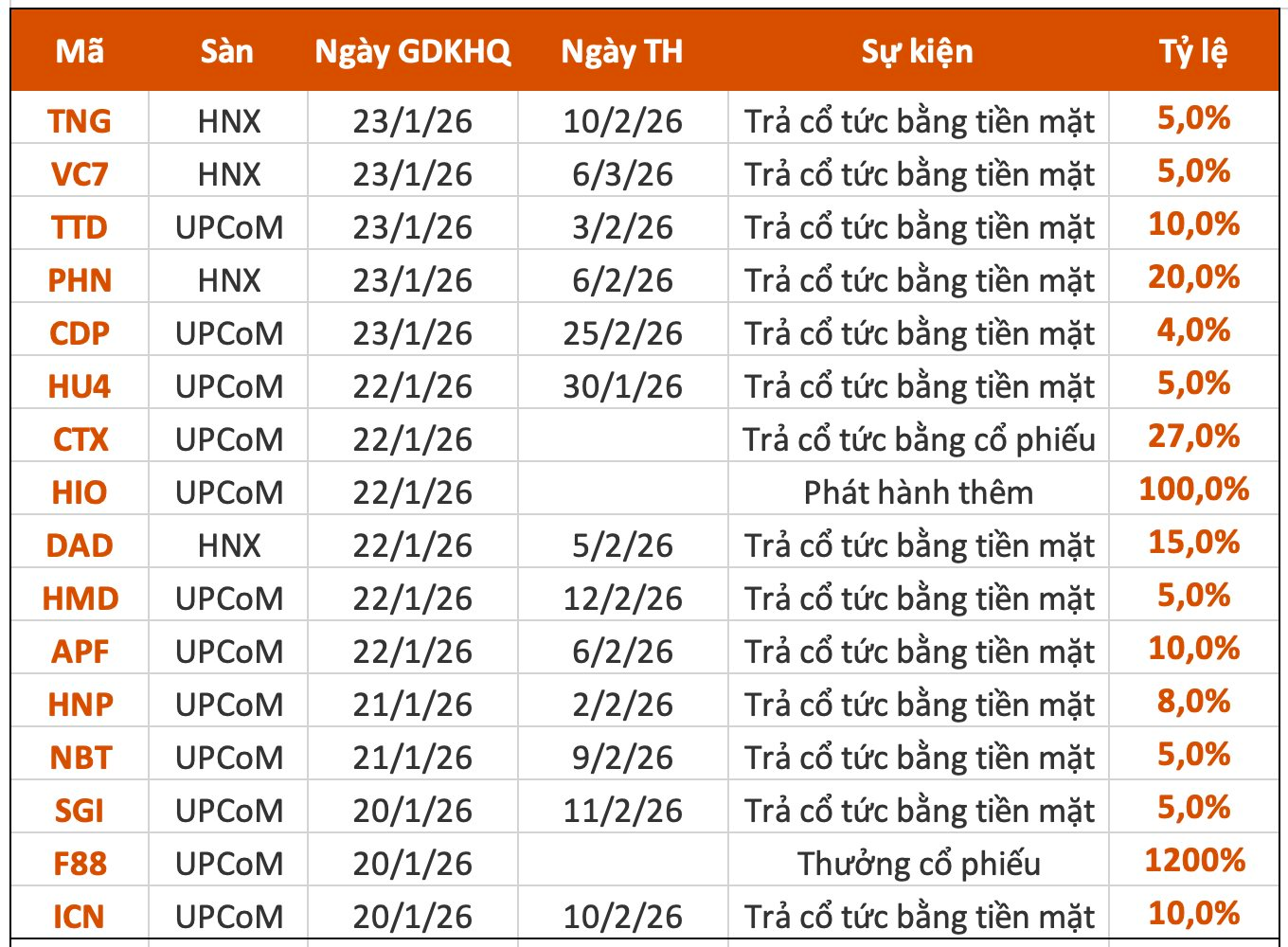

Against this backdrop, WCM has consistently demonstrated its superior operational capabilities through positive results. According to the latest report, net revenue for July 2025 reached VND 3,486 billion, a 23.0% increase compared to the same period last year, surpassing the base growth target of 8-12%. Notably, WinMart+ stores in rural areas recorded an impressive 46.2% year-over-year revenue growth, amounting to approximately VND 1,024 billion. WinMart+ Urban stores grew by 16.4%, and the WinMart store system witnessed a 13.3% increase. For the first seven months of the year, net revenue reached VND 21,400 billion, a 14.8% increase compared to the same period last year, with a 7.6% LFL growth for stable operating stores, reflecting a sustainable improvement in business performance.

In parallel, WCM continues to rapidly expand its presence nationwide, especially in rural areas, which account for over 63% of the population and remain heavily reliant on traditional retail channels. In July alone, the company inaugurated 36 new stores, bringing the total count since the beginning of the year to 354, completing over 50% of the annual plan (400-700 stores). Nearly 75% of these are WinMart+ stores in rural areas.

The Central region remains prominent with 175 new stores, accounting for nearly 50% of the total new openings, reflecting the company’s strategic and flexible approach to site selection and deployment. Unlike the “expand at all costs” model prevalent in the market, this enterprise steadfastly links scale growth with financial efficiency, as all new stores opened this year have recorded positive profits, validating the appropriateness of the WinMart+ model in rural areas, which meets essential needs while providing additional convenient services to the community.

Opportunities and Challenges

WCM’s rapid expansion strategy presents opportunities for revenue and market share growth but also brings challenges. Opening hundreds of stores each year entails significant initial investment costs, including rent, renovations, personnel, and logistics. With rising rent and operating costs in many areas, maintaining profit margins will be more challenging, especially for new stores that have not yet reached optimal output levels.

Image: Chart showing cost structure of WCM’s new stores

In addition to cost factors, ensuring consistent service quality and supply chain management across a vast network is another crucial aspect. To sustain efficiency, WCM needs to balance expansion speed with operational capabilities, ensuring that each new store positively contributes to overall profitability.

In the second half of the year, WCM will maintain its network expansion pace while implementing an optimized classification strategy, deepening collaborations with Masan brands to launch private label products, conducting promotions, and offering personalized marketing to Win Club members. Simultaneously, the company will continue renovating the WinMart Urban and WinMart Rural supermarket models, optimizing costs, and enhancing profit margins, aiming for a full-year EBIT margin of 1%. With its “profitable growth” strategy and integrated ecosystem spanning production to distribution, WCM is well-positioned to surpass its plans and reinforce its leadership in modernizing Vietnam’s retail industry.

Image: Chart showing WCM’s integrated ecosystem

The Great Cash Flow Rush into MSN: Unlocking the Potential for New Heights

On August 11, Masan Group’s stock, ticker symbol MSN, experienced a blockbuster trading session, surging to a closing price of 82,000 VND per share, an impressive nearly 7% jump from the previous session. The standout feature of this rally was the record-breaking liquidity, with nearly 30 million shares changing hands – an all-time high since its listing. This remarkable volume indicates a substantial influx of capital from both domestic and international investors, underscoring the strong appeal of this stock in the market.

WinCommerce Turns a Profit in June Despite Stagnant Store Numbers from Q1 to Q2: What’s the Story?

“The management team is confident that WCM can achieve positive net income in Q3 and Q4 of 2024 if the company sustains a 9% like-for-like growth rate in these quarters.” – Vietcap stated.