The VN-Index ended the session on August 18 at 1,636 points, marking a solid gain of 6 points, or 0.39%.

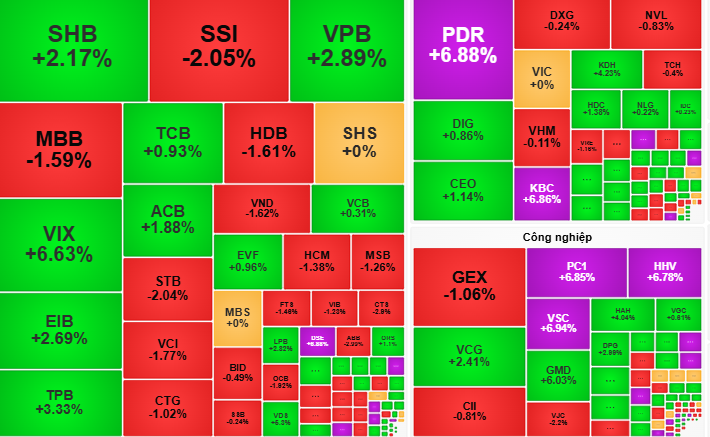

Vietnam’s stock market kicked off August 18 on a positive note, with the VN-Index surging 10 points at the opening bell. This upward momentum was driven by strong buying interest in banking stocks (SHB, VPB), oil and gas (GAS, PVD), and steel (HPG, NKG). However, heavyweights such as VJC and HVN, along with the Vingroup trio (VIC, VHM, VRE), faced selling pressure, leading to a tug-of-war that kept the index fluctuating during the morning session. It eventually closed the morning at 1633.67 points.

In the afternoon session, the market continued to oscillate around the 1,630-point level, reflecting investors’ cautious sentiment. Bottom-fishing activities resurfaced for Vingroup stocks mid-session, narrowing losses and pushing the VN-Index back into positive territory. Towards the end of the day, money flowed into real estate (PDR, HDG, KBC hitting the ceiling price), marine transportation (VSC, HAH, GMD), while maintaining upward momentum in construction investment (HHV hitting the ceiling price, FCN +5.61%) and food (ANV, HAG, BAF).

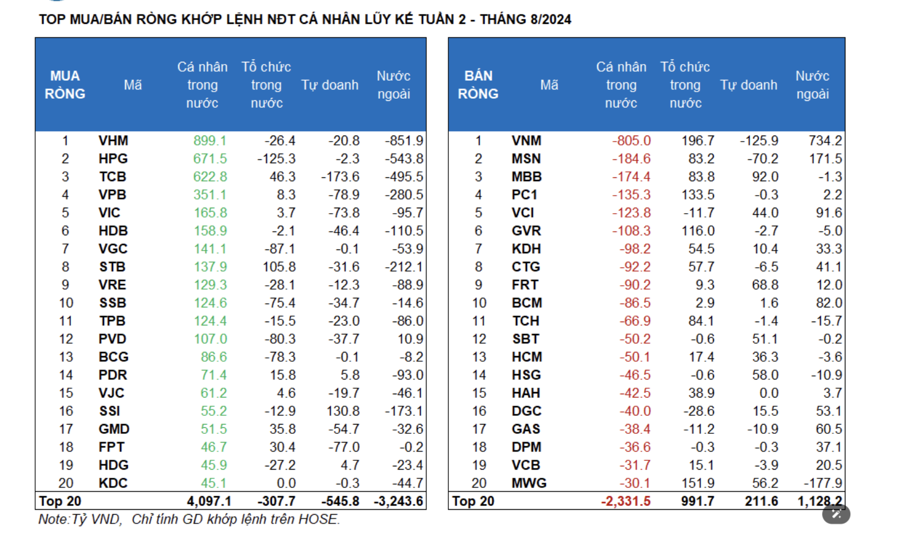

Foreign investors maintained their net selling position, offloading a significant VNĐ 1.946,97 trillion, focusing on SHB, VPB, and FPT.

At the close, the VN-Index ended at 1,636 points, up 6 points, or 0.39%.

According to VCBS, bottom-fishing emerged as the VN-Index retreated to the lowest level of the day on August 18, indicating a fierce tug-of-war between buyers and sellers. The decrease in trading volume reflected investors’ cautious attitude after the market’s recent sharp gains. VCBS recommends that investors realize profits on stocks that have surged significantly while maintaining a safe margin ratio. New investment opportunities may lie in mid and small-cap stocks with strong business potential.

VDSC anticipates a continued market recovery, forecasting a challenge to the 1,650-1,660 resistance zone in upcoming sessions. As the market undergoes a clear sector rotation, investors are advised to make prudent trading decisions. Real estate, construction investment, marine transportation, and food stocks are attracting cash inflows due to their growth potential and solid fundamentals. However, given the reduced liquidity and foreign net selling, investors should refrain from chasing overheating stocks and carefully consider allocating capital to mid and small-caps with long-term prospects.

Who is the Secret Company that Just Signed a Deal to Purchase TDC’s Land in Binh Duong Ward?

“TDC and Global Corp have signed an agreement for the transfer of residential properties in Lot E15, part of the TDC Hoa Loi residential project in Binh Duong Ward, Ho Chi Minh City. This seemingly low-key enterprise has caught the attention of many big players in the stock market, with its connections to major power players.”

The New Ho Chi Minh City: A Fresh Property Landscape with Condos Starting from VND 28-280 Million per square meter

The residential market has witnessed a significant shift with a wave of new project launches just two months after Ho Chi Minh City’s merger with Binh Duong and Ba Ria-Vung Tau. This move has effectively addressed the prolonged shortage of supply, offering a diverse range of options across the spectrum, from affordable to luxury segments. The launch prices of these new projects vary considerably, starting from VND 28 million to nearly VND 280 million per square meter.

Living Near the Metro: The Latest Trend Among Urban Youth

Living near a metro station is fast becoming the new urban living standard in many major cities worldwide. The appeal lies in the unparalleled connectivity it offers, providing quick and convenient access to various parts of the city. This convenience translates into a sustainable boost in property values, making it a sought-after lifestyle choice for discerning individuals.