Vietnam’s iron and steel exports faced quantity and value declines in the first seven months of 2025 compared to 2024, according to preliminary statistics from the General Department of Customs.

The total export volume reached over 6.4 million tons, generating a turnover of $4.2 billion. This decrease was primarily driven by the slump in steel prices in the international market, which led to a more significant decline in export value compared to the drop in production volume.

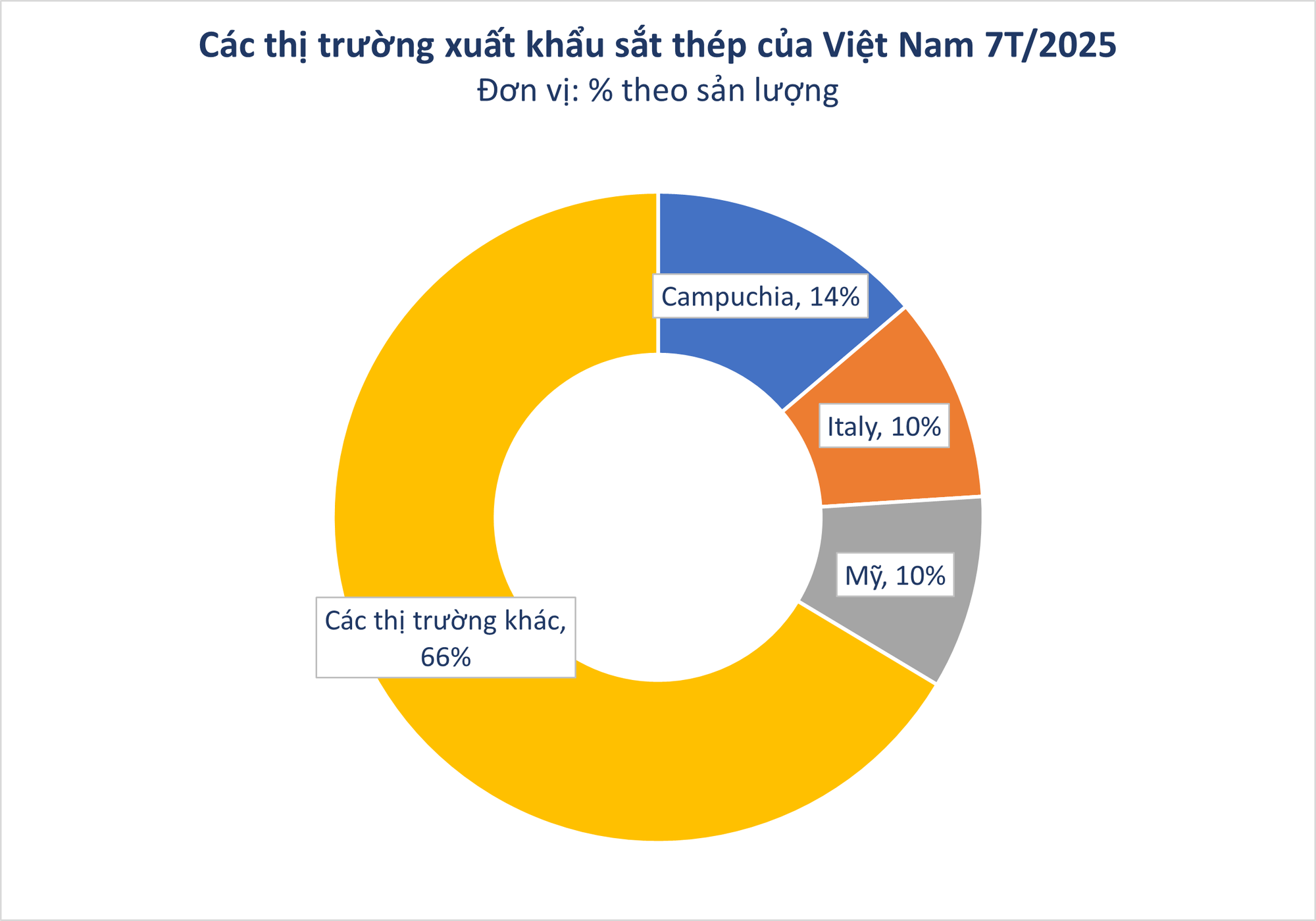

Despite the overall market downturn, some countries witnessed a surge in exports from Vietnam. Notably, Cambodia has emerged as the largest market for Vietnamese iron and steel, importing over 887,000 tons valued at more than $508 million. This represents a 32% increase in volume and a 19% rise in value compared to the same period in 2024. However, the average export price fell by 9.5% to $573 per ton.

Vietnamese iron and steel products benefit from a 0% tax rate when exported to Cambodia, as per the Bilateral Trade Promotion Agreement between the two countries, signed on the sidelines of the 7th ACMECS Summit, 8th CLMV Summit, and the World Economic Forum on the Mekong Region.

Italy claimed second place, importing 656,000 tons of various iron and steel products from Vietnam, valued at over $413 million. This marks a 28% decrease in both volume and value compared to the previous year. The United States, which previously held the second spot, has slipped to third place and has consistently reduced its imports from Vietnam in recent months, despite a 24% drop in export prices.

The decline in exports to the US can be attributed to increased import tariffs and additional taxes of up to 50% on certain products. Moreover, Vietnamese businesses face high anti-dumping duties, with companies like Hoa Phat and Hoa Sen incurring rates of nearly 59%.

While domestic consumption has witnessed a strong surge (finished steel output reached 15.825 million tons, a 9.7% increase, and domestic consumption rose by 10.2%), and there has been a noticeable recovery thanks to public investment and a rebound in domestic construction, exports remain a challenge due to external factors.

Overall, the consensus predicts that domestic steel production and consumption will continue to grow in 2025, particularly in the construction steel segment and steel products catering to public investment. However, steel exports may face hurdles due to escalating trade barriers.

Finished steel output is projected to reach 28-30 million tons, with domestic consumption estimated at 21-25 million tons, reflecting an 8-10% increase compared to 2024. Domestic construction steel prices are expected to remain stable or witness a slight increase, but they may also come under downward pressure from the global market.

In summary, Vietnam’s steel market is anticipated to experience positive developments in the remaining months of 2025, with a recovery in the domestic market and growing steel consumption. However, exports may continue to face challenges due to global economic factors.

The King of Fruits: Vietnam’s Durian Exports Take Flight to China

Cambodia has reached a significant milestone with its first-ever export of durians to China via air freight. This groundbreaking achievement marks a new era for the country’s agricultural industry, showcasing the potential for premium Cambodian produce to reach international markets. With its rich flavor and unique taste, Cambodian durian is set to captivate the palates of consumers abroad, solidifying the country’s position as a prominent player in the global durian market.

The US and Vietnam Reach Agreement on Catfish Anti-Dumping Measures

The resolution of the bilateral dispute between Vietnam and the United States over catfish is a testament to the goodwill and negotiation efforts of both parties. It is a result of constructive spirit, good faith, and a mutual desire to find a solution, particularly on the part of the United States Department of Commerce (DOC) and the United States Trade Representative (USTR).