Phuoc An Port Petroleum Investment and Exploration Joint Stock Company (PAP, UPCoM: PAP) recently announced the appointment of Ms. Tran Thi Hien Luong as Deputy General Director, effective August 15.

This decision has drawn attention due to Ms. Luong’s young age, as she was born in 2002 and is the daughter of Board Member Tran Nhan Tam.

Mr. Tran Nhan Tam, born in 1971, holds a degree in Land Management Engineering. He was appointed to the PAP Board of Directors at the 2024 Annual General Meeting of Shareholders. Mr. Tam currently holds over 5.2 million PAP shares, representing a 2.6% stake in the company.

With her appointment, Ms. Luong will become the fifth member of the Phuoc An Port’s management team, joining General Director Truong Hoang Hai and Deputy General Directors Dao Minh Tung, Nguyen Huu Thang, and Le Dinh Nghiem.

In terms of business performance, Phuoc An Port continued to report a net loss of over 125 billion VND in the second quarter of 2025, the highest to date. The loss was attributed to insufficient revenue to cover cost of sales and financial expenses.

Specifically, revenue for the quarter stood at just over 19 billion VND, while cost of sales amounted to 75 billion VND and financial expenses totaled 61 billion VND.

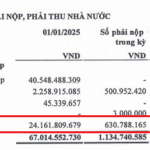

For the first six months of the year, PAP recorded revenue of nearly 29 billion VND but incurred a loss of 248 billion VND. The cumulative loss as of the end of the second quarter of 2025 approximated 279 billion VND.

The PAP management set a target of nearly 450 billion VND in net loss for 2025, while aiming for a total annual revenue of 150 billion VND, of which only about 25% has been achieved so far.

As of June 30, 2025, Phuoc An Port’s total assets increased by 19.2% from the beginning of the year to 8,491 billion VND. This included 2,957.5 billion VND in long-term work-in-progress and 980.9 billion VND in short-term receivables.

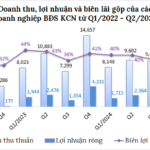

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.

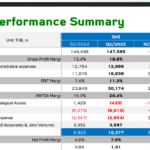

“VSC Aims to Triple Profit Plans, Targeting Over VND 1,000 Billion”

The Board of Directors of Vietnam Container JSC (HOSE: VSC) has approved a proposal to be presented at an Extraordinary General Meeting of Shareholders, regarding an increase in the company’s pre-tax profit plan for the year 2025.

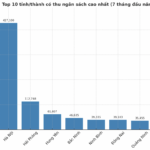

The Economic Powerhouse: Generating the Nation’s Highest Revenue Post-Provincial Merger

The initial figures from the 34 merged provinces and cities paint an intriguing picture of fiscal revenue trends. Ho Chi Minh City, bolstered by the inclusion of Binh Duong and Ba Ria-Vung Tau, has surged ahead to become the nation’s top earner, boasting an impressive revenue of over VND 465 trillion. Notably, a significant spike in land-related revenues has provided a substantial boost to the city’s coffers, presenting both opportunities and challenges in terms of market stability and efficient resource utilization.