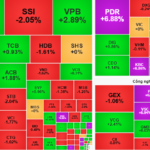

The VN30 group witnessed a clear divergence, with a dominant number of declining stocks – 17 codes decreased, while only 12 increased. The market lacked dynamic leadership, with many VN30 representatives absent.

In the banking group, TPB and EIB gained 2-3%, while ACB and SHB inched up slightly by 1-2%. Meanwhile, MBB, CTG, HDB, and BID all experienced declines. Among securities stocks, VIX surged by 6.63%, contrasting with declines of around 1-2% in SSI, STB, and VCI.

The real estate sector grabbed attention with a series of stocks, including PDR, KBC, HDG, and CRE, hitting the ceiling price. The trading activity of this group was relatively positive compared to the overall market.

Oil and gas stocks witnessed a notable surge.

The oil and gas group also attracted attention, with BSR surging for the second consecutive session after news of a shareholder vote on a capital increase. In its latest announcement, Binh Son Refinery and Petrochemical Joint Stock Company (BSR) stated that August 27 is the ex-rights date for shareholders to vote in writing regarding the approval of the capital increase plan.

Previously, the Vietnam National Oil and Gas Group (Petrovietnam – PVN) had approved a plan to increase BSR’s charter capital to over VND 20,000 billion, from VND 31,000 billion to VND 50,073 billion (equivalent to nearly USD 2 billion).

In the oil and gas group, PET also hit the ceiling price. Last month, this stock witnessed a nearly 50% increase and is currently trading at VND 38,600 per share. Against the backdrop of the stock’s strong performance, Petroleum General Services Joint Stock Company (PET) has just announced the trading results of Ms. Pham Thi Hong Diep, Member of the Board of Directors and Deputy General Director of the Company. Accordingly, from August 1-11, Ms. Diep sold all 153,300 PET shares.

Also during this period, from August 6 to September 4, four other PET leaders registered to sell their shares. If the transactions are successful, these leaders will no longer hold any PET shares.

Specifically, Mr. Vu Tien Duong, Member of the Board of Directors and General Director of PET, registered to sell all 399,250 shares. Mr. Ho Minh Viet, a member of the Board of Directors, registered to sell 209,100 shares. In addition, two deputy general directors, Mr. Huynh Van Ngan and Mr. Ho Hoang Nguyen Vu, intended to sell 297,000 shares and 78,020 shares, respectively.

At the close of the trading session, the VN-Index rose 6.37 points (0.39%) to 1,636.37 points; the HNX-Index increased by 1.53 points (0.54%). Conversely, the UPCoM-Index decreased by 0.64 points (0.58%). Liquidity declined, with the market’s trading value reaching nearly VND 50,000 billion. Foreign investors continued to net sell over VND 2,068 billion, focusing on SHB, VPB, FPT, VIX, MBB, CTG, and others.

Stock Market Update: Mid and Small-Cap Stocks to Attract Investors’ Interest

The August 18th session concluded with a robust buying spree as investors sought to take advantage of discounted stock prices. For the upcoming August 19th trading day, we anticipate a shift in focus towards mid and small-cap stocks, presenting a strategic opportunity for savvy investors to diversify their portfolios and potentially capitalize on the momentum of these dynamic segments of the market.

“Tailored Financial Solutions for Tourism, Entertainment, and Securities Giants: NCB’s Promise”

“National Commercial Joint Stock Bank (NCB) has unveiled a range of tailored credit solutions exclusively for large enterprises in the securities and entertainment tourism industries. These innovative financial offerings are designed to empower businesses with enhanced cash flow management, enabling them to boost their competitive edge and seize emerging growth opportunities.”

Who is the Secret Company that Just Signed a Deal to Purchase TDC’s Land in Binh Duong Ward?

“TDC and Global Corp have signed an agreement for the transfer of residential properties in Lot E15, part of the TDC Hoa Loi residential project in Binh Duong Ward, Ho Chi Minh City. This seemingly low-key enterprise has caught the attention of many big players in the stock market, with its connections to major power players.”

The New Ho Chi Minh City: A Fresh Property Landscape with Condos Starting from VND 28-280 Million per square meter

The residential market has witnessed a significant shift with a wave of new project launches just two months after Ho Chi Minh City’s merger with Binh Duong and Ba Ria-Vung Tau. This move has effectively addressed the prolonged shortage of supply, offering a diverse range of options across the spectrum, from affordable to luxury segments. The launch prices of these new projects vary considerably, starting from VND 28 million to nearly VND 280 million per square meter.

The Livestream Trend in Real Estate: How Effective Is It, and Who Protects the Buyers?

The live-streaming wave of real estate sales is sweeping through the industry in the first months of 2025. But beyond the impressive view counts lie unanswered questions: What are the actual effects, and who will protect the buyers?