In recent years, retail banking has evolved from a “supplementary spearhead” to the “main axis” of many banks’ strategies. With the digital boom, banks are also well-positioned to boost their retail banking segment for sustainable growth.

At Orient Commercial Joint Stock Bank (OCB), Mr. Pham Hong Hai, CEO, shared: “Retail remains our key strategy. Additionally, we also focus on small and medium-sized enterprises (SMEs), especially startups, as we believe this will be a high-potential segment for market growth… It can be said that if startups are the new lifeblood of the economy, then banks must be the lifeblood that channels smart capital.”

This strategy of prioritizing individual customers, SMEs, and the startup community, coupled with a digital infrastructure and a comprehensive financial ecosystem, is clearly reflected in OCB’s business results.

According to the financial report for Q2 2025, OCB recorded a pre-tax profit of VND 999 billion, an increase of 11.2% compared to the same period last year. Total net revenue reached VND 2,642 billion, up 16.3%, with net interest income growing by 9.7% to VND 2,179 billion due to expanded credit facilities.

Notably, non-interest income was a highlight, with a significant recovery. Non-interest income increased by 321.5% compared to Q1 and 61.9% year-over-year, reflecting the impact of accelerated service charges and the recovery of foreign exchange trading. Service charges alone increased by VND 146 billion, equivalent to 97.6% compared to the same period last year, while foreign exchange trading income surged by 1,387.3% quarter-over-quarter to VND 104 billion. For the first six months of the year, OCB’s pre-tax profit reached VND 1,892 billion.

OCB also achieved an important milestone in terms of scale, with total assets surpassing VND 300,000 billion. Specifically, as of June 30, 2025, this indicator reached VND 308,899 billion, up 10% from the beginning of the year. The bank recorded market lending of VND 190,789 billion, an increase of 8.4%, and market deposits of VND 153,940 billion, up 8.1%. SME credit growth was particularly impressive: up 51.7% in 2024 compared to 2023 and continuing to rise in 2025.

At the heart of OCB’s retail strategy is digital transformation, with digital products delivering high cost-efficiency and profit margin improvements. As of June 30, 2025, transactions on the OCB OMNI digital banking platform (for individual customers) increased by 97% compared to the same period in 2024; CASA grew by 28%, and online savings deposits increased by 30%.

In the corporate segment, OCB is focusing on Open Banking to create a differentiated offering. To date, the number of transactions connected via Open API with OCB has increased by 57.9% year-over-year; transaction value has grown by 184.8%, and CASA has increased by 31.8% on average.

OCB considers Open Banking a significant opportunity to differentiate itself in the market.

Along with digital transformation, OCB is focusing on a “good and green” growth structure. The bank continues to invest in renewable energy projects, green buildings, smart agriculture, and more. OCB’s green credit portfolio has grown by over 10% in the first six months, contributing to improved asset quality and risk management standards.

For the period 2025 – 2030, OCB aims to become one of the top five joint-stock commercial banks in Vietnam in terms of ESG.

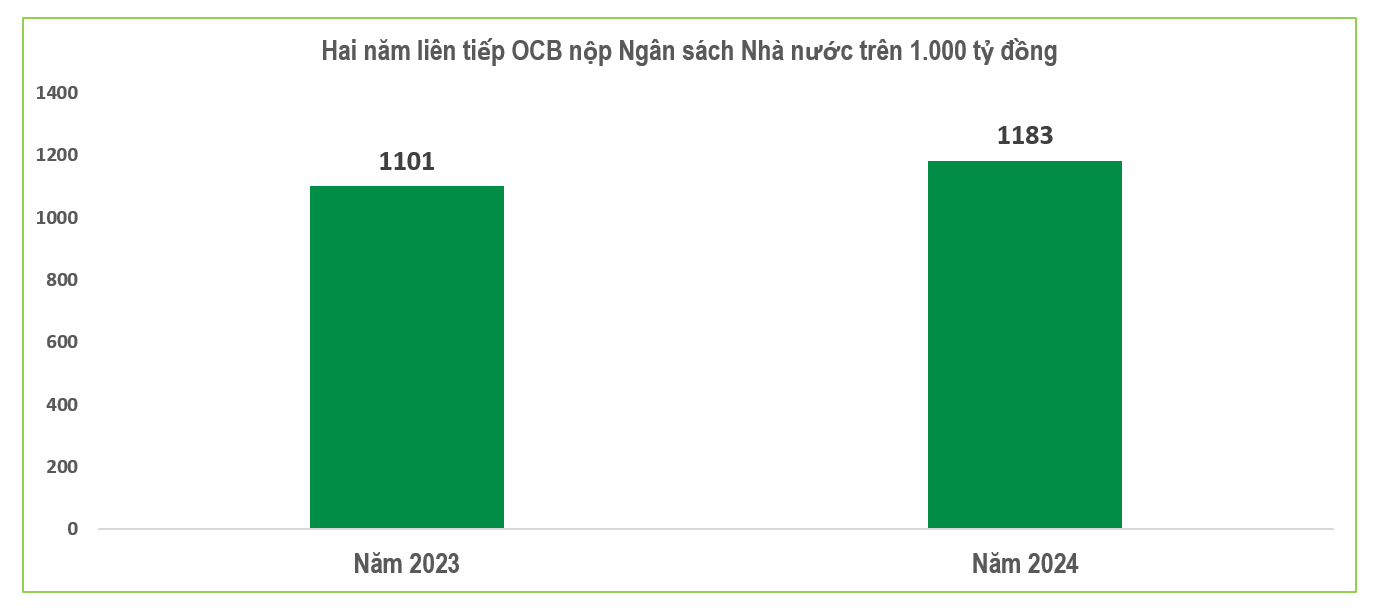

Thanks to its effective development strategy, OCB has made significant contributions to the state budget, which has increased year after year.

The above-mentioned business and operational efficiency have translated into tangible contributions to society and the state budget. According to a list of the top 20 banks with the highest tax contributions published by CafeF, in 2024, OCB contributed VND 1,183 billion, marking the second consecutive year of tax contributions exceeding VND 1,000 billion. These contributions include corporate income tax (CIT), personal income tax (PIT), value-added tax (VAT), and a range of other fees and charges, which are directly remitted to the national budget.

“Registering Your Land: A Guide for Those With Ineligible Red Book Requirements”

“Mr. Nguyen Bao Trung, Deputy Director of the Department of Digital Transformation and Environmental Resource Data Information, revealed that the Ministry of Natural Resources and Environment is moving towards allowing registration of land information even for land that does not yet meet the requirements for certification.”

MobiFone Appoints New Deputy General Director, Born in 1989

On August 19, 2025, Mobifone Telecommunications Corporation held a ceremony to announce the decision on personnel matters. According to Decision 58/QD-HDTV dated August 19, Mr. Tran Duc Thanh, born in 1989, Chairman of the Board of Directors of Mobifone Digital Solutions JSC, was appointed as the new Deputy General Director of Mobifone Telecommunications Corporation.

Unlocking Innovation: Propelling Data Exploitation as the Epicenter of Economic Prosperity

On August 18th, at the Hoa Lac High-Tech Park in Hanoi, a momentous occasion took place with the attendance of Pham Minh Chinh, a member of the Politburo and the Prime Minister of Vietnam. The event marked the official launch of the National Data Center No.1 and the inauguration of the National Database System hosted within the center. This significant development in Vietnam’s technological landscape was organized by the Ministry of Public Security.

Unlocking the Potential: Minister of Science and Technology, Going Beyond Tech Indexes to Tackle Core Tech and Market Conundrums

In the context of the integration of the science and technology sector with the information and communications field, the Prime Minister requested that the Ministry shift its focus from building targets to creating a technology market, forming innovative enterprises, and mastering 70% of domestic strategic technology.