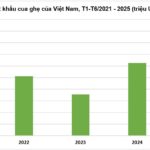

Vietnam’s crab and crayfish exports witnessed a strong performance in the second quarter of 2025, according to the Vietnam Association of Seafood Exporters and Producers (VASEP). While crab exports maintained steady growth, crayfish and horseshoe crab exports saw a slight dip in the last month of the quarter. Nevertheless, the overall six-month export value reached an impressive $173 million, a 38% increase compared to the same period in 2024, setting a decade-high record.

Vietnamese crab, crayfish, and other crustaceans are now present in 25 international markets, with China remaining the largest destination. After a strong first quarter, imports stabilized in the second quarter, but Vietnamese crab continued to command mid-to-high-end prices, catering to restaurants, supermarkets, and e-commerce platforms in major cities such as Shanghai, Beijing, and Guangzhou.

In Japan, the demand remained stable, maintaining market share for Vietnamese businesses. Australia, after a period of decline, saw a remarkable 58% surge in exports during the second quarter. Notably, exports to the European Union (EU) increased by 71% year-on-year, despite a slower pace compared to the first quarter. This broad-based growth demonstrates the adaptability of Vietnamese businesses in exploring new markets rather than relying solely on traditional partners.

Vietnamese crab and crayfish are known for their fresh, nutrient-rich meat. Photo: IT.

Over 93 Vietnamese businesses are involved in exporting crab and crayfish. The biggest strength of Vietnamese crab and crayfish lies in the superior quality of their meat, which is fresh, nutrient-dense, free from antibiotic residues, and safe for consumers. Cà Mau crab, a well-established brand, is favored in both domestic and international markets. Additionally, green crab from the central and southern coastal regions has also made its mark, becoming a popular choice across various markets.

The strong international demand has driven up domestic procurement prices. In Cái Nước, Cà Mau, top-grade egg-carrying crab fetches a price of 700,000 VND/kg, while meat crab ranges between 400,000 and 450,000 VND/kg. At seafood ports, premium-grade crayfish is priced at 500,000-600,000 VND/kg, while lower-grade ones range from 200,000 to 300,000 VND/kg. Many localities have reported a significant increase in crab exports to China during the summer, keeping wholesale prices stable at high levels.

According to experts, the outlook for crab and crayfish exports in the second half of the year remains positive. The third and fourth quarters typically coincide with festive seasons in many Asian countries, including China and South Korea, leading to increased demand for seafood. With the current momentum, annual export turnover is expected to surpass $350 million, doubling the figure from 2023. This marks a significant step forward, solidifying the position of Vietnamese crab and crayfish on the global seafood map.

However, this success is not without its vulnerabilities. The heavy reliance on a few key markets makes the industry susceptible to short-term demand fluctuations. Additionally, the competition from other Southeast Asian countries is becoming more intense, compelling Vietnamese businesses to enhance their quality and order fulfillment capabilities.

Annual export turnover is projected to double that of 2023. Photo: VASEP.

Stringent requirements for quarantine, traceability, farming zone codes, and biosecurity (IUU) are also creating significant pressure. High-end markets like the US and the EU continuously raise technical barriers, ranging from antibiotic residue regulations to sustainable farming certifications. If Vietnamese businesses fail to upgrade their production and processing systems, they may not be able to fully capitalize on the high-value segment’s potential.

Following VASEP’s recommendations, local authorities should expand farming areas to meet international standards and invest in modern cold storage and logistics systems. These are prerequisites for tapping into the live crab market, which offers superior profit margins. Businesses are also advised to pursue long-term contracts to mitigate the risk of price suppression during peak seasons.

“Vietnamese Products Hit a 10-Year High: Seizing the Golden Opportunity to Soar on the Global Stage”

The Vietnamese crab and shrimp industry has witnessed a remarkable surge in exports, propelling the sector to record-breaking heights. This exceptional performance has positioned the industry at its pinnacle over the last decade.

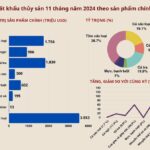

Seafood Exports on Track to Hit $10 Billion Landmark

With the current growth trajectory, Vietnam’s seafood industry is on track to achieve its target of $10 billion for the full year 2024, marking an impressive 11.5% increase from 2023. Shrimp and catfish will remain the key drivers, with projections of reaching $4 billion and $2 billion, respectively.

Vietnam Prepares for EU Inspection Delegation in Aquaculture

The European Union (EU) inspection team is set to visit Vietnam to audit its aquaculture industry. The team is expected to evaluate the country’s residue control program for products destined for the EU market and verify the reliability of ensuring that farmed seafood complies with residue regulations.