Vietnam’s rubber exports have seen a strong recovery recently, bolstered by increased supply from the new harvest season and surging demand from the primary market, China.

According to data from the Customs Department, Vietnam’s rubber exports in July 2025 reached 206,155 tons, valued at $334.6 million, marking a significant increase of 43.3% in volume and 39.5% in value compared to the previous month.

Cumulative exports in the first seven months of 2025 amounted to 899,771 tons, worth $1.62 billion, representing a slight decline of 1.5% in volume but a substantial growth of 14.6% in value year-on-year, attributed to higher prices.

The average export price of rubber in the January-July period stood at $1,803 per ton, reflecting a notable surge of 16.3% compared to the same period last year. However, the average export price in July 2025 dipped to $1,623 per ton, marking the fourth consecutive month of declining prices.

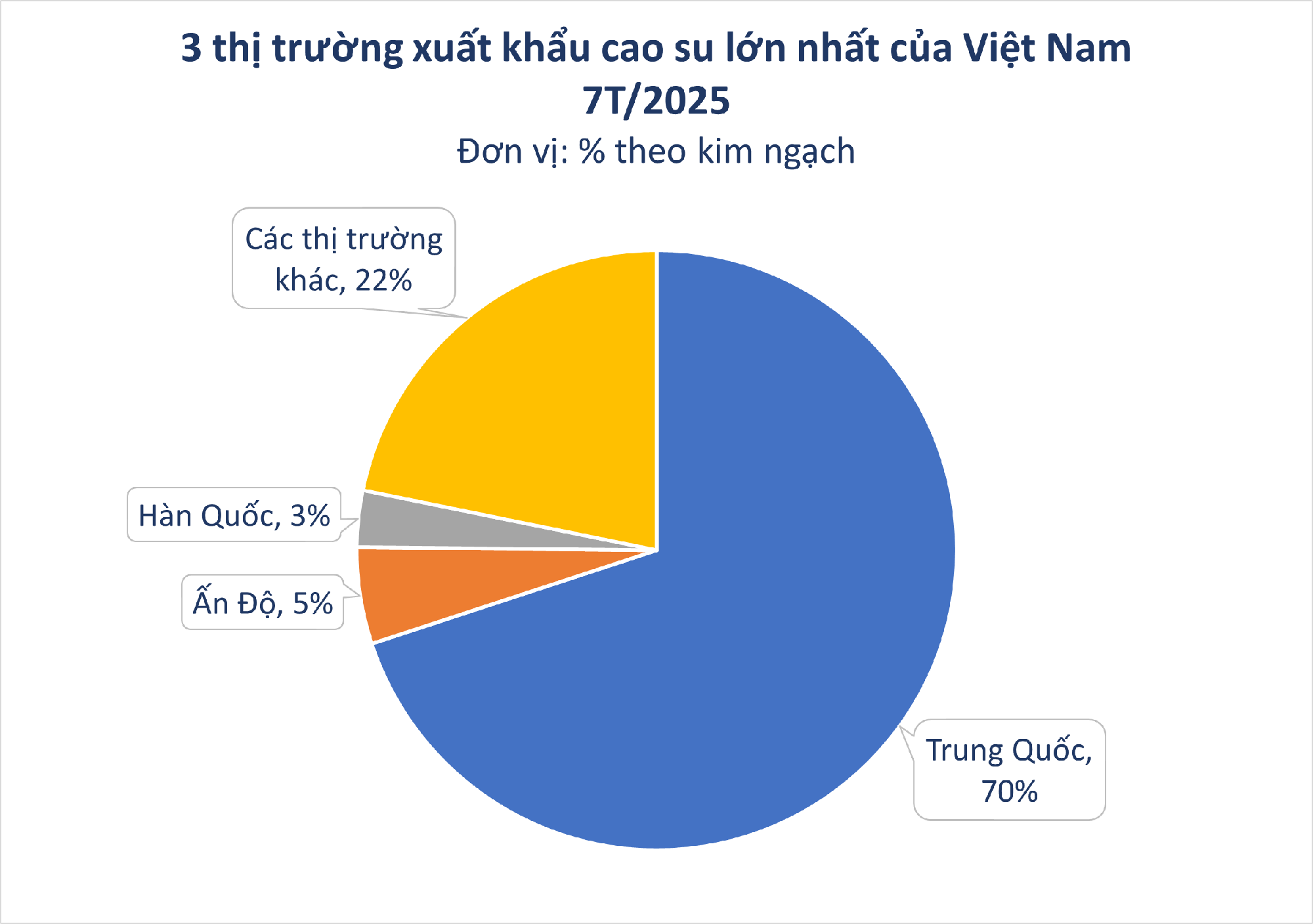

China remained the largest importer of Vietnamese rubber during the seven-month period, accounting for 70.8% of the volume and 70% of the export value. Specifically, rubber exports to China reached 637,114 tons, valued at $1.13 billion. The average export price to this market was $1,781 per ton in the first seven months of 2025, indicating an increase of 18.9% year-on-year.

China’s robust rubber imports coincide with strong automotive sales performance. According to the Import-Export Department, the positive growth trajectory of China’s automotive industry is contributing to enhanced prospects for rubber consumption in the world’s largest consumer market.

Meanwhile, exports to the second-largest market, India, witnessed a sharp decline of 40.3% in volume and 31.2% in value compared to the previous year. Exports to South Korea, the third-largest market, decreased by 10% in volume but rose by 5.1% in value.

Notably, Malaysia emerged as a significant importer of Vietnamese rubber, with imports surging to 25,600 tons, valued at $36 million, representing remarkable growth of 217% in volume and value year-on-year. Consequently, Malaysia’s market share rose dramatically from 0.9% in 2024 to 2.9% in 2025, becoming the fourth-largest export destination.

On a related note, on August 1, 2025 (Vietnam time), the United States issued a presidential decree adjusting countervailing duty rates, deciding to adjust the rates for 69 countries and territories, effective from 12:00 PM on August 7, 2025 (Washington time).

The countervailing duty rate for Vietnam was reduced from 46% to 20%. This is considered a positive signal and relatively appropriate given that Vietnam is one of the leading exporters to the United States in the Southeast Asian region. The tax rate for Vietnamese goods is generally not significantly different from the 19% rate applied to other ASEAN countries such as Cambodia, Indonesia, Malaysia, Thailand, and the Philippines. Therefore, it is unlikely to cause significant investment shifts or competitive imbalances.

The Import-Export Department (Ministry of Industry and Trade) opined that natural rubber prices could continue their upward trend in the short term due to supply disruptions, especially if adverse weather conditions persist. In the medium term, market developments will hinge on the pace of demand recovery in China and macroeconomic regulatory policies in the United States and the European Union. If the global economy demonstrates a distinct improvement, rubber prices may stabilize.

Additionally, the Import-Export Department attributed the rise in crude oil prices, fueled by optimistic sentiments surrounding trade negotiations, to the improved outlook for the global economy and oil demand. This factor also bodes well for natural rubber prices, as synthetic rubber, produced from crude oil, competes with natural rubber for market share.

A Profitable Second Quarter: BSR Surpasses Annual Targets

The upward trajectory of crude oil prices compared to the downward trend in the same period last year has resulted in a positive impact on the performance of Binh Son Refining and Petrochemical Joint Stock Company (HOSE: BSR). This quarter, the company witnessed a significant growth in its business, surpassing its annual profit plan just within the first six months.

The Billion-Dollar Product from Vietnam: A Global Frenzy with Prices Soaring to a 2-Year High, China as its Top Patron

The export price of this commodity hit a 2-year high as of June 2022. This marks a significant peak, with prices soaring to levels not seen since 2020. This news is sure to capture the attention of investors and economists alike, as it indicates a potential shift in the market and could have far-reaching implications for the global economy. With such a dramatic rise, the question now is whether this upward trend will continue or if a correction is on the horizon.