In a newly published strategic report, Agriseco Securities projected a 20% growth in overall market profits in 2025 compared to 2024.

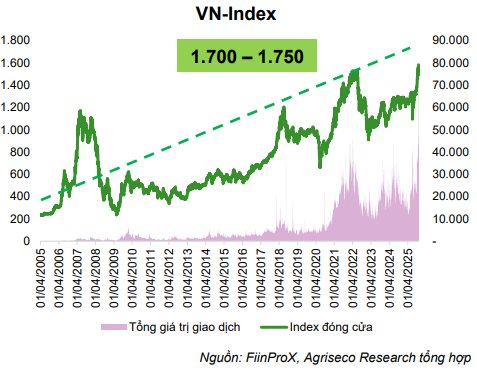

Agriseco Research forecasts VN-Index to reach the 1,700-1,750 point range by the end of 2025 based on: (1) a 20% growth in overall market profits; and (2) a reasonable P/E of 15 times.

Additionally, favorable factors that will continue to support the market’s upward trend include the potential for the Fed to start lowering interest rates from September 2025. Domestically, the government’s determination to achieve economic growth with a target of 8.3%-8.5% this year, along with various moves to boost credit growth, enhance fiscal policies, disburse public investment capital, and aim for market upgrade.

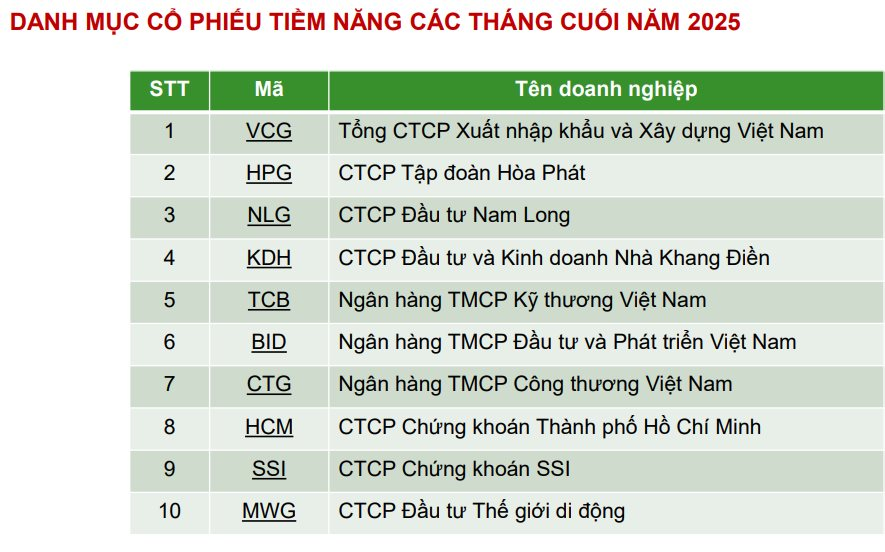

With these projections, Agriseco identifies 10 potential stocks suitable for investment in the last months of 2025.

Firstly, Vinaconex, Stock code: VCG . The analysis team expects Vinaconex’s real estate segment to remain the main growth driver for the company’s business results in 2025 due to the accelerated sales and handover of projects with high-profit margins.

The infrastructure construction segment is also anticipated to perform well, with many projects ahead of schedule. Furthermore, Vinaconex is expected to record an extraordinary profit in 2025 due to its divestment from Vinaconex ITC. With an initial investment capital of VND 1,629 billion in VCR, VCG is projected to record a profit of over VND 3,670 billion from financial activities this year. Apart from generating a substantial profit, this event is expected to improve cash flow and create momentum to promote the growth of other projects for Vinaconex.

Secondly, Hoa Phat Group, Stock code: HPG . Agriseco anticipates improved consumption volume for HPG, attributable to demands from: (1) The real estate market continues to show positive signals, with the number of newly licensed projects in Q2/2025 increasing by 28.9% compared to the previous quarter (according to the Ministry of Construction); and (2) The disbursement of public investment capital in the first seven months rose by 25.8% compared to the same period last year and continues to be promoted.

Previously, Hoa Phat recorded revenue of VND 73,532 billion, up 4.4% compared to the same period last year, and after-tax profit of over VND 7,600 billion, a 23% increase in the first half of the year.

Thirdly, Nam Long Investment Corporation, Stock code: NLG . The analysis team expects NLG’s sales to continue increasing, driving business results in the coming years as NLG launches new products. The real estate market in the outskirts of Ho Chi Minh City, such as Long An and Dong Nai – where NLG’s projects are concentrated, is expected to recover thanks to infrastructure development and provincial integration.

Meanwhile, profits in 2025 are projected to increase thanks to the recognition of financial revenue from the sale of a 15.1% stake in the Izumi City project. NLG will benefit in the medium and long term from its large urban land fund, with affordable housing projects that meet actual demand amid limited supply in the Southern region.

Fourthly, Khang Dien House Trading and Investment JSC, Stock code: KDH . KDH possesses a land fund of over 600ha in the Eastern region of Ho Chi Minh City, which is considered highly promising in the medium and long term due to its extensive land bank.

Business results in 2025 are expected to maintain growth, mainly due to the launch of Gladia, a project developed by KDH in collaboration with Keppel (Scale: 11.8ha, including 226 low-rise units and 600 apartments). The project is currently selling more than 200 villas, with expected prices ranging from VND 200-250 million/sqm. Agriseco anticipates that real estate sales in the 2025-2026 period will significantly increase, mainly contributed by the Gladia project and partly by the Solina project.

Fifthly, Vietnam Technological and Commercial Joint Stock Bank (Techcombank), Stock code: TCB . With its leading position in retail and real estate lending, Agriseco Research estimates that TCB’s credit growth in 2025 will exceed 20%, driven by: (1) Reasonable interest rate levels, stimulating borrowing demand; and (2) The recovery of the real estate market, benefiting TCB’s personal lending and real estate project financing portfolios this year.

TCB’s net interest margin continues to recover thanks to low funding costs and growing net interest income, along with improved asset quality through increased loan loss reserves.

Sixthly, Vietnam Bank for Investment and Development (BIDV), Stock code: BID . Similar to TCB, Agriseco expects an improvement in BIDV’s asset quality by the end of the year. The outlook for profit growth stems from: (1) A 16% credit growth target for the full year 2025; (2) Expected NIM recovery to the 2.3-2.5% range; and (3) Improved asset quality. Furthermore, BID plans to increase charter capital to VND 91,870 billion in 2025, notably including a proposal to pay dividends in stocks at a rate of 19.9% and privately offer a maximum of 269.8 million shares (equivalent to a rate of 3.84%).

Seventhly, VietinBank, Stock code: CTG, with profit growth driven by the promotion of retail lending. It is estimated that CTG’s net interest income in 2025 will reach over VND 70,813 billion (+15% compared to the same period last year), and the bank’s ROA/ROE ratios have continuously improved, indicating positive long-term operational efficiency.

Additionally, asset quality is expected to continue improving thanks to the gradual recovery of the economy and the revival of production and business activities and the real estate market.

Eighthly, Ho Chi Minh City Securities Corporation, Stock code: HCM . With the expectation of an upgrade in September, Agriseco projects that the upgrade will create a strong impetus for HSC’s brokerage revenue and enhance its appeal to international investors. Simultaneously, HFIC’s plan to divest opens up opportunities to remove ownership barriers, increase capital scale, invest in technology, expand the service ecosystem, and attract international strategic partners, aligning with the trend of global standardization.

Ninthly, SSI Securities Corporation, Stock code: SSI . Agriseco believes that SSI is expanding into digital financial products and services to embrace the digital transformation trend in the securities industry. Through SSI Digital Ventures (established in 2023), the company focuses on investing in potential technology startups, prioritizing blockchain, AI, and capital market solutions. This strategic move diversifies SSI’s portfolio, expands its ecosystem, and strengthens its long-term position.

In the context of market upgrade expectations and the influx of foreign capital into Vietnam, SSI will benefit from its leading position in serving foreign investors. The operation of the KRX system also paves the way for developing new securities products, positively supporting SSI’s business activities.

“Vingroup: A Testament to the Visionary Leadership of Billionaire Pham Nhat Vuong”

Vingroup Group was bestowed with the First-Class Labor Order for its exceptional achievements in constructing and preponing the operation of the National Fair and Exhibition Center by 15 months.

Pork Prices Plummet

The African Swine Fever outbreak has wreaked havoc on pig farmers, causing consumers to be wary and domestic pork prices to plummet. The authorities have identified three major issues that are prolonging this crisis.