“Shrimp Exports to the US Stagnate Amid Tariff Headwinds, While Asian Markets Boom”

After a robust surge in May and June, driven by tariff-evading orders, shrimp exports to the US have started to level off as the 20% retaliatory tariff on Vietnamese shrimp takes its toll. The looming threat of high anti-dumping and countervailing duties further squeezes profit margins, compelling businesses to adjust their pricing strategies and order structures. Meanwhile, competitors such as Ecuador (with a 15% import tariff), Indonesia, and the Philippines (19%) are gaining a competitive edge.

Shrimp Exports to the US Take a Hit in July

|

In stark contrast, exports to Asian markets are booming. China and Hong Kong remain at the forefront, raking in 710 million USD in the first seven months, marking a 78% increase and accounting for 29% of the total value. July alone witnessed a 63% surge, amounting to 115 million USD. Geographical advantages, lower logistics costs, and soaring domestic demand, particularly for lobster, have bolstered Vietnam’s dominance in these markets.

Exports to South Korea also maintained stability, reaching 203 million USD, a 13% increase, attributed to the demand for convenient products in the HORECA channel.

The CPTPP bloc contributed 699 million USD, reflecting a 36% increase and comprising 28% of the total exports. Japan, the largest market within the bloc, attained 320 million USD, a 15% increase. Despite a slight dip in July due to the weak yen, Japan sustained stable purchasing power, favoring value-added and ready-to-eat products.

In Europe, exports amounted to 309 million USD, signifying a 17% increase. July witnessed a 21% surge, totaling 57 million USD, thanks to the benefits of the EVFTA and stable demand as inflation eased. Germany and France stood out with impressive growth rates of 28% and 17%, respectively.

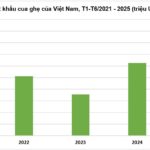

In terms of species, whiteleg shrimp continues to reign supreme, raking in 1.6 billion USD, equivalent to 63% of total exports and an 8% increase from the previous year. Black tiger shrimp reached 260 million USD (a 5% increase), while the ‘other shrimp’ category, including frozen orders from Asia, soared by 117% to 657 million USD.

VASEP forecasts that shrimp exports for the entire year could attain 3.6 – 3.8 billion USD if businesses effectively tap into Asian markets, the EU, and the CPTPP bloc while increasing the proportion of value-added products destined for Japan. However, the growth momentum may decelerate in the second half as the US tightens import restrictions, intensifying competitive pressures on Vietnamese shrimp.

– 13:19 18/08/2025

Navigating Tariffs: Exploring New Markets, Revitalizing Old Ones

“With the ever-increasing commercial competition, businesses are now looking to explore new avenues. Tapping into niche markets, venturing into new territories, and revitalizing old ones are the strategies that will pave the way for future success. It’s time to adapt, evolve, and embrace these new challenges.”

The Sunken Treasure: Vietnam’s Aquatic Delicacies Shine Abroad

The product in question is highly sought-after in countries like China and Australia due to its superior quality and Vietnamese origin.