Illustrative Image

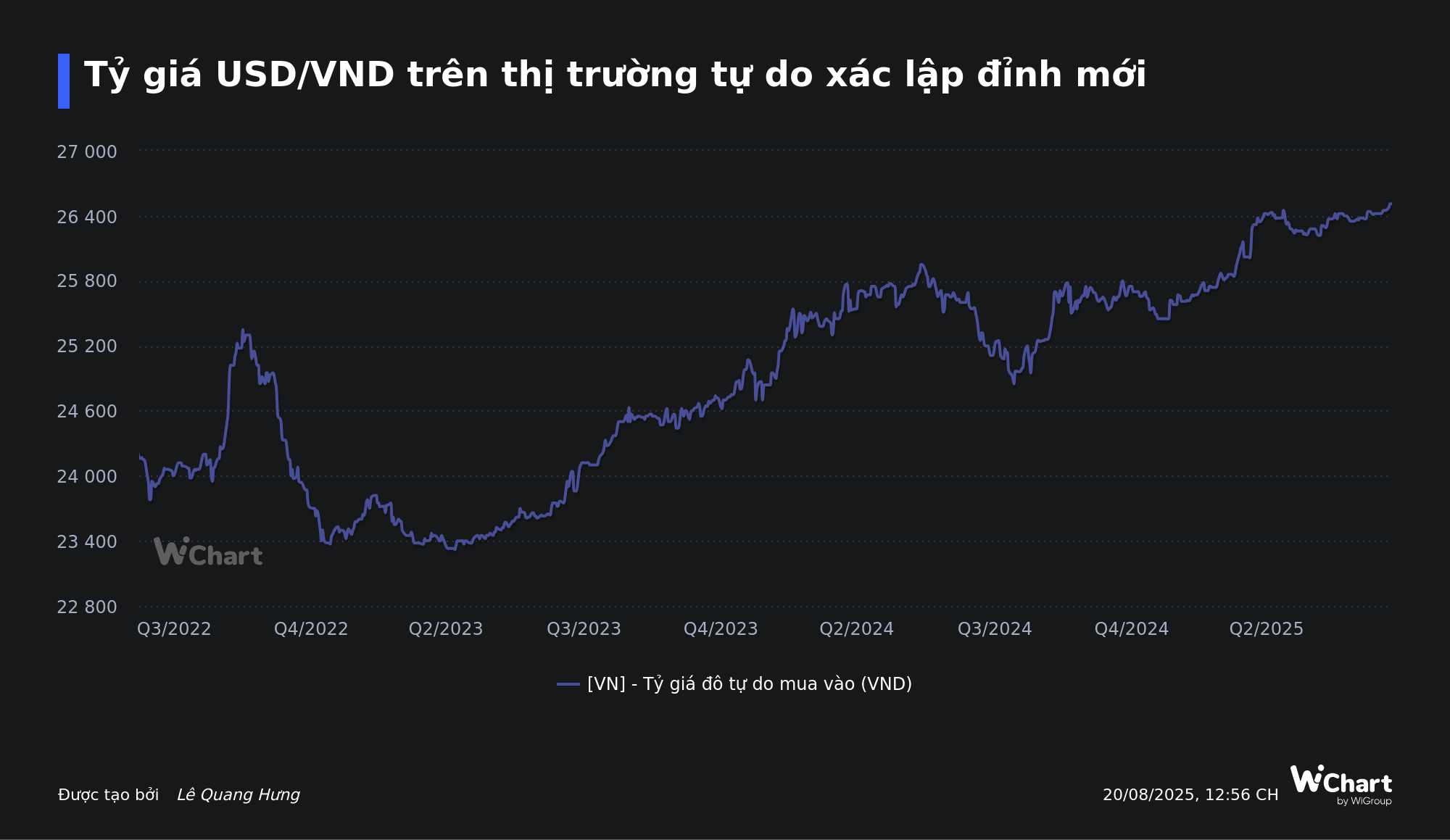

On August 20, the State Bank of Vietnam set the daily reference exchange rate at 25,263 VND/USD, an increase of eight dong from the previous day and the highest level since the application of this mechanism. With a fluctuation margin of 5%, commercial banks are allowed to trade the US dollar within a range of 24,000 – 26,526 VND/USD.

The State Bank of Vietnam’s Trading Center also adjusted the buying and selling rates up to 24,050 – 26,476 VND/USD.

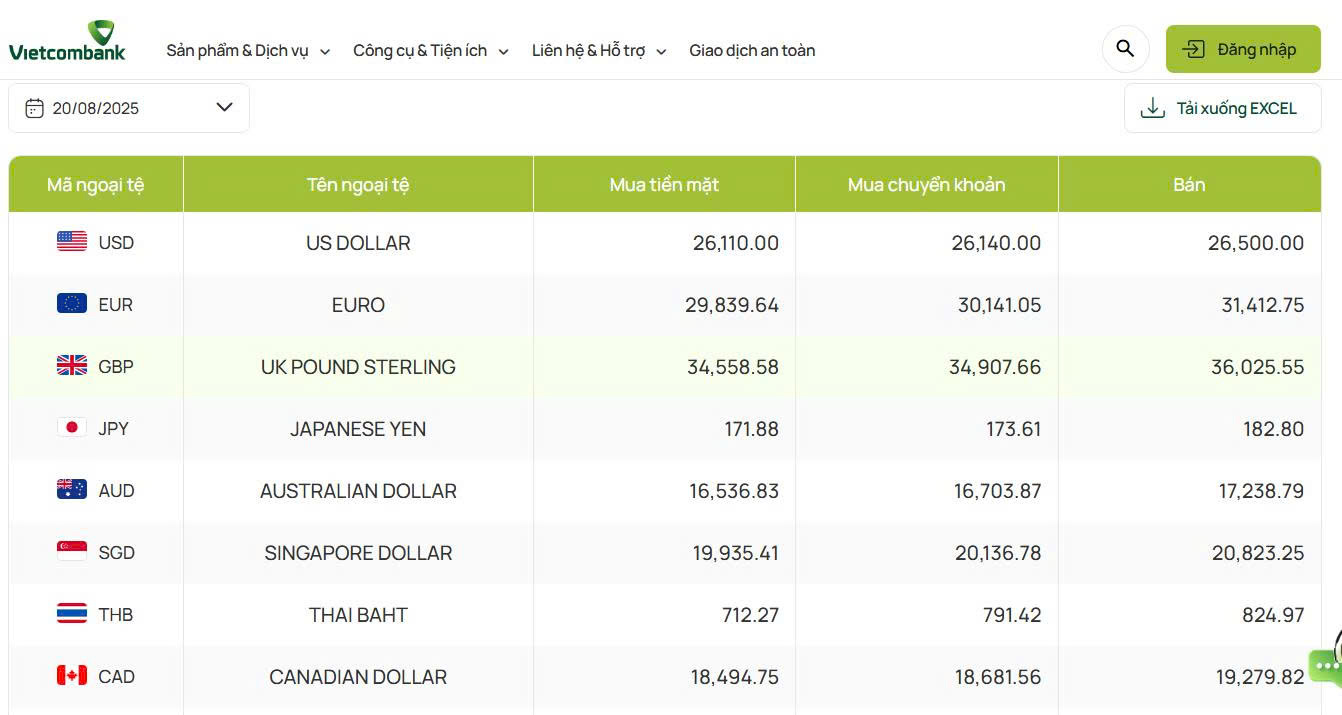

This morning, banks simultaneously raised their USD selling prices to around 26,500 VND. At 11 am, Vietcombank, the bank with the largest foreign currency trading volume in the system, listed the USD buying and selling rates at 26,110 – 26,500 VND/USD, an increase of 20 dong in both directions compared to the previous day’s survey. Since the beginning of the year, the USD rate at Vietcombank has increased by about 3.7%.

VietinBank raised both buying and selling rates by 24 dong, bringing the selling rate to 26,511 VND/USD. BIDV increased its buying and selling rates by 20 dong each, reaching 26,500 VND/USD.

Other major banks, including Techcombank, ACB, MB, Eximbank, and Sacombank, also raised their USD selling prices to the range of 26,500 – 26,510 VND/USD.

In the interbank market, the exchange rate at the end of the August 19 session was 26,318 VND/USD, a further increase of 21 dong compared to the August 18 session.

In the unofficial market, the USD also surged. A survey at 11:00 am showed that money changers were buying and selling USD at 26,520 – 26,600 VND/USD, with buying and selling prices increasing by 70 dong and 100 dong, respectively, compared to the previous day.

Internationally, the US Dollar Index (DXY), which measures the strength of the US dollar against a basket of major currencies, hovered around 98.3 points.

With the DXY having risen 1.5% from its June low, the USD/VND exchange rate is facing upward pressure. Previously, the USD/VND rate had increased by 3% in the first half of 2025 despite an 11% decline in the US dollar in the international market.

In a recently published report, MBS Securities forecast a possible decrease in the USD exchange rate by the end of the year as the Fed is expected to start cutting interest rates. However, internal factors will continue to put upward pressure on the exchange rate, including the persistent interest rate differential between USD and VND even if the Fed cuts rates to 4%.

The pressure also comes from larger import demands as a 0% tax rate is applied to goods from the US, while exports, in general, are expected to slow down, leading to a narrower trade surplus. Moreover, FDI inflows may slow down as investors await clearer information on tariffs, and the gold price differential between the domestic and international markets in the context of rising gold prices.

Credit Growth and the ‘Carrot’ for Select Banks

The rapid growth of credit contrasted with slower capital mobilization has put significant strain on the banking system’s liquidity. In response, the State Bank has intervened by reducing the statutory reserve ratio by 50% for four banks that are recipients of mandatory transfers from four banks under special control.

The Greenback Hits a New High: Official Exchange Rate Surpasses 26,500 VND

The US dollar is on a roll, with the exchange rate reaching new heights on August 20, 2025. The official exchange rate hit a record high, with the selling price reaching a staggering VND 26,500 per USD at banks across the country. This unprecedented surge has the market buzzing, as the Vietnamese currency feels the heat from the mighty dollar.

“High Interest Rates on Short-Term Deposits: Implications for Vietnam’s Economy”

The private sector in Vietnam is currently dominated by banking and real estate enterprises. This, according to Dr. Le Xuan Nghia, former Vice Chairman of the National Financial Supervisory Commission, is an inevitable phase of accumulation that many nations have gone through on their path to industrialization and the development of science and technology.

Title: “Currency Update: USD and Yuan Continue Their Surge”

“Vietcombank and BIDV have both listed their USD exchange rates at 23,100 VND for buying and 23,460 VND for selling. Vietcombank has increased their rates by 10 VND, while BIDV has raised theirs by 20 VND for both buying and selling. This adjustment in rates showcases the dynamic nature of the foreign exchange market in Vietnam, where rates can fluctuate daily.”

The Profit Sprint: Unlocking Banking’s Q2 Success

The latest Q3 business trend survey by the Forecasting and Statistics Department – Monetary and Financial Stability (SBV) revealed that credit institutions have slightly raised their credit growth expectations for the year to 16.8%, surpassing the actual figure for 2024. This growth forecast is considered a significant impetus, promising to maintain the upward trajectory of profits for the entire banking sector compared to the previous year.