VPBank’s Remarkable Surge

Vietnam Prosperity Commercial Joint Stock Bank (VPBank) witnessed a remarkable surge in its stock price at the beginning of the trading session on August 19, skyrocketing by almost 7% to 34,200 VND, following the news that VPBank Securities (VPBankS) plans an initial public offering (IPO) in Q4.

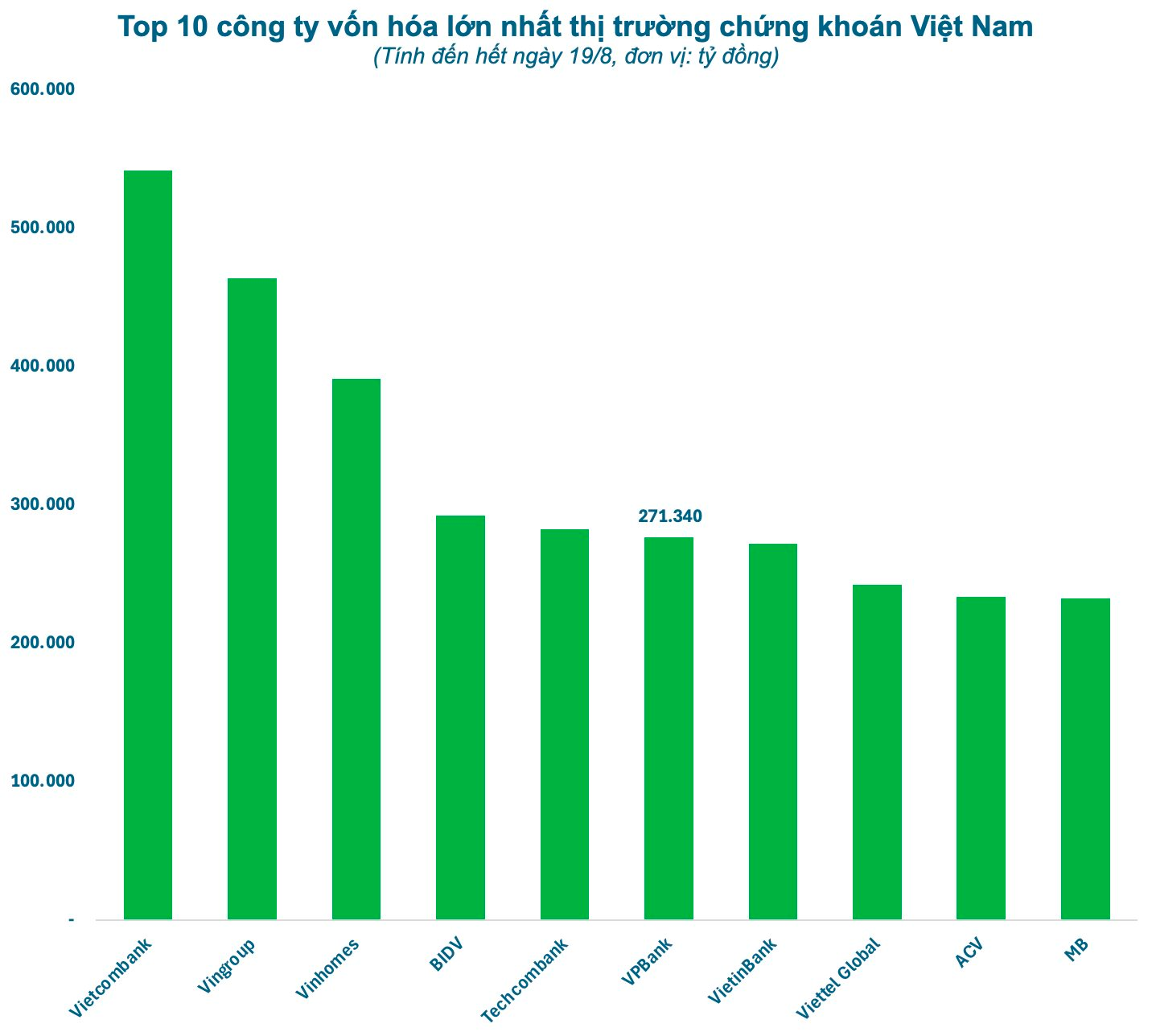

By the end of the session, the stock still had a buying limit of nearly 12 million units, making the most significant contribution to the VN-Index’s gain. The private bank’s market capitalization surpassed 271 trillion VND, equivalent to over $10 billion, surpassing VietinBank to rank 4th in the banking system.

VPBank’s Market Capitalization Exceeds $10 Billion for the First Time

Since the beginning of July, VPB has been on an impressive upward trajectory, surging from over 18,000 VND to above 34,000 VND, representing a nearly 90% increase. This rapid doubling of its stock price within just over a month is not a coincidence but a reflection of investors’ growing confidence in VPBank’s long-term growth prospects and their faith in the transformation of Vietnam’s banking industry.

In terms of financial metrics, VPBank’s consolidated total assets surpassed 1.1 quadrillion VND, solidifying its leadership position among private banks. Its pre-tax profit for the first half of the year exceeded 11,200 billion VND, marking a 30% growth despite a slowdown in larger-scale banks’ performance.

Regarding valuation, VPB was previously considered one of the most attractively valued bank stocks on the stock market. Its P/E ratio in mid-2025 hovered around 9 times, significantly lower than the industry average of 10-12 times and the VN-Index’s range of 12-14 times.

Not only VPB but the entire Vietnamese banking sector was undervalued at that time. The industry’s P/B ratio was merely 1.4 times, a valuation only seen during two exceptional periods: the COVID-19 outbreak and the Van Thinh Phat shock.

According to analysts, bank stocks remain an appealing investment avenue due to their reasonable valuations compared to their potential. The current price levels only partially reflect the achieved financial results, whereas the industry’s growth prospects remain vast. As the backbone of the economy, banks directly benefit from the growth cycle, businesses’ capital needs, and consumer spending booms.

This allure is further enhanced by the anticipation of substantial capital inflows into the industry as Vietnam moves closer to its market upgrade goal, presenting opportunities to attract additional foreign investment.

Anticipating the VPBankS IPO

In the medium to long term, bank stocks, including VPB, are still considered attractive investment options by many experts due to their reasonable valuations relative to their potential. VPBank, in particular, has distinct advantages.

VPBank currently owns 99.99% of VPBankS, the only securities company in its ecosystem, with a charter capital of 15 trillion VND. In just three years of operation, VPBankS has achieved remarkable growth.

The first half of 2025 witnessed an even more remarkable surge, as the company reported a record pre-tax profit of nearly 900 billion VND, an 80% increase from the previous year, placing it in the top 5 in the industry. With total assets nearing 51 trillion VND and owner’s equity of nearly 18,200 billion VND, VPBankS ranks among the top 3 and top 4 in the market, respectively.

Margin lending soared to nearly 18 trillion VND, doubling in just six months. More importantly, with its robust capital strength, VPBankS still has a limit of nearly 19 trillion VND for margin lending, while many securities companies have reached the regulatory limit.

Investors anticipate that the VPBankS IPO could propel VPBank’s market value to new heights, similar to the Vinpearl listing, which tripled Vingroup’s stock price this year, or the TCBS IPO, valued at approximately $4 billion.

It is also worth mentioning that VPBank is one of the few institutions in Vietnam to successfully execute two billion-dollar transactions: the sale of a 49% stake in FE CREDIT to foreign partner SMBCCF and the issuance of a 15% stake to SMBC. With its unique expanded ecosystem comprising banking, consumer finance, securities, and insurance, along with experience from billion-dollar deals, the VPBankS IPO is expected to provide a new boost to the entire market.

Unlocking VPB’s Stock Potential: The CASA Advantage

In the first half of 2025, VPBank witnessed an impressive growth in its CASA, reaching a scale of nearly VND 100,000 billion, thanks to a series of breakthrough initiatives. This remarkable achievement has played a pivotal role in sustaining the bank’s robust profit growth. As a testament to its success, the bank’s stock, VPB, has consistently reached new heights, attracting significant foreign investment.

“AVA Center Inks Deals with Five Major Partners, Embracing New Opportunities”

“Tyson An Phu’s leading developers have partnered with top brands, solidifying AVA Center’s position as the premier All-round City in Northeast Ho Chi Minh City. This modern, integrated urban development promises a new standard of quality and convenience for the region.”

Market Beat: Profit-Taking Pressure Mounts, VN-Index Retreats.

The selling pressure intensified, causing key indices to sink into the red by the end of the morning session. At the mid-session break, the VN-Index hovered near the reference level, settling at 1,639.45 points; while the HNX-Index stood at 282.49 points, a decline of 0.93%. The number of declining stocks is gradually gaining the upper hand, with 540 losers versus 207 gainers.