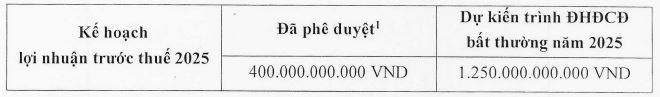

VSC plans to increase its pre-tax profit target from 400 billion VND to 1,250 billion VND. This new plan is more than three times the target approved at the previous annual general meeting of shareholders.

|

VSC’s adjusted profit target plan

Source: VSC

|

VSC recently set the record date for the 2025 Extraordinary General Meeting of Shareholders on August 22, with the ex-rights date being August 21.

The share price of VSC surged in the past week, reaching the maximum daily increase for five consecutive sessions from August 12 to 18. The price rose from 25,900 VND/share to 36,200 VND/share, an increase of nearly 40%. Following a request for explanation from HOSE, VSC attributed this sharp rise to the objective supply-demand dynamics in the Vietnamese stock market, along with the company’s positive business results in the first half of the year.

“Currently, our production and business activities are proceeding as usual, in line with our established plan, and there are no abnormal issues within VSC. We assure that we have disclosed information in accordance with legal regulations and that there is no subjective influence aimed at affecting the trading price of VSC shares in the stock market,” stated VSC in their explanation.

Compared to the beginning of the year, VSC‘s share price has surged impressively by over 170% to 34,100 VND/share as of August 21, accompanied by an average liquidity of nearly 10 million shares/day.

| VSC’s Share Price from the Beginning of 2025 |

In the first half of 2025, VSC recorded consolidated revenue of 1,489 billion VND, a 14% increase year-on-year. Pre-tax profit reached nearly 312 billion VND, a surge of over 54%. Net profit stood at 197 billion VND, an increase of nearly 75%.

With 78% of the profit target achieved in the first half, VSC has a solid basis for raising its profit target. Moreover, the significant increase in the profit plan indicates the company’s positive outlook for the remaining months of 2025.

On August 15, the Board of Directors of VSC resolved to contribute capital to establish Hai An Green Shipping Lines LLC. This new company is a multi-member limited liability company, with VSC holding a 60% stake.

On the same day, Hai An Shipping and Stevedoring JSC (HOSE: HAH) announced its contribution of 40% to the establishment of Hai An Green Shipping Lines. The new company has a charter capital of 1,000 billion VND and is headquartered in Hai Phong city. It aims to invest in the construction of large-scale transport vessels to expand the fleet and enhance the competitiveness of both HAH and VSC in the international maritime transport market.

– 15:58 21/08/2025

The Economic Powerhouse: Generating the Nation’s Highest Revenue Post-Provincial Merger

The initial figures from the 34 merged provinces and cities paint an intriguing picture of fiscal revenue trends. Ho Chi Minh City, bolstered by the inclusion of Binh Duong and Ba Ria-Vung Tau, has surged ahead to become the nation’s top earner, boasting an impressive revenue of over VND 465 trillion. Notably, a significant spike in land-related revenues has provided a substantial boost to the city’s coffers, presenting both opportunities and challenges in terms of market stability and efficient resource utilization.

ACV Raises Capital to Over VND 35,800 Billion Post-Dividend Payout

As of August 8th, ACV has distributed over 1.4 billion bonus shares as dividend payments to its 11,992 shareholders. This move has successfully boosted the aviation enterprise’s chartered capital to over VND 35.8 trillion.

Profits Plummet for Tire Manufacturing Group

The second quarter of 2025 witnessed a distinct dichotomy within the rubber industry, with a clear divide between product manufacturers and latex harvesters. While rubber tappers thrived amidst sustained high latex prices, tire manufacturers faced significant challenges due to soaring raw material costs, resulting in their lowest gross profit margins in a decade.

The Ultimate Cash Cow: Unveiling the Financial Giant with a Stellar Performance that Rivals the Best

In Q2, the company reported a revenue of nearly VND 40 trillion, a 15% increase year-over-year, marking an all-time high since its inception.