Thaco Agri, a subsidiary of billionaire Tran Ba Duong’s Thaco Group – Illustrative image

|

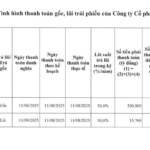

The Hanoi Stock Exchange (HNX) announced that Thaco Agri has completed the repurchase of the entire lot of bonds with the code THGCH2126001, valued at VND 2,400 billion, on August 14. This was the company’s only outstanding bond issue.

The bonds were issued on October 1, 2021, with a term of 60 months and a maturity date of October 1, 2026. Securities firm VPS arranged the issuance, which comprised 24 million bonds with a face value of VND 100,000 each, raising a total of VND 2,400 billion.

These were non-convertible bonds, without warrants, that were asset-backed and payment-guaranteed by the parent company, Thaco Corporation. The initial collateral was 240 million Thaco shares, which were later replaced by land use rights and assets on two plots of land in An Loi Dong Ward, Thu Duc City, covering an area of over 2 hectares.

The bonds carried an interest rate of 8.2% per annum for the first two periods, followed by a rate adjusted based on the reference rate plus a margin of 2.5% per annum. In 2024, Thaco Agri paid nearly VND 200 billion in interest on this debt.

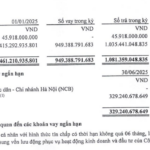

Established in 2019 with an initial charter capital of VND 15,000 billion, Thaco Agri currently operates agricultural production on 84,000 hectares of land in Vietnam, Laos, and Cambodia. According to its financial report for the first half of 2024, the company recorded a post-tax profit of VND 6.1 billion, up 25% over the same period last year but relatively modest compared to its nearly VND 14,700 billion in equity. ROE reached 0.04%.

As of Q2 2024, the company’s total financial debt stood at approximately VND 42,500 billion, 2.9 times its equity. Of this, bond debt accounted for 0.2 times, equivalent to VND 2,900 billion.

About HAGL Agrico

Thaco Group officially entered the agriculture sector in 2018 through a strategic partnership with Hoang Anh Gia Lai Group (HAGL, HOSE: HAG). In 2021, Thaco took over Hoang Anh Gia Lai Agriculture Joint Stock Company (HAGL Agrico, UPCoM: HNG).

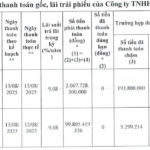

However, HAGL Agrico continues to struggle. In Q2 2025, HNG reported a net loss of over VND 113 billion, marking the 17th consecutive quarter of losses, with cumulative losses of nearly VND 9,582 billion. Financial borrowings exceeded VND 10,223 billion, of which more than VND 9,300 billion was owed to Thaco Agri.

At the 2025 Annual General Meeting of Shareholders, Mr. Tran Ba Duong, Chairman of Thaco Group and Chairman of both Thaco Agri and HNG, acknowledged that HAGL Agrico was “like a lifeless body” and that the goal for 2025 was to resolve all outstanding issues to enter 2026 with a “clearer mind.”

In a related development, HAGL Agrico has appointed Mr. Phan Ba Cuong as Deputy General Director from August 1, 2025, replacing Mr. Nguyen Hoang Phi, who stepped down for personal reasons. Mr. Cuong currently serves as Deputy General Director of Thaco Agri, the unit in charge of agriculture within the Thaco Group ecosystem.

By The Manh

– 10:05, August 22, 2025

“CMC Repays Over 300 Billion VND in Principal and Interest on Bonds”

CMC has just made a significant payment of over VND 300 billion in principal and nearly VND 16 billion in interest on the CVTB2125003 bond lot.

The Smart City Development: A Visionary Proposal for Chu Lai

“Secretary of the Danang City Party Committee, Nguyen Van Quang, emphasized the importance of developing a vibrant ecosystem within the Chu Lai Open Economic Zone and industrial parks. He envisioned the creation of a liveable environment with essential services, housing, and entertainment options. Mr. Quang proposed the development of “Truong Hai City” or “Thaco City,” potentially even a smart city, to transform the area into a thriving and attractive destination.”