Biwase Joint Stock Company – Environment (Biwase, HOSE: BWE) has fulfilled all obligations of the transferor to the transferee as stipulated in the terms of the contracts for the transfer of the entire ownership stake (52% of charter capital) in Biwase Construction-Installation Joint Stock Company (BIWELCO). As a result, BIWELCO is no longer a subsidiary of BWE as of August 19, 2025. BWE‘s ownership stake in BIWELCO has decreased to 0%.

According to the second-quarter 2025 financial report, BIWELCO was one of 11 first-tier subsidiaries of BWE. BWE invested 111 billion VND in this company, which operates in the field of electricity production from solar energy and electrical system installation.

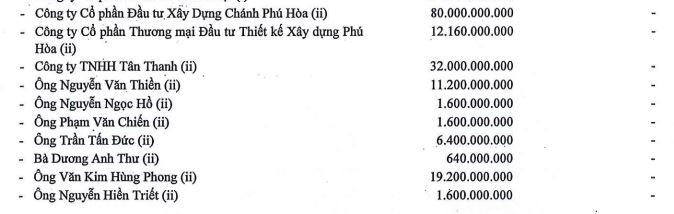

On March 25, 2025, the BWE Board of Directors approved the plan to reduce financial investment in BIWELCO and transfer the ownership to investors with financial capabilities and potential to support the development of this subsidiary. Accordingly, during this period, the Company signed contracts to transfer 10.4 million shares to registered investors. The total value of the transfer was 166.4 billion VND.

|

List of investors receiving BIWELCO transfer

Unit: VND

Source: BWE Financial Statements

|

Regarding BIWELCO, according to the Resolution dated May 3, 2025, the BWE Board of Directors agreed on the investment strategy to purchase shares of Biwase Quang Binh Joint Stock Company from BIWELCO. Accordingly, the Company signed and completed the transaction to acquire 1.2 million shares from BIWELCO, with a total value of over 14 billion VND. The transaction was completed on May 12, 2025.

After this transaction, as of June 30, 2025, the Company owned nearly 5.2 million shares of Biwase Quang Binh with a total investment cost of 54.4 billion VND. The Company’s voting rights in Biwase Quang Binh as of June 30, 2025, was 43.28%.

As of June 30, 2025, BWE had invested more than 5.3 trillion VND in subsidiaries, associated companies, and other units, with a provision of over 117 billion VND.

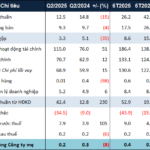

| Business results of BWE |

In the first half of 2025, BWE recorded net revenue of nearly VND 2,250 billion, up 23% over the same period. Profit after tax was nearly VND 461 billion, up nearly 44%. Net profit was VND 443 billion, up 40%. Financial revenue reached nearly VND 108 billion, of which dividend income accounted for nearly VND 78.4 billion. However, financial expenses amounted to VND 250 billion (of which interest expense accounted for VND 189.5 billion), an increase of nearly 30%.

BWE set a target of VND 640 billion in after-tax profit for 2025. The Company has achieved 72% of its goal in the first half of the year.

– 15:21, August 20, 2025

“NBB Successfully Transfers NBB Quang Ngai After a Year-Long Delay”

On August 13th, NBB Joint Stock Company (HOSE: NBB), a prominent investment firm, announced that it had successfully completed the transfer of its capital contribution in its subsidiary, NBB Quang Ngai One Member Co., Ltd., to SDP Investment Joint Stock Company.

TNG Issues Over 6 Million ESOP Shares at VND 10,000 Each, with the Chairman’s Family Planning to Purchase Nearly 40%

The Hanoi-based Investment and Trading Joint Stock Company TNG (HNX: TNG) plans to offer over six million shares to its employees and stakeholders at a discounted price of 10,000 VND per share, which is significantly lower than the current market price. This move will see the company’s Chairman, Nguyen Van Thoi, and his two sons being offered nearly 40% of this allocation.