This bond issue, with the code CII425001, has a 10-year maturity and is a type of convertible bond into common stock, unsecured and without warrants.

The bonds will be converted into common stock over nine phases, starting from January 25, 2027, until maturity. For the ninth and final conversion phase, bondholders are required to convert all their bonds into common stock. The conversion rate is 1:8 (each bond is convertible into eight shares). The conversion price is VND 12,500/share.

Interest will be paid periodically every three months. The interest rate for the first four interest periods will be fixed at 10% per annum; subsequent interest periods will apply a floating interest rate equal to the sum of 3.5% per annum and the reference rate (12-month term deposit interest rate for individuals of Vietnam Foreign Trade Joint Stock Bank).

According to CII, although the value of this bond issue is VND 2,000 billion, the amount of subscription money deposited into the locked account is nearly VND 2,743 billion. The company explained that the excess amount was due to the total volume of bonds registered for purchase exceeding the volume of bonds allowed to be offered and the amount of money deposited by investors was not valid. All of this excess money will be refunded to investors by CII after the locked account is unblocked as prescribed.

After deducting expenses (nearly VND 1.3 billion), CII‘s net revenue from this bond offering is nearly VND 1,999 billion. This amount will be used by CII to restructure its debt.

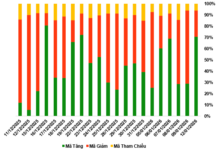

There were 155 investors participating in the successful offering, including: 106 domestic individuals (bond purchase volume accounts for 13.28% of the total offered volume), 40 foreign individuals (2.34%), 3 domestic institutions (74.39%), and 6 foreign institutions (9.99%).

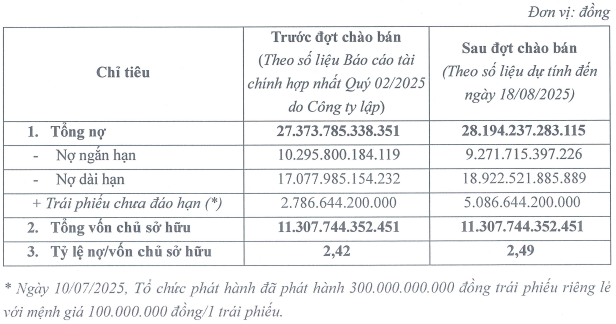

In terms of financial situation, CII‘s outstanding bonds not yet matured as of August 18 increased by 83% compared to the end of June 2025, to nearly VND 5,100 billion. Total liabilities increased by 3%, to over VND 28,100 billion. The debt-to-equity ratio increased from 2.42 times to 2.49 times.

|

Financial situation of CII after the convertible bond issue

Source: CII

|

At the end of June 2025, CII announced that the group of investors, including the Company, CII Infrastructure Service Joint Stock Company (CII Service), IMIC Infrastructure Construction Joint Stock Company, and HOSE: FDC – Ho Chi Minh City Foreign Trade and Investment Development Joint Stock Company, will coordinate to establish a project proposal for the elevated road project extending from Vung Tau Intersection to Vo Nguyen Giap Intersection with Bien Hoa – Vung Tau Expressway. The project aims to relieve traffic pressure on the Ho Chi Minh City – Vung Tau route, especially at hot spots from Vung Tau Intersection to Gate 11.

CII Consortium Approved for Proposal of Elevated Road Along National Highway 51

CII Proposes to Build an Elevated Road Along National Highway 51 Without Using State Capital

– 17:32 20/08/2025

“HDBank Seeks Shareholder Approval for Key Strategic Initiatives: Relocating Headquarters, Relaxing Foreign Ownership Limits, and Issuing Shares to Strategic Investors and Treasury Stock Sales.”

HDBank (HOSE: HDB) is pleased to announce that it is seeking shareholder approval for several key initiatives. The proposals include relocating the bank’s headquarters, adjusting foreign ownership limits, selling treasury shares, and issuing shares to convert previously issued convertible bonds. These strategic moves aim to bolster HDBank’s presence and enhance its standing in the dynamic financial landscape.

The Art of Monetary Policy: Navigating the Financial Landscape with a $54 Trillion Twist

The State Bank of Vietnam (SBV) has been reducing liquidity support for the system as interbank interest rates have plummeted in recent sessions.

Are Social Housing Buyers About to Get a Boost?

The Ministry of Construction is seeking feedback from other ministries and sectors on a draft resolution to allocate preferential capital for social housing development. The proposed package, totaling approximately VND 100,000 billion, would be funded through the issuance of government bonds. This is the first time the Ministry has suggested utilizing government bonds as a means to facilitate social housing projects.