## EVS Shareholders Face Collateral Consequences as Stock Price Surges: A Complex Web of Debt and Intrigue

A recent agreement to use EVS shares as collateral for a loan has brought to light intricate financial dealings within the company. The agreement stipulates that, in addition to the pledged assets, associated rights and benefits are also subject to simultaneous enforcement. These include dividend entitlements, reimbursement rights, and any other interests or property rights related to the collateral.

As of June 30, 2025, Mr. Vu Manh Tien held the largest number of shares in EVS, owning 16 million shares worth VND 160 billion at par value, representing a 9.71% stake in the company’s total capital investment of over VND 1,648 billion. This proportion has remained unchanged since the beginning of the year.

In the event that there are no changes in ownership ratios, Mr. Vu Manh Tien will pledge all his shares as collateral for the company’s loan. It is understood that the lender in this scenario is Mr. Nguyen The De.

This is not an isolated incident, as a similar resolution was passed by the EVS Board of Directors on July 30, using 3.7 million shares owned by Board member Vu Hai Anh as collateral for payment obligations to Mr. Mai Anh Tien.

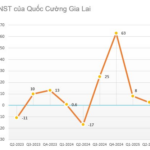

EVS’s stock price has been trading below par, closing at VND 8,400 per share on August 19, 2025, despite a 50% increase since the beginning of the year. The average trading volume has been over 321,000 shares per day.

| EVS Share Price Surge since the Beginning of 2025 |

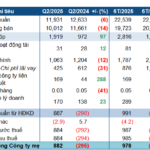

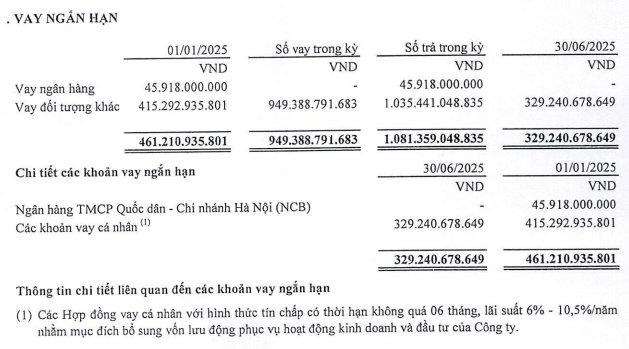

As of June 30, 2025, EVS’s total loan balance exceeded VND 329 billion, a 29% decrease from the beginning of the year. These loans were all short-term, unsecured personal loans with a term of no more than 6 months and an interest rate of 6-10.5%/year, intended to supplement the company’s working capital for business and investment activities.

Source: EVS’s 2025 Semi-Annual Reviewed Financial Statements

|

EVS faced challenges in the second quarter of 2025, with a 40% decrease in revenue compared to the previous year, amounting to nearly VND 39 billion. The company incurred a post-tax loss of almost VND 8 billion, in contrast to a profit of over VND 17 billion in the same period last year.

According to EVS, market fluctuations and reduced trading volumes during the second quarter of 2025 impacted brokerage and margin revenues, as well as profits from proprietary trading. Additionally, the decline in stock prices led to an increase in the allowance for losses on financial assets compared to the previous year.

The disappointing second-quarter results caused EVS’s cumulative profit for the first half of 2025 to plummet by 92%, reaching only VND 2.5 billion.

| EVS’s Profit for the First Half of 2025 Significantly Decreased |

In a notable development, on August 6, 2025, the EVS Board of Directors passed a resolution to approve a credit facility of up to VND 300 billion from Vietcombank’s Thanh Xuan Branch for the purpose of investing in government bonds and local government bonds. The maximum loan term is 6 months.

The resolution also stated that EVS agreed to pledge or mortgage the company’s or third-party assets to secure all repayment obligations under the loan contracts.

Recently, EVS has repeatedly approved extensions for payment obligations of Viet Media JSC and Tien Thanh Consulting Services Co., Ltd. regarding bond purchase contracts.

On July 21, 2025, the EVS Board of Directors passed a resolution to extend the payment deadline for Tien Thanh Consulting Services Co., Ltd. for two bond purchase contracts (signed on May 16, 2024), totaling over VND 737.5 billion. The original deadline of July 22, 2025, was extended by 3 months to October 22, 2025. This extension followed a previous one granted on March 20, 2025, which pushed the deadline from March 22 to July 22, 2025.

Earlier, on June 2, 2025, the company also approved an extension for Viet Media JSC’s payment obligations under a bond purchase contract (signed on December 25, 2024). The total amount of nearly VND 315 billion (including the bond purchase price and late payment interest up to March 25, 2025) was extended for 5 months, from March 25 to August 30, 2025.

– 5:40 PM, August 19, 2025

“PetroVietnam Drills into Profits with Reduced Costs and Interest Expenses”

In Q2 2025, EVNGENCO3, listed on the Ho Chi Minh Stock Exchange (HOSE: PGV), witnessed a remarkable surge in profits compared to the previous year’s loss-making quarter. This impressive turnaround can be attributed to a significant reduction in both cost of goods sold and borrowing expenses.

The Ultimate Guide to Saigontel’s Ambitous Endeavor: Unlocking the $1.6 Billion Loan for Vietnam’s Industrial Revolution

On December 12th, the Board of Directors of Saigon Telecommunication Technology Corporation (Saigontel, HOSE: SGT) approved a resolution to accept a credit facility of up to VND 1,635 billion from VPBank. This financing will be utilized to invest in the second phase of the Dai Dong – Hoan Son Industrial Park project.

The Art of Refinancing: TCO Holdings Prepares to Issue Convertible Bonds to Restructure Debt.

“TCO Holdings JSC (HOSE: TCO) is planning to offer private bonds worth VND 180 billion (at par value) to Lighthouse Investment Fund Management and Vietnam Industrial and Commercial Bank Fund Management Joint Stock Company (Vietinbank Capital).”