HDBank, a listed bank, has consistently maintained an impressive ROE of over 25% for many years. In the first half of 2025, the bank reported a remarkable pre-tax profit of 10,068 billion VND, a 23.3% increase compared to the same period last year – the highest half-year profit in its history. With an ROE of 26.5% and an ROA of 2.2%, HDBank is among the industry’s most efficient institutions. Total assets exceeded 784 trillion VND, and credit growth reached 18.2% – nearly double the system-wide average.

The Forbes ranking is based on audited financial reports and market capitalization data, focusing on sustainable growth, profitability, and financial health. Key metrics such as capitalization, revenue, profit margins, ROE, and EPS are analyzed over a 3-5 year period, along with qualitative assessments of corporate governance, brand reputation, and industry influence.

On the stock market, HDB is one of the largest capitalized stocks in the banking sector. Just a year after its IPO, HDB became part of the VN30 and ranked among the Top 10 best companies on the HOSE. It has also consistently been in the Top 20 of the Sustainability Index of Ho Chi Minh City Stock Exchange, VN30, VN Diamond, and VN Finlead. This enhances liquidity, attracts domestic and foreign investment funds, and reflects market confidence in the bank’s long-term strategy.

HDBank’s excellence is not only recognized in Vietnam but also internationally. The bank was selected as one of the few Vietnamese enterprises to attend the 2025 ASEAN Corporate Governance Awards in Malaysia. This presence affirms the bank’s pioneering role in embracing international standards and elevating Vietnamese enterprises on the global financial map.

With over 35 years of development, HDBank has become one of Vietnam’s leading diversified retail banks, contributing to the country’s prosperity. Being in the Forbes Top 50 not only confirms the strength of the HDB brand and the appeal of its stock but also serves as a springboard for the bank to further expand its influence and contribute to the sustainable development of the financial market and the pioneering role of the private sector in the global integration process.

– 15:06 22/08/2025

Capturing the Moment: A Billionaire’s Song Amidst the August Celebrations

“At the inauguration of the Saigon Marina International Financial Centre (Saigon Marina IFC) on August 19 in Ho Chi Minh City, female billionaire Nguyen Thi Phuong Thao surprised the audience with a rendition of ‘The Song of Pac Bo.’ Her powerful and unexpected performance of this iconic song left a lasting impression on the flag-waving, flower-filled space celebrating the National Day.”

The Real Estate and Oil Stocks are Rocking the Boat

Kicking off the new trading week, domestic stocks regained their upward momentum, shrugging off profit-taking pressures on many large-cap stocks. Today, August 18th, saw the real estate and oil & gas sectors making waves and driving the market higher.

“HDBank Seeks Shareholder Approval for Key Strategic Initiatives: Relocating Headquarters, Relaxing Foreign Ownership Limits, and Issuing Shares to Strategic Investors and Treasury Stock Sales.”

HDBank (HOSE: HDB) is pleased to announce that it is seeking shareholder approval for several key initiatives. The proposals include relocating the bank’s headquarters, adjusting foreign ownership limits, selling treasury shares, and issuing shares to convert previously issued convertible bonds. These strategic moves aim to bolster HDBank’s presence and enhance its standing in the dynamic financial landscape.

What Causes Multiple Bank Codes to Surge?

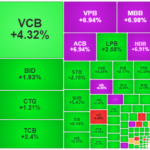

The trading session on August 14 witnessed a stellar performance from the banking stock group. MBB, VPB, and HDB soared to the maximum daily limit, while VCB witnessed substantial price gains. This impressive showing from the banking sector heavyweights propelled the financial index to new heights.