Speaking at the talk show “Buy a House with Salary Installments,” hosted by the Tuoi Tre newspaper on August 22, economic expert Dinh The Hien shared his insights on home-buying among young people. He suggested that today’s youth approach homeownership as a combination of living and investment. This strategy, according to Mr. Hien, necessitates not only a frugal lifestyle but also other suitable conditions to avoid financial strain and ensure a successful home purchase.

In the context of an industrial economy, especially in large cities like Ho Chi Minh City, owning a house or renting an apartment each has its advantages and drawbacks. However, to build wealth for their families and retirement, young people should allocate a portion of their income towards investments, advised Mr. Hien.

“In Vietnam, the safest and most profitable investment avenue remains real estate,” asserted Mr. Hien. He recommended that young working adults consider purchasing an apartment as a wise investment and a place to call home. This dual purpose, he added, makes it a sound decision for those starting their independent lives.

Mr. Hien suggested that young people contemplate buying an apartment after at least three years of stable employment. This option is also suitable for young couples planning to start or already having a child. Additionally, they must embrace a frugal lifestyle and cut down on entertainment and leisure expenses for at least five years to save for the down payment.

According to the expert’s estimates, a stable total income of over 20 million VND per month is necessary, with a minimum of 10 million VND allocated for installments. Furthermore, a down payment of at least 30% of the apartment’s value, amounting to over 500 million VND, should be saved or sought through parental support.

For young people under 35 with average incomes and modest savings, Mr. Hien recommended considering affordable apartments. Those with higher incomes could opt for mid-range options. He further questioned whether the current prices of these mid-range apartments in urban areas like Ho Chi Minh City are within the affordable range for young people with stable incomes.

Economic expert Dinh The Hien shares his insights at the talk show “Buy a House with Salary Installments,” hosted by Tuoi Tre newspaper in Ho Chi Minh City on August 22.

|

How to Determine a Reasonable Selling Price for an Apartment?

To determine a reasonable selling price, Mr. Hien suggested calculating the appropriate price per square meter for a specific segment (mid-range, average, or affordable) and location. Once the segment and location are established, one should consider the various cost factors that contribute to the formation of the price per square meter.

First and foremost is the land cost, which should be based on the current value rather than the initial purchase price. This can be calculated in two ways: either by considering the lowest price of a completed project in the area or by determining the minimum compensation for landowners, which is then converted into construction land prices.

The allocation of land costs per square meter of construction floor area is governed by state regulations, with a typical coefficient of 6 for high-rise buildings. For instance, if the lowest land price in the old District 2, adjacent to the old District 9 in Ho Chi Minh City, is 100 million VND per square meter, the land cost allocated per square meter of construction floor area would be 100/6 = 16.6 million VND.

The second factor is direct construction costs, which depend on the standards of luxury, mid-range, or affordable housing. The minimum cost for a true mid-range apartment should not be less than 14 million VND per square meter, while an average apartment would cost around 12 million VND per square meter.

The third factor pertains to management and infrastructure costs, encompassing legal, design, and project management expenses. Typically, these costs account for 14-20% of the project’s construction costs, varying depending on whether it is a luxury or affordable development.

The sum of these three cost factors forms the basis for the price per square meter of construction floor area. This amount is then divided by a ratio ranging from 60-75%, depending on the apartment segment, to arrive at the commercial price per square meter of the apartment.

For an average apartment, the commercial ratio is highest at approximately 75%, with the remaining area dedicated to common amenities. In contrast, mid-range apartments have a slightly lower commercial ratio of around 70%, as explained by the expert.

Mr. Hien asserted that for a standard 64-square-meter apartment (a common size for a 2-bedroom unit), young families have the following options when it comes to purchasing a property with a 15-year mortgage:

– To buy an affordable apartment, a young family needs a stable minimum income of 26.3 million VND per month.

– To purchase a mid-range apartment, their stable minimum income should be 33.3 million VND per month.

– For a mid-level apartment, their stable minimum income needs to be at least 45.8 million VND per month.

Moreover, Mr. Hien pointed out that while a family’s income may increase over time, this additional income will likely be allocated to cover living expenses and contingency funds.

To make homeownership more accessible to families with incomes below these thresholds, he suggested extending the loan term to 20 years or considering smaller apartments with areas of around 55-50 square meters.

Consequently, a young family with a combined income of 24 million VND per month could afford to purchase an affordable apartment with a 20-year mortgage. Similarly, a family earning 30 million VND per month could opt for a mid-range apartment with the same extended loan term.

– 15:18 23/08/2025

“TT AVIO: The Privilege of ‘Payment Negotiation’ for Owning a Luxury Japanese Condo”

Owning a home in Ho Chi Minh City has never been more accessible, thanks to the groundbreaking TT AVIO project by the renowned Japanese consortium. This consortium is offering young families the opportunity to negotiate payment terms and secure their dream home in the vibrant metropolis. With their innovative approach, the consortium is revolutionizing the real estate market, making the dream of homeownership a reality for many.

The Stanley Brothers’ Stock Change Hands?

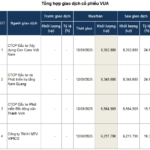

The shareholder structure of Stanley Brothers Securities Joint Stock Company (UPCoM: VUA) has recently undergone a significant transformation with the entry of four new institutional investors. These institutions collectively acquired nearly 29.5 million shares, equivalent to 87% of the company’s charter capital. This substantial investment underscores the confidence that these new shareholders have in the potential of VUA, marking a pivotal moment in the company’s journey.

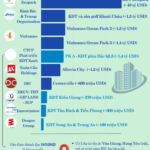

The Top 10 Urban Giants of Hung Yen: Ecopark and Vinhomes Reign Supreme, With a 5-Month-Old Newcomer Giving Them a Run for Their Money

Hưng Yên is emerging as one of the new “hot spots” on the Northern real estate map. Its strategic location bordering Hanoi, coupled with an ever-improving infrastructure and a wave of investments from both domestic and foreign giants, is transforming the area.