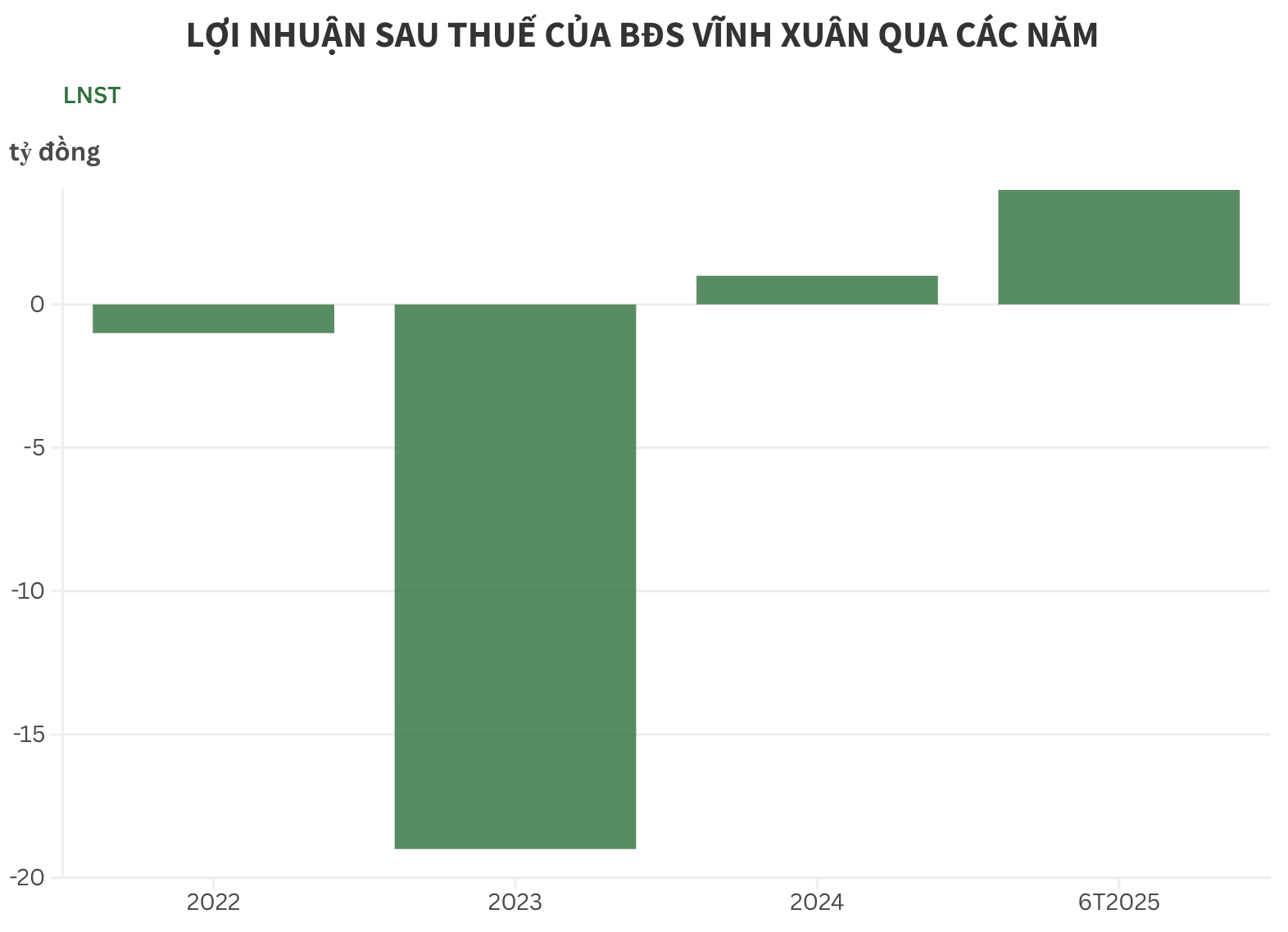

Vinh Xuan Real Estate JSC has released its financial report for the first half of 2025, posting a net profit of nearly VND 4.7 billion, a significant improvement from the loss of over VND 522 million in the same period last year.

As of June 30, 2025, the company’s equity stood at VND 258.6 billion, a slight increase from the previous year. Their return on equity (ROE) was 1.81%.

The company’s debt-to-equity ratio was 4.28, with total liabilities exceeding VND 1,106 billion. The majority of this debt stems from the issuance of VND 1,000 billion in bonds and additional liabilities of over VND 106 billion as of June 30, 2025.

According to the Hanoi Stock Exchange (HNX), Vinh Xuan Real Estate JSC currently has no outstanding bond issues in the market.

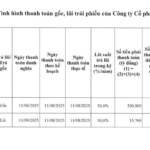

On July 10, 2025, the company missed a payment of over VND 634.2 billion in principal and interest for two bond issues, VINHXUAN2020-02 and VINHXUAN2020-03. However, they negotiated with investors and planned to make the payment on July 18, 2025, as they were unable to secure the funds by the due date.

Similarly, on June 24, 2025, the company defaulted on a payment of nearly VND 423 billion (including VND 400 billion in principal and nearly VND 23 billion in interest) for the VINHXUAN2020-01 bond issue. They announced their intention to settle this debt by July 1, 2025.

All three bond issues mentioned above had a five-year term, a 11.5% interest rate, and were issued in June and July 2020, totaling VND 1,000 billion in value. Initially, these bond issues had a 36-month term, which was extended to 2025 with the bondholders’ approval. The identity of the investors, who are domestic organizations, remains undisclosed.

In the first half of 2025, Vinh Xuan Real Estate JSC made interest payments totaling VND 57.7 billion on these bonds, with one late payment due to a delay in receiving the funds.

Vinh Xuan Real Estate JSC currently has no outstanding bond issues.

Established in November 2015, Vinh Xuan Real Estate JSC primarily operates in the real estate and land use rights sector. The company is headquartered at The Prince Residence, 17-19-21 Nguyen Van Troi, Ward 12, Phu Nhuan District, Ho Chi Minh City.

At its inception, the company had a chartered capital of VND 20 billion, with two shareholders: Ms. Vo Thi Kim Khoa (60%) and Mr. Nguyen Quoc Hien (40%). In May 2020, they increased their capital to VND 270 billion, maintaining the same shareholder structure but with altered ratios: Ms. Vo Thi Kim Khoa (4.444%) and Mr. Nguyen Quoc Hien (95.556%).

Mr. Nguyen Quoc Hien, born in 1971, currently serves as the Chairman of the Members’ Council and legal representative of Vinh Xuan Real Estate JSC.

In addition to his role at Vinh Xuan Real Estate JSC, Mr. Nguyen Quoc Hien also represents several other companies, including Mercury Transport JSC, Dalat Lake Real Estate Co., Ltd., An Khang Real Estate Development Co., Ltd., Saigon Center Real Estate Investment Co., Ltd., Cat Minh Real Estate JSC, Van An Real Estate Investment Co., Ltd., and Horizon Commercial Services and Investment JSC.

The Swine Industry’s Profit Windfall

The pig farming industry shone brightly in Q2 2025, with almost all businesses in the sector reaping impressive profits. It was a continuation of their stellar performance from the previous quarter, as they continued to thrive and prosper.

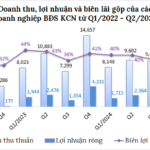

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.