The threshold for upgrading is near

With legal reforms and infrastructure upgrades, Vietnam’s stock market is approaching a pivotal moment as FTSE Russell is expected to consider an upgrade in its September 2025 review.

Vietnam’s stock market is on the cusp of significant growth in 2025. Photo: LE VU |

According to Tran Ngoc Thuy Vy, an analyst at Mirae Asset Vietnam Securities Company, Circular No. 68/2024 of the Ministry of Finance, which allows trading of stocks without requiring foreign investors to have sufficient funds before placing orders – the non-prefunding mechanism, has enabled them to trade on T+0 and settle on T+1 or T+2.

In addition, Circular No. 03/2025 of the State Bank of Vietnam has clarified the regulations for foreign investor accounts under the indirect model, removing barriers that led to Vietnam’s “delayed upgrade” in the March 2025 review.

These policies, according to Vy, have brought Vietnam’s legal framework closer to international standards and eliminated one of the biggest obstacles to the country’s long-awaited upgrade.

“The removal of the prefunding mechanism is a prerequisite for FTSE Russell to consider upgrading Vietnam to a secondary emerging market, while also opening the door for MSCI to re-evaluate the possibility of including Vietnam in its watchlist for potential upgrades in the near future,” Vy assessed.

Similarly, Pham Thi Thuy Linh, Head of Market Development at the State Securities Commission of Vietnam (SSC), shared that 10 securities companies and 10 custodian banks have implemented non-prefunding after Circulars 68/2024 and 18/2025 of the Ministry of Finance took effect.

As a result, the market recorded more than 90,000 NPF transactions with a total value of over VND 20,000 billion, equivalent to more than 6,000 transactions with a value of VND 1,400 billion per day since the KRX system officially operated on May 5, 2025 – accounting for about 50% of the total value of foreign block purchases. This is three times higher in volume and twice in value compared to the previous period.

“The mechanism for handling failed transactions has also been effective, with only 4 failed transactions out of hundreds of thousands of orders, and all were safely resolved,” said Linh.

In addition to policy changes, companies in the VN30 group are now required to disclose information simultaneously in both Vietnamese and English. Information from stock exchanges, VSDC, and large enterprises is also published in these two languages to facilitate access for foreign investors.

Approximately 2,000 listed and traded companies in the entire market are expected to complete the process of English disclosure by the end of 2026.

Moreover, the SSC has established the International Advisory Group for Market Development (IAG) with 33 members, divided into three task forces, to address and resolve issues, and optimize the experience for foreign investors within the framework of the law. Various international investment promotion programs have also been implemented to promote Vietnam’s stock market.

These efforts have significantly contributed to meeting the criterion of “Receiving positive feedback from foreign investment organizations” – an important factor in the decision to upgrade.

“International investors appreciate the legal framework, growth potential, and liquidity of Vietnam’s stock market. The upgrade, if achieved in September, will be encouraging but not the final destination,” said Bui Hoang Hai, Vice Chairman of the SSC, at a workshop.

Shaping a Sustainable Future

Recognizing that the upgrade will significantly boost the Vietnamese capital market by increasing access to foreign investors, the regulatory authorities and market members aim beyond merely meeting the technical criteria set by FTSE Russell for secondary emerging markets.

There are still barriers hindering investors’ access to the stock market. Illustration: Dung Minh. |

According to Bui Hoang Hai, many of Vietnam’s solutions already exceed FTSE Russell’s standards, such as information disclosure in English – a requirement from MSCI. However, the criterion for foreign ownership ratio remains a challenge for regulatory authorities.

“MSCI will assess negatively if the regulations on foreign ownership ratio affect more than 10% of the total number of shares in the market. Vietnam’s regulations on foreign ownership are still complex,” said Hai.

To address this issue, the authorities are implementing several solutions, including amending the foreign ownership limit in Decree 155/2020 (currently submitted to the Government); coordinating with the State Bank of Vietnam to amend Circular No. 17/2024 to simplify the procedures for opening, closing, and using payment accounts for foreign investors.

However, to meet MSCI’s standards, Bui Hoang Hai emphasized the need for risk management tools to facilitate investors. Nguyen The Minh, Director of Research & Retail Client Development at Yuanta Vietnam Securities Company, added that increasing the foreign ownership ratio depends not only on the Securities Law but also on the Enterprise Law, Investment Law, and specific regulations in conditional business fields.

Therefore, resolving this issue requires time, coordination between various ministries and sectors, and strong determination from the Government. In this context, issuing non-voting depository receipts (NVDR) could be a suitable technical solution. In Thailand, NVDR transactions account for 21% of the total daily market value, attracting significant foreign capital and increasing the trading ratio of institutional investors.

Building on this foundation, Minh suggested that NVDR would enable investment funds, which prioritize price differentials over voting rights, to purchase stocks that frequently face “foreign room limits,” such as FPT and banks, thereby improving market liquidity.

Additionally, Nguyen Son, Chairman of the Members’ Council of Vietnam Securities Depository and Clearing Corporation (VSDC), emphasized that maintaining market stability after the upgrade is crucial, especially given that 99% of investors in the market are individuals, who are easily influenced by herd mentality. He suggested developing financial institutions like investment funds and insurance companies to balance individual and institutional investors. He also recommended introducing risk management products, as there could be significant fluctuations in the future if foreign exchange rates rise.

“This would be a significant concern for investors. Therefore, risk management tools like derivatives products are needed to provide a ‘protective shield’ for investors participating in the Vietnamese market in the long term,” Son stated.

Van Phong

– 07:00 23/08/2025

HDBank: Among the Top 50 Listed Companies in 2025

On August 21, 2025, Forbes Vietnam unveiled its list of Vietnam’s 50 Best Listed Companies in 2025, featuring leading enterprises across key sectors, representing the dynamic and resilient listed company sector of the economy. Among them, HDBank stands out as a prominent multi-functional retail bank, solidifying its position and pioneering role in the private sector of Vietnam’s financial and banking system.

Stock Market Wrap-up: A Peak Pause

The VN-Index struggled during the week’s final session as intense profit-taking pressure drowned the market. This development mirrors late July 2025, when the rally stalled after an extended uptrend. The upcoming trading sessions will be pivotal in determining whether the market is taking a breather before resuming its ascent or transitioning into a more distinct corrective phase.

The Real Estate and Oil Stocks are Rocking the Boat

Kicking off the new trading week, domestic stocks regained their upward momentum, shrugging off profit-taking pressures on many large-cap stocks. Today, August 18th, saw the real estate and oil & gas sectors making waves and driving the market higher.

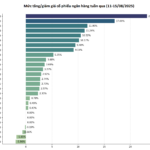

Stock Market Update: Mid and Small-Cap Stocks to Attract Investors’ Interest

The August 18th session concluded with a robust buying spree as investors sought to take advantage of discounted stock prices. For the upcoming August 19th trading day, we anticipate a shift in focus towards mid and small-cap stocks, presenting a strategic opportunity for savvy investors to diversify their portfolios and potentially capitalize on the momentum of these dynamic segments of the market.