On the morning of August 20, in Hanoi, the VietTimes Electronic Magazine in collaboration with the Institute of Strategy, Agriculture and Environment Policy (Ministry of Agriculture and Environment) organized a workshop on “Perfecting land laws to create momentum development in the digital age.”

Mr. Nguyen Quoc Hiep, Chairman of the Vietnam Contractors Association (VACC) and Chairman of the Board of Directors of Global Oil and Gas Real Estate Investment Joint Stock Company (GP.Invest), raised an issue that enterprises are most concerned about today, which is land price.

At the workshop, Mr. Nguyen Quoc Hiep opined that enterprises are most concerned about land prices.

Mr. Hiep described the land price issue as “vital” to enterprises. He shared his experience from a project in Hanoi, where the first land allocation decision for an area of over 7 hectares required the enterprise to pay land use fees within 30 days. By the second allocation decision (8.4 hectares), the land price had increased by 20% compared to the first. And by the third decision (6.7 hectares), the price went up by another 20%.

“With each land allocation, the price increases, leading to unreasonable cost hikes for enterprises. This is the biggest challenge,” Mr. Hiep emphasized.

He argued that abandoning the mechanism of “specific land prices” and replacing it with an annual land price list, adjusted by coefficients, is an important step forward. However, clear criteria are needed for the issuance of these coefficients.

Mr. Hiep recounted an incident where a project by GP.Invest had to bear a land price coefficient of 2.8 times the announced price list. “This number is unreasonable, and without specific standards, it can lead to arbitrary applications, causing significant risks for businesses,” he said.

Sharing the same sentiment at the workshop, Mr. Pham Duc Toan, CEO of EZ Property, opined that calculating land prices under the current mechanism is challenging. When projects span over a decade, daily fluctuations in land prices can lead to losses and insufficient funds for tax payments.

Mr. Pham Duc Toan, CEO of EZ Property, shared his thoughts at the workshop.

Regarding the land price list, Mr. Toan suggested having a unified list applicable to both citizens and enterprises, based on the advantages and location of each plot of land. He also shared the story of enterprises always having to pay extra money to individuals, with rates up to 5-10% of the compensation value, for private negotiations with each household, which causes difficulties and expenses.

“Why isn’t there a unified land price list, based on the advantages and location of the land, to make enterprises feel more comfortable when investing?” Mr. Toan questioned.

Raising the issue of similar land locations being priced differently by each locality, Mr. Toan proposed that law-building agencies clarify land price calculations for each locality, giving enterprises peace of mind in their investments.

Also at the workshop, Mr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association (VNREA), shared additional insights into the land price bottleneck.

“We are currently implementing an annual land price list, which is challenging for government agencies, so adjusting the law to a five-year cycle would be more appropriate,” he said.

Another challenge is determining prices based on the principle of market prices, as there is a lack of clear distinction between primary and secondary land prices. This leads to situations where price lists are issued for areas without infrastructure investment, and where there are signs of speculation and price manipulation, effectively legitimizing “virtual prices.”

Mr. Dinh suggested that the responsibility for determining land prices be entrusted to independent specialized agencies.

According to Mr. Dinh, this situation increases the financial obligations of enterprises regarding land, pushing up real estate prices. As a consequence, home ownership becomes increasingly out of reach for citizens.

Mr. Dinh also pointed out another challenge in land valuation, where consulting firms are hesitant to provide low valuations, and local authorities are cautious as well. To ensure safety, they approve higher prices. This situation has adverse effects on citizens, as real estate prices cannot decrease.

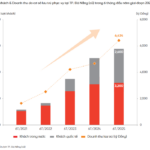

Statistics show that real estate prices have soared, while investment activities have stagnated in many localities. The principle is that real estate values should increase with investment, but in some areas with no investment, real estate prices still surge, Mr. Dinh noted.

He proposed that the responsibility for determining land prices be entrusted to independent specialized agencies, unrelated to real estate projects, to provide consulting services for land valuation. According to him, these agencies will make accurate assessments for the managing authorities to determine land prices based on this information.

The current law requires the managing authority to approve land prices, which Mr. Dinh considers reasonable. However, he believes that the approving authority needs a basis for approval (i.e., through consulting firms as mentioned above), instead of approving high prices out of caution, which negatively impacts the real estate market and makes it challenging to implement the Central’s spirit of regulating real estate prices to their actual values.

VNREA representatives expressed their hope that this law amendment would create a transparent, clear, and favorable legal corridor, facilitating enterprises’ proper development and establishing a correct value baseline for citizens’ accessibility.

The Ultimate Guide to Investing in Da Nang’s Real Estate Renaissance: Unlocking the Potential of Vietnam’s Rising Property Market

The impact of infrastructure planning and administrative boundary mergers is fueling expectations of a new price hike cycle in the Danang real estate market. With land prices in Danang still approximately 30% lower than in thriving tourist destinations such as Quang Ninh and Nha Trang, or even many other provinces, the city is attracting a wave of investment.

Prime Real Estate Auction: 100sqm Lot Reaches 7.7 Billion VND, Almost Quadruple the Reserve Price

The auction of 18 land plots in the residential area south of Tran Hung Dao Street, in Dong Hoi ward, was a resounding success, generating nearly VND86 billion. The auction witnessed an enthusiastic response, with winning bids for several plots reaching twice to 2.7 times the starting price, and in one exceptional case, a plot was secured for nearly four times the reserve price.

Is the Big Wave Coming? A Sneak Peek Into the Da Nang Land Market and Its Future Prospects

As investors with cash reserves ranging from 4 to 10 billion VND start returning to the market, it signals a positive shift in the Danang land market. This resurgence of investment activity post-Tet has increased liquidity and selling prices, indicating that the market is poised to ride a new wave of growth.