Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 2.28 billion shares, equivalent to a value of more than 64.2 trillion dong; HNX-Index reached over 219 million shares, equivalent to a value of more than 4.9 trillion dong.

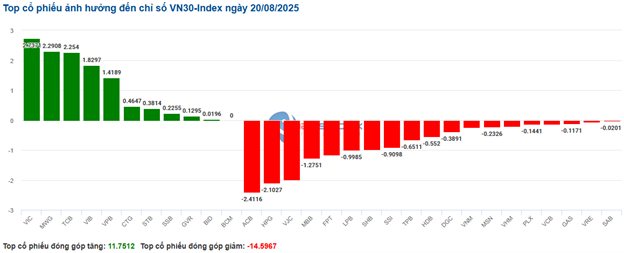

VN-Index opened the afternoon session with a rather tug-of-war but the buying side gradually regained its position, helping to quickly pull the index back to the reference level and closed in a positive green towards the end of the session. In terms of impact, VIC, VHM, VPB and TCB were the codes that had the most positive impact on VN-Index with an increase of more than 17.7 points. On the contrary, VCB, HPG, FPT, GAS are the codes that are still under selling pressure and took away more than 5.3 points from the overall index.

| Top 10 stocks with the strongest impact on VN-Index on 08/20/2025 (in points) |

On the other hand, HNX-Index had a rather pessimistic movement as the index was negatively affected by the codes MBS (-3.99%), PVS (-4.59%), CEO (-4.07%), BAB (-2.56%)…

|

Source: VietstockFinance

|

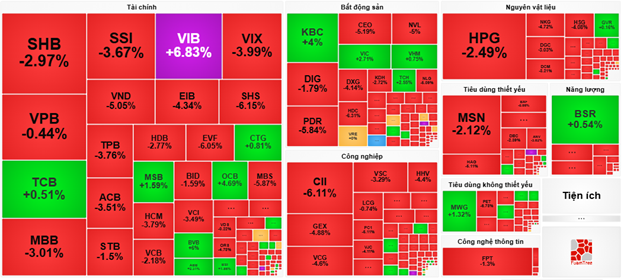

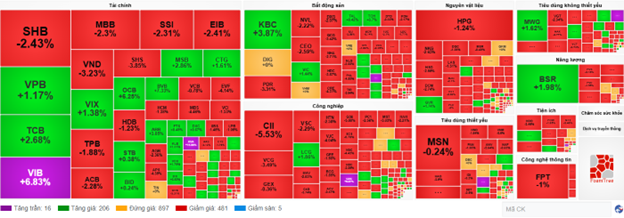

At the close, red dominated most industries. Among them, the real estate industry was the group with the best recovery on the market with 2.69% mainly from the codes VIC (+5.08%), VHM (+5.43%), KBC (+6.93%) and VRE (+0.17%). Following the recovery were the energy and financial sectors with increases of 1.05% and 0.88%, respectively. On the contrary, the information technology industry was the group that recorded the strongest decline in the market with a decrease of 2.67% mainly from the code FPT (-2.59%), CMG (-3.9%) and ELC (-3.34%).

In terms of foreign trading, foreigners continued to net sell more than 433 billion dong on the HOSE floor, focusing on the codes VPB (533.8 billion), FPT (179.18 billion), CII (146.86 billion) and VND (132.91 billion). On the HNX floor, foreigners net bought more than 206 billion dong, focusing on the code SHS (240.49 billion), CEO (17.37 billion), L14 (3.66 billion) and IPA (3.09 billion).

| Foreign buying and selling movements |

Morning session: Selling pressure increases, foreigners dump VPB shares

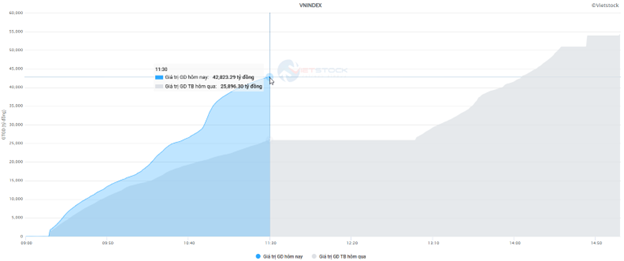

The selling pressure increased sharply, causing the main indices to sink into the red at the end of the morning session. By the midday break, VN-Index fell nearly 21 points to 1,633.22 points; HNX-Index fell to 278.15 points, down 2.9%. Sellers dominated with 620 declining stocks and 154 advancing stocks.

Market liquidity increased sharply this morning. Trading volume on the HOSE floor reached more than 1.5 billion units, equivalent to a value of nearly 43 trillion dong, up sharply by 65.4% compared to the previous session. Similarly, HNX recorded a value of 3.1 trillion dong, up 27.7% compared to the previous session.

Source: VietstockFinance

|

In terms of impact on the VN-Index, VCB was the code with the most negative impact when it took away 2.7 points from the index. This was followed by HPG, MBB, ACB and BID, which also pulled the index down by 4.7 points. Meanwhile, VIC was a bright spot on the opposite side with a positive contribution of 3 points.

Most sectors were submerged in red. The media & telecommunications services group temporarily “bottomed out” with a decrease of 2.66% due to the negative performance of VGI (-2.72%), FOX (-3.08%), CTR (-2.71%), SGT (-2.12%), VNB (-1.08%), FOC (-1.37%), TTN (-2.31%) and YEG (-4.69%).

Large-cap sectors such as finance and industry put heavy pressure on the overall index, plunging 1.48% and 2.17%, respectively. Most stocks were deep in the red, with a series of stocks recording selling pressure of more than 2% such as VCB, MBB, ACB, LPB, HDB, SSI, TPB, SHB; VJC, MVN, GEX, GEE, VGC, VCG, PHP and VTP.

On the contrary, real estate was the only group that managed to stay in the green, up 0.12% thanks to the positive contribution of stocks such as VIC (+2.71%), VHM (+0.75%), KBC (+4%) and TCH (+2.55%).

Source: VietstockFinance

|

Foreigners continued to net sell with a value of 903.87 billion dong on the three exchanges. The selling pressure was concentrated in VPB with a value of 364.6 billion dong, far exceeding the other stocks. Meanwhile, SHB led the net buying list with a value of 175.4 billion dong.

| Top 10 stocks net bought and sold by foreigners on 08/20 |

10:30 am: Sellers dominate the market

Selling pressure increased compared to the beginning of the session and the market continued to fluctuate around the reference level. As of 10:30 am, VN-Index fell more than 3.4 points, trading around 1,650 points. HNX-Index fell 3.5 points, trading around 282 points.

Red gradually dominated the VN30-Index basket. Specifically, ACB, HPG, VJC and MBB respectively took away 2.41 points, 2.1 points, 1.99 points and 1.27 points from the overall index. On the contrary, VIC, MWG, TCB and VIB were the codes that remained in the green and helped the overall index hold on to more than 9 points.

Source: VietstockFinance

|

The breadth of sectors with red dominating most industries presented a rather pessimistic picture.

Among them, the two largest sectors in the market, finance and real estate, showed strong divergence with selling pressure somewhat overwhelming. Specifically, in the financial selling group, SHB fell 2.97%, MBB fell 2.48%, TPB fell 3.53% and VND fell 3.84%… and the real estate group had NVL falling 2.78%, DIG falling 1%, CEO falling 3.33%, PDR falling 3.7%… are under strong selling pressure.

The materials sector also faced difficulties with red dominating most codes such as HPG falling 1.42%, DGC falling 1.57%, DCM falling 2.74% and HSG falling 3.06%…

Compared to the beginning of the session, the sellers had a slight advantage. There were 481 declining codes (5 floor codes) and 206 advancing codes (16 ceiling codes).

Source: VietstockFinance

|

Opening: Selling pressure appears at the beginning of the session

At the beginning of the 08/20 session, as of 9:30 am, VN-Index reversed and weakened, fluctuating around the reference level, reaching 1,664 points. HNX-Index also fluctuated around the reference level.

Red dominated most industries. Among them, information technology was the group with the strongest decline in the market with selling pressure concentrated mainly on the large cap FPT (-1.2%) and some others such as SBD (-1.3%), DLG (-1.23%), VEC (-2.61%).

The energy group also faced difficulties with most codes in the red. Specifically, stocks such as BSR (-1.98%), PLX (-0.91%), PVS (-1.08%), PVD (-1.53%)…

Besides the two aforementioned groups, many Large Caps also had negative movements. VHM, MBB, HDB, ACB are also putting pressure on the overall index.

– 15:20 08/20/2025

The Market Beat: Kingmaker Stocks Push VN-Index to New Heights

The VN-Index demonstrated resilience, quickly recovering from early afternoon pressures to close at a record-breaking 1,688 points. Despite the positive finish, today’s market left many investors feeling uneasy, as the old adage of “green on the outside, red on the inside” rang true.

“VN-Index: A Clear Path to Conquer the 1,700-Point Threshold?”

The VN-Index climbed for the fourth consecutive session, closely hugging the upper band of the Bollinger Bands. While trading volume has been volatile in recent sessions, indicating investor sentiment is not yet firmly established, the rally has been largely driven by large-cap stocks. Nonetheless, the MACD indicator continues to trend upward without showing any signs of weakness, suggesting the VN-Index could soon breach the 1,700-point threshold in upcoming sessions.

“Vietstock Daily 20/08/2025: Sustaining the Uptrend”

The VN-Index reached new heights, with trading volume recovering above the 20-session average. The upward trend of the index remains robust as the MACD indicator continues to widen the gap with the signal line, providing a strong buy signal. However, investors should be cautious of potential short-term volatility if the Stochastic Oscillator indicator continues to weaken.

Market Pulse for August 22: Pessimism Prevails as Foreign Investors Heavily Sell Off HPG

The market closed with notable losses, as the VN-Index dipped by 42.53 points (-2.52%), settling at 1,645.47. Likewise, the HNX-Index witnessed a decline of 11.91 points (-4.19%), ending the day at 272.48. The overall market breadth was dominated by decliners, with 647 stocks trading lower against 180 gainers. This bearish sentiment was echoed in the VN30 basket, where 26 stocks closed in the red versus just 4 in the green.

Stock Market Wrap-up: A Peak Pause

The VN-Index struggled during the week’s final session as intense profit-taking pressure drowned the market. This development mirrors late July 2025, when the rally stalled after an extended uptrend. The upcoming trading sessions will be pivotal in determining whether the market is taking a breather before resuming its ascent or transitioning into a more distinct corrective phase.