F88’s Skyrocketing Stock Price: Unraveling the Reasons Behind its Success

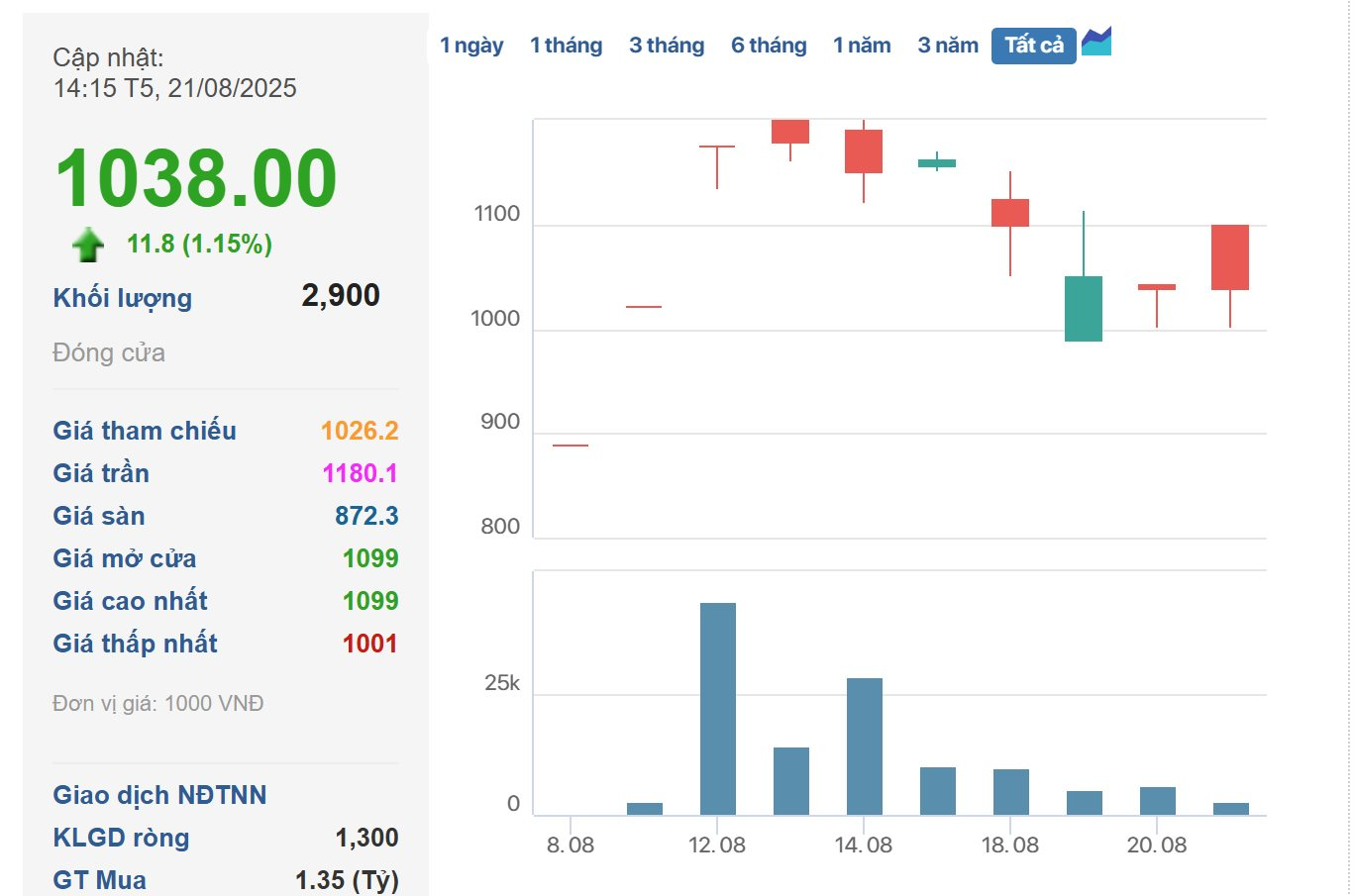

On August 21, F88’s stock closed at a staggering 1,038,000 VND per share, a 1.1% increase, making it the only stock in Vietnam to surpass the million-dong mark. With a market capitalization exceeding 8,500 billion VND, equivalent to over 320 million USD, F88 has caught the attention of investors.

Since its debut on UPCoM on August 8, F88’s stock price has been a topic of interest. With a reference price of 634,900 VND per share and a price fluctuation limit of ±40% for the first trading day, the stock soared to the maximum allowed, reaching 888,800 VND, and continued its upward trajectory to the 1-million-dong milestone.

Addressing the seemingly high stock price, Mr. Phung Anh Tuan, Chairman of F88’s Board of Directors, attributed it to the limited number of shares currently available—a mere 8 million. As a result, the stock is highly concentrated, leading to its elevated price.

“The perception of a high stock price stems from a lack of understanding,” Mr. Tuan shared. He further added that F88 plans to split its shares within the next one to two months, which would bring the price down to approximately 100,000 VND per share.

Mr. Tuan also expressed that F88’s decision to go public and trade on UPCoM is a stepping stone to eventually listing on HoSE. Therefore, the company is not issuing new shares to the public, and current market transactions primarily involve internal trades among shareholders and ESOP-related transactions. This dynamic has contributed to the share price surpassing 1 million VND.

“In terms of company valuation, F88 was valued at 350 million USD back in 2023, corresponding to the current trading value on UPCoM,” Mr. Tuan revealed. He further added, “From my perspective, F88’s stock price and market capitalization are still understated compared to the company’s true value.”

Supporting Mr. Tuan’s explanation, Ms. Tran Mai Thao, F88’s CFO, emphasized that the high price is not without basis. The initial offering price of 634,900 VND was carefully determined by considering the market price on the OTC market plus the book value per share. After calculating the average and applying certain factors, F88 arrived at the starting price.

According to Ms. Thao, the upward movement of the stock price after the first trading session indicates that the market recognizes a higher value for F88’s shares than initially set by the company.

Asserting that stock price determination is solely market-driven, Ms. Thao confirmed that the company does not engage in any buying or selling of its shares on the market.

Looking ahead, Mr. Tuan shared F88’s plans for a pre-IPO round, likely to take place in early 2026. The company aims to attract strategic investors who can bring not only capital but also enhance F88’s reputation and contribute to its management expertise.

With a target valuation of 1 billion USD by 2027, Ms. Thao explained that F88 expects to achieve a P/E ratio of 20 times, based on the PEG model (P/E ratio relative to growth rate), given the company’s exceptional growth trajectory compared to the industry.

F88 has developed a detailed financial model targeting a 30% annual growth in loan balances and a 20% increase in revenue.

“HoSE Queries Viconship on VSC Stock’s Five-Day Rally”

The Ho Chi Minh Stock Exchange (HoSE) has requested that Viconship provide an explanation for the surge in its stock price, which hit the ceiling for five consecutive sessions from August 12, 2025, to August 18, 2025.

Who is the Secret Company that Just Signed a Deal to Purchase TDC’s Land in Binh Duong Ward?

“TDC and Global Corp have signed an agreement for the transfer of residential properties in Lot E15, part of the TDC Hoa Loi residential project in Binh Duong Ward, Ho Chi Minh City. This seemingly low-key enterprise has caught the attention of many big players in the stock market, with its connections to major power players.”

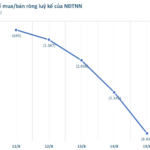

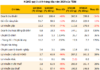

“Foreign Investors’ Sell-Off: Blue-Chip Stocks Witness a Massive $1 Billion Outflow in the Week of August 11-15, Contrasting the Strong Buying of Securities Stocks”

Foreign investors continued their net selling streak in the billions during the week of August 11-15, with selling pressure intensifying towards the week’s end.