Novaland (Novaland, HoSE: NVL) has just announced an update regarding the repayment of principal and interest on its Novaland.Bond.2019 bonds.

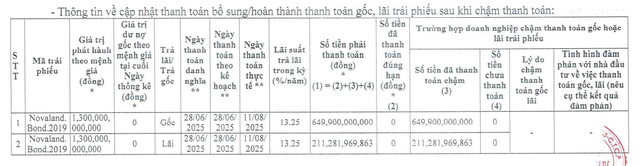

Specifically, on August 11, 2025, Novaland made a payment of over VND 861.2 billion to settle the principal and interest due on June 28, 2025. This included VND 649.9 billion in principal and VND 211.3 billion in interest.

According to the Hanoi Stock Exchange (HNX), the Novaland.Bond.2019 bond issue comprised 13,000 bonds with a face value of VND 100 million each, totaling VND 1,300 billion. These bonds were issued by Novaland on June 28, 2019.

Novaland pays off more than VND 861 billion in principal and interest on Novaland.Bond.2019 bonds.

Earlier in 2023, Novaland had requested to extend the term of this bond issue from 4 years to 6 years, postponing the maturity date to June 28, 2025.

Consequently, the company adjusted the interest payment schedule from quarterly installments to a one-time payment of principal and interest upon maturity or early redemption.

Novaland stated that it would consider repurchasing the bonds before maturity if it could arrange funds earlier than expected from sales or other sources of revenue.

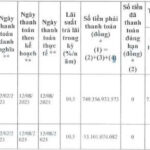

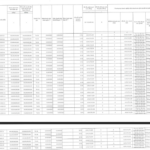

In the first half of 2025, Novaland was unable to make payments totaling VND 2,523.4 billion in principal and interest for 6 bond issues.

In addition to the aforementioned Novaland.Bond.2019 bonds, the company had outstanding principal and interest payments for the following bond issues: NVLH2123010 (nearly VND 1,092.5 billion), NVLH2123013 (nearly VND 114.3 billion), NVLH2124002 (nearly VND 285.5 billion), NVLH2232001 (nearly VND 164.6 billion), and NVLH2232002 (nearly VND 5.5 billion).

The delay in repaying the principal and interest on these bond issues was due to the inability to arrange funds. The company is currently in negotiations with investors to settle the outstanding debt.

During this period, the company only made timely interest payments for two bond issues: NVL20202-03-340 (over VND 18.5 billion) and NVLH2224006 (over VND 14.7 billion).

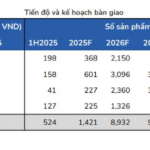

At the 2025 Extraordinary General Meeting of Shareholders, shareholders approved a plan to issue over 151.85 million shares at a price of VND 40,000 per share to exchange for the entire outstanding principal of 13 bond codes.

These bonds were issued between 2021 and 2022, with maturities mainly falling in 2023-2025, and had a total outstanding principal of VND 6,074 billion.

Regarding the detailed plan, Novaland stated that it would negotiate with bondholders, and the implementation is expected to take place in 2026, subject to approval from the State Securities Commission.

This outstanding private bond principal has been pending since 2023 due to challenging business conditions and financial pressures. However, Novaland has been unable to fulfill its commitments to bondholders.

Once the additional share issuance plans are approved and successfully implemented, Novaland’s chartered capital is expected to increase to nearly VND 22,700 billion, with the ratio of issued shares to total outstanding shares at 16.4%.

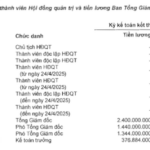

According to Novaland’s management, the short-term issuance of additional shares will dilute the ownership of existing shareholders. Still, it is a necessary step for the company’s restructuring, easing cash flow pressure, improving financial safety ratios, and ensuring the benefits of all related parties.

“Novaland Could Repatriate 4.358 Trillion VND of Provisions from Lakeview Project, BSC Predicts”

“BSC predicts that the latter half of 2025 will be a supportive phase for NVL, attributed to positive legal progress across projects, significant improvement in financial performance with the reversal of 4,358 billion VND in provisions at Lakeview, and enhanced cash flow from asset sales and installment collections at Aqua City.”