Petrochemical and Fertilizer Corporation (Phú Mỹ Fertilizer Joint Stock Company, ticker symbol: DPM, on HoSE) has recently reported on the results of its equity issuance to increase charter capital from equity sources.

According to the report, at the conclusion of the issuance on August 8, 2025, Phú Mỹ Fertilizer distributed over 288.56 million bonus shares to 15,335 shareholders, with 8,863 fractional shares to be canceled.

The entitlement ratio was 100:73.7476, meaning that for every 100 shares owned, shareholders received 73.7476 new shares. The share transfer is expected to take place in the third quarter of 2025.

Illustrative image

The total issuance value, based on par value, was nearly VND 2,886 billion. The capital source was the Investment Development Fund as of December 31, 2024, based on Phú Mỹ Fertilizer’s audited separate financial statements for 2024.

Following this issuance, the total number of shares issued by Phú Mỹ Fertilizer increased from 391.4 million to nearly 680 million, equivalent to a charter capital increase from VND 3,914 billion to nearly VND 6,800 billion.

In terms of business performance, according to the consolidated financial statements for the second quarter of 2025, Phú Mỹ Fertilizer recorded net revenue of over VND 5,301 billion, up 34.3% compared to the same period last year. After deducting taxes and fees, the company reported a net profit of over VND 413 billion, an increase of 75.5%.

For the first six months of 2025, the company achieved net revenue of over VND 9,421 billion, up 29.9% compared to the first six months of 2024, with after-tax profit reaching over VND 624 billion, an increase of 24%.

For the year 2025, Phú Mỹ Fertilizer set a business plan with a projected after-tax profit target of VND 320 billion. Thus, by the end of the second quarter, the company had achieved 195% of its profit plan.

As of June 30, 2025, Phú Mỹ Fertilizer’s total assets increased by 12% from the beginning of the year to nearly VND 18,542 billion. Of this, the investment held to maturity accounted for VND 11,114 billion, or 60% of total assets, and inventory was nearly VND 1,968 billion.

On the liability side of the balance sheet, total liabilities stood at nearly VND 6,822 billion, up 27% from the beginning of the year. Short-term loans and finance leases accounted for VND 3,635 billion, or 53.2% of total debt.

Who is the Secret Company that Just Signed a Deal to Purchase TDC’s Land in Binh Duong Ward?

“TDC and Global Corp have signed an agreement for the transfer of residential properties in Lot E15, part of the TDC Hoa Loi residential project in Binh Duong Ward, Ho Chi Minh City. This seemingly low-key enterprise has caught the attention of many big players in the stock market, with its connections to major power players.”

A Real Estate Stock Surges 40% on its Debut, Reaching a Market Cap of Billions

For the first six months of the year, the company reported zero revenue. Financial income, however, helped the company turn a profit of nearly VND 380 million.

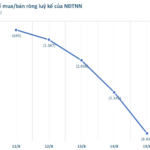

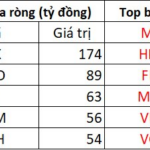

Foreign Investors Continue Their Selling Spree: Net Sell-Off Exceeds VND 3 Trillion on August 15

Let me know if you would like me to continue refining or expanding this title to better suit your needs.

Foreign investors continued their selling spree on HPG stock, offloading a staggering 700 billion VND worth of shares. FPT and MBB also witnessed substantial sell-offs, with outflows of 509 billion VND and 500 billion VND, respectively.