VETC Joint Stock Company (VETC) has announced the results of its bond issuance to the Hanoi Stock Exchange (HNX).

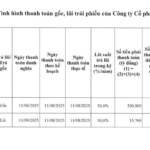

On July 22, 2025, VETC issued 500 bonds with the code ETC42501, a face value of VND 1 billion per bond, totaling a value of VND 500 billion. With a five-year term, this bond lot is expected to mature on July 22, 2030.

This issuance is part of an investment by the International Finance Corporation (IFC), a member of the World Bank Group, in convertible bonds issued by VETC. The coupon rate for VND is 5%.

With this partnership, both parties aim to accelerate smart transportation projects pursued by the company, enhance international connectivity, and improve product, service, and environmental standards with IFC’s support.

Image: Tasco

According to the introduction by Tasco Joint Stock Company (HUT), VETC is a member of the Tasco group. As of June 30, 2025, Tasco is the parent company, owning 99.26% of VETC’s capital.

Tasco shared that VETC is currently the largest operator of the electronic toll collection (ETC) system in Vietnam, holding a 75% market share with 133 toll stations and 719 non-stop toll lanes. They serve over 3.8 million customers and process an average of 1.8 to 2.3 million transactions daily, equivalent to approximately 700 million transactions annually.

Regarding VETC, the enterprise was established in May 2015, with its head office located on the 11th floor, Tasco Building, HH2-2, Pham Hung Street, Tu Liem District, Hanoi.

According to a business registration change in January 2022, the company’s charter capital is VND 747.4 billion.

Currently, Mr. Nguyen Le Thang (born in 1982) is the General Director and legal representative of the company. Additionally, Mr. Nguyen Danh Hieu, Vice Chairman of Tasco’s Board of Directors, also holds the position of Member of VETC’s Board of Directors.

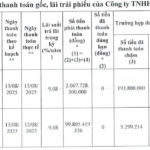

Extending the Maturity of AE Resort Cua Tung’s Eco-Resort Township Project: A 450 Billion VND Bond Extension

The INFINITYH2127001 bondholder’s meeting of Infinity Land Joint Stock Company (IFNC) has approved a resolution to extend the bond term from 72 months to 96 months.

“Vingroup Guarantees 15,000 Billion VND of Bonds Issued by Vinhomes.”

“Vingroup leverages its extensive assets to secure a substantial 15,000 billion VND private bond issuance for its subsidiary, Vinhomes. This strategic move underscores Vingroup’s unwavering commitment to fostering the growth and financial stability of its real estate arm.”