I. VIETNAM STOCK MARKET WEEK 18-22/08/2025

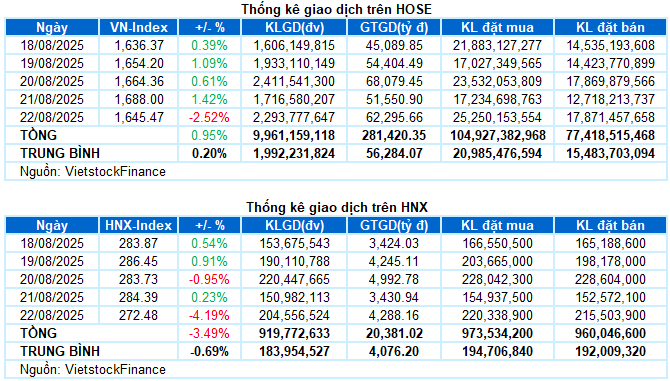

Trading: VN-Index ended the week at 1,645.47, a sharp decline of 2.52% from the previous session. HNX-Index also plunged 4.19% to 272.48. For the whole week, VN-Index narrowed its gain to 15.47 points (+0.95%), while HNX-Index dropped 9.86 points (-3.49%).

The stock market experienced a volatile week. Despite strong fluctuations, the VN-Index still had four rising sessions with impressive demand for pillar stocks, especially in the financial group. However, the overall picture did not show consensus as many stocks soon entered a correction phase. In the final session, when the pillar group “ran out of steam” after a steep climb, the index quickly sank with a fragile recovery effort. The accumulated results of the past week narrowed significantly, with the VN-Index stopping at the 1,645.47 mark, just over 15 points higher than the previous week.

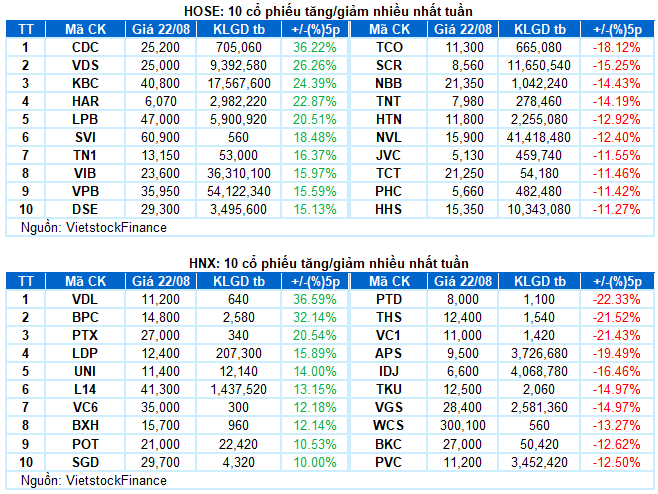

In terms of impact, the top 10 negative-performing stocks took away more than 22 points from the VN-Index, with the strongest pressure coming from VPB and TCB. Meanwhile, BID and VCB were rare bright spots on the opposite side, but they only helped the index regain 2.5 points.

No sector escaped the red, with the least-declining non-essential consumer group losing nearly 1%. The energy group was at the bottom with a deep drop of 4.4%, as large-cap stocks in the industry fell sharply, such as BSR hitting the floor, PLX (-2.57%), PVS (-2.29%), OIL (-4.07%), PVD (-2.75%), and PVT (-1.1%).

The indices of large-cap sectors such as finance and industry also evaporated more than 2%, putting more pressure on the market. Most stocks plunged into the red, and many even faced a “buy-side drought” like VPB, SHB, EIB, VND, BSI; VGC, VSC, IPA, PC1, and DPG.

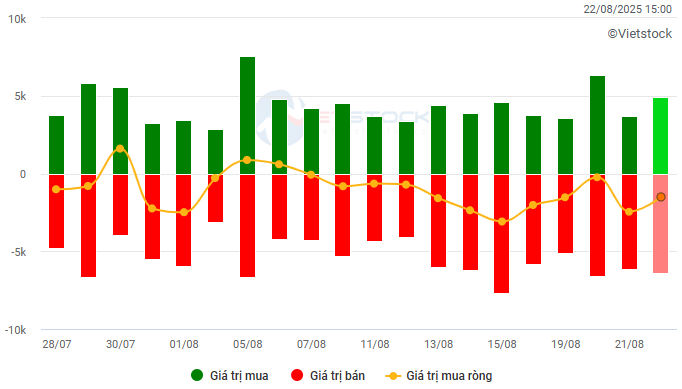

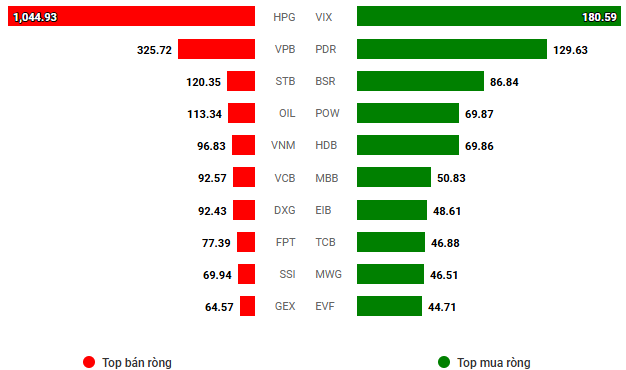

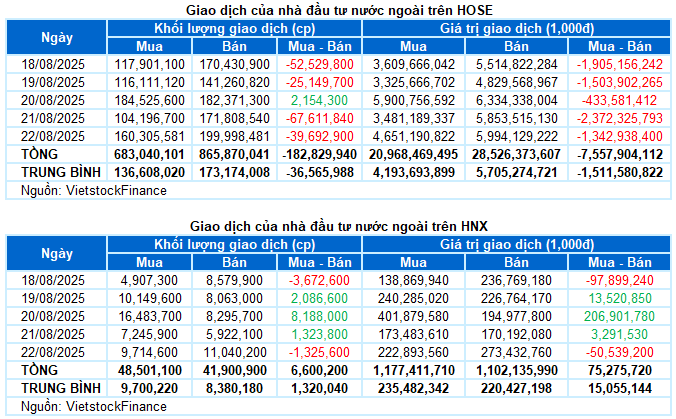

Foreign investors net sold a value of nearly VND 7.5 trillion on both exchanges last week. Specifically, foreign investors net sold more than VND 7.5 trillion on the HOSE but still net bought more than VND 75 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

Stocks with outstanding performance last week: VDS

VDS up 26.26%: VDS concluded an impressive trading week with the appearance of a Big White Candle pattern. Trading volume surged and far exceeded the 20-session average, reflecting investors’ positive sentiment.

Along with this, the MACD indicator continues to widen the gap with the Signal line since giving a buy signal in early July 2025, indicating that the positive trend is likely to continue.

Stocks with strong declines last week: SCR

SCR down 15.25%: SCR was adjusted strongly last week after a long previous increase. Three consecutive declining sessions brought the stock price close to the Lower Band of Bollinger Bands.

Currently, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. The old peak of July 2025 has been surpassed (equivalent to the 8,200-8,500 region), which will act as support in the coming time.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 17:13 22/08/2025

The King of Stocks Reigns Supreme: What Do the Experts Say?

The surge in bank stock prices is not a fleeting phenomenon but a result of a confluence of factors: robust business fundamentals, conducive monetary and legal policies, market reforms, and a stable macroeconomic environment. However, the differentiation will become more pronounced, and only banks with strong governance, cheap capital advantages, a thriving digital ecosystem, and a robust asset structure will sustain their allure.

“If I Had Invested in Stocks Instead of Playing it Safe, I Could’ve Afforded That Car”

While bank savings accounts offer a meager 5-6% annual interest rate, the stock market presents a tantalizing opportunity for superior returns. This has prompted many to reconsider their once “safe” choice.

The Stock Market’s Stealthy Strategists: In-House Traders Unveil their Tactics with a $9 Million Shopping Spree on August 18th.

The proprietary securities firms continued their net buying streak on the HoSE, with a total value of 208 billion VND. The focus was on the leading technology stock, which saw a significant boost in trading volume and value. This strategic move by the proprietary firms showcases their confidence in the tech sector’s potential and strengthens their position in the market.

Stock Market Update: Mid and Small-Cap Stocks to Attract Investors’ Interest

The August 18th session concluded with a robust buying spree as investors sought to take advantage of discounted stock prices. For the upcoming August 19th trading day, we anticipate a shift in focus towards mid and small-cap stocks, presenting a strategic opportunity for savvy investors to diversify their portfolios and potentially capitalize on the momentum of these dynamic segments of the market.

For the First Time in Vietnam’s History: A Decade of Trillion-Dollar Banks

The banking stocks, particularly the private sector, have witnessed a remarkable rally with double-digit percentage gains over a short period.