Source: State Bank of Vietnam

|

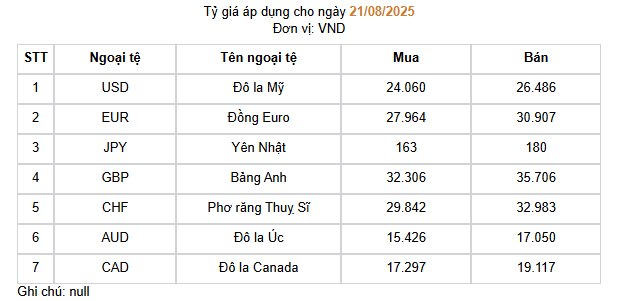

On the morning of August 21, 2025, the State Bank of Vietnam (SBV) set the daily reference exchange rate at 25,273 VND per USD, a 10-dong increase from the previous day, marking a new record since the central exchange rate system was officially adopted. With a permitted fluctuation of 5% on either side, commercial banks can now trade dollars within the range of 24,009 – 26,536 VND/USD.

The SBV’s trading arm also adjusted its buying and selling rates accordingly, setting them at 24,060 – 26,486 VND/USD.

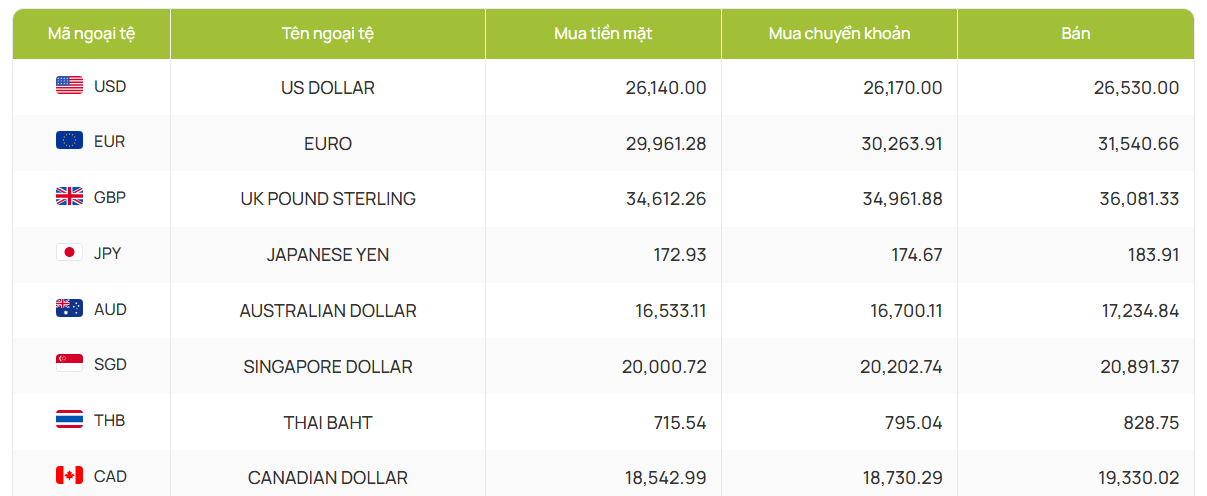

Vietcombank, one of the country’s largest lenders, followed suit, offering rates of 26,114 – 26,530 VND/USD, an increase in both buying and selling prices compared to the previous day.

Source: Vietcombank

|

The US dollar’s appreciation comes amid a plentiful foreign exchange supply in the market. Vietnam’s trade surplus has been a significant contributor to this supply. According to the latest data, the country recorded a trade surplus of over $10.2 billion in the first seven months of 2025, with a surplus of approximately $2.29 billion in July alone. Stable export earnings ensure a consistent flow of foreign currency in the market.

Additionally, up to the end of July 2025, registered FDI capital into Vietnam reached $24.09 billion, a 27.3% increase compared to the same period last year. The realized FDI capital has also shown positive figures, continuously adding to the economy’s foreign exchange supply.

Remittances are another significant source of foreign currency. In Ho Chi Minh City alone, remittances in the first six months of 2025 exceeded $5.23 billion.

Prof. Dr. Nguyen Huu Huan, Senior Lecturer at the University of Economics Ho Chi Minh City, stated that the exchange rate has officially surpassed the 26,500 VND/USD mark, setting a new standard. This surge results from a combination of short-term and long-term pressure factors.

Firstly, seasonal pressure was anticipated, as the current period is one of the three peak seasons for foreign currency demand. This pressure is further intensified by foreign investors’ net selling after a period of net buying, directly impacting the overall balance of payments and the USD supply.

At the same time, in the interbank market, the interest rate differential between the USD and VND is widening, creating a conducive environment for speculative activities. Looking at the broader macroeconomic context, the policy of maintaining low-interest rates over the long term to support economic growth, although necessary, is an inherent factor that constantly puts pressure on the exchange rate.

Mr. Nguyen Quang Huy, CEO of Finance – Banking, Nguyen Trai University, opined that the USD/VND exchange rate at commercial banks approaching the threshold of 26,530 VND/USD, despite a weak global USD index, reflects the confluence of several factors, including technical aspects, short-term supply and demand, and international capital flows.

Firstly, the central exchange rate mechanism, with a ±5% margin, allows commercial banks to quote rates close to the ceiling whenever the central rate is adjusted. While this is a technical factor, it immediately creates a sense of upward pressure, regardless of the overall abundant foreign exchange supply.

Secondly, there is a sharp increase in short-term USD demand. The seasonality of importing raw materials, international debt payments, and businesses’ risk management needs coincide, while foreign exchange supply allocation lags, creating a temporary liquidity gap. Consequently, the exchange rate rises, even though the current account balance remains stable in the long term.

Another critical factor is the country’s foreign reserve, which, although at a safe level, no longer has the same ample room as before. This situation may lead the market to anticipate a more cautious approach from the regulators regarding intervention, potentially triggering a hoarding mentality or encouraging early foreign currency purchases.

Moreover, the current domestic interest rate policy leans towards supporting economic growth, resulting in less attractive VND-USD interest rate differentials. With USD yields remaining relatively high, the tendency to hold USD is reinforced, and there may be an incentive for some short-term capital outflows. Peer pressure from the region is also significant. The fluctuations of the Chinese yuan and other Asian currencies create a “new normal,” making it challenging for the VND to move entirely against the regional trend while maintaining export competitiveness. Hence, even with a weak global USD index, the USD/VND exchange rate can still rise due to regional comparative factors.

|

The USD Index is hovering around 98.3 points

Source: TradingView

|

Notably, in the stock market, foreign investors have been net sellers. When they withdraw capital and convert it into foreign currency to transfer abroad, the VND supply increases, but so does the demand for USD, exerting direct pressure on the exchange rate. This channel of transmission is often overlooked but consistently impacts the market. Lastly, market psychology and the way banks quote their rates play a part. Once a few banks quote rates close to the ceiling, others tend to follow suit, forming a “new expectation anchor” and driving businesses’ risk management demand.

According to Mr. Huy, the exchange rate increase, despite ample foreign exchange, is not a paradox. It results from the confluence of short-term supply and demand, policy management, external capital flows, and psychological factors. For businesses, the priority is risk management: importers should use forward contracts or split payments; exporters should consider the timing of foreign currency sales; and investors should closely monitor the central exchange rate, external capital flows, and regional dynamics. Strategically, the current exchange rate adjustment can be viewed as a controlled step, absorbing immediate pressure while creating room for the economy in the medium term.

By Cat Lam

– 11:44 21/08/2025

“Viet Nam Dong Surges: Bank Rates Surge Past 26,500, Freefalling USD Hits New Lows”

This morning, the US dollar rate surged past 26,500 VND at several banks. Meanwhile, the dollar rate in the free market hit a record high of 26,600 VND on the selling side.