Only 9.3% of Businesses Able to Access Loans

The recently released report, “Credit for SMEs: Opportunities and Risks” by FiinGroup (a financial solutions provider), offers insights into the financial health, risk exposure, and credit accessibility of Small and Medium-sized Enterprises (SMEs) in Vietnam.

According to the report, only 9.3% of SMEs have accessed bank loans, significantly lower than the 56.1% rate for larger corporations. This disparity highlights the persistent credit barriers that hinder the growth, investment, and competitiveness of SMEs.

Small and medium-sized enterprises continue to face challenges in accessing bank capital. Photo: Minh Tâm

The FiinGroup report also reveals a notable increase in risk exposure for SMEs from 2022-2024, with nearly 60% of businesses facing high to very high-risk levels during this period.

The challenges faced by SMEs in accessing capital have been a recurring issue raised by the business community. Mr. Nguyen Duc Xuan, Chairman of Ha Thanh Trading and Investment Joint Stock Company, shared his experience: “Our company won bids for supplying medical equipment but faced obstacles in obtaining bank loans due to a lack of collateral.” The situation improved when they partnered with a larger company, but it came at the cost of their independence and growth opportunities.

On a positive note, Mr. Nguyen Duc Linh, Director of Khanh Linh Co., Ltd. (a dried fruit and vegetable company in Ho Chi Minh City), shared their success in obtaining short-term working capital loans (at a preferential interest rate of about 6%) and medium to long-term loans for machinery purchases (at 9% interest). This was made possible despite initial challenges due to their property being in a planned area. Mr. Linh attributed this success to timely guidance and the bank’s flexibility in providing collateral-free loans for feasible production and business plans.

Addressing the Challenges

According to the State Bank of Vietnam, credit growth has been notable, with a 9.8% increase as of July 29 compared to the end of 2024, and a 19.75% surge compared to the previous year. However, the paradox is that many businesses, especially small and medium-sized enterprises, still struggle to access bank credit.

Experts attribute this disparity to the uneven distribution of credit across industries and business sizes. Larger corporations, conglomerates, and real estate projects tend to attract most of the credit, while SMEs, which form the backbone of the economy, are often left behind. Banks’ preference for well-collateralized and low-risk borrowers further disadvantages smaller businesses that lack collateral.

Mr. Nguyen Van Than, Chairman of the Vietnam Association of Small and Medium Enterprises, explains that commercial banks, facing their revenue and profit pressures, tend to favor larger, more established businesses with transparent financial records and sufficient collateral. This approach ensures a balance between profitability and risk management for the banks.

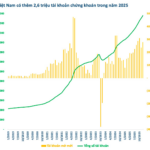

Economist Dr. Le Xuan Nghia suggests that Vietnam’s stock market currently lacks depth and quality, leaving businesses heavily reliant on credit. He references the dedicated Ministry of Small Business in the US and proposes that Vietnam consider establishing a more robust and specialized support mechanism for its SMEs.

Meanwhile, Dr. Nguyen Quoc Hung, Vice Chairman and General Secretary of the Vietnam Bankers Association, attributes the challenges faced by businesses in accessing credit to the broader economic difficulties impacting their operations and financial health. He also points out that many businesses with collateral encounter legal obstacles, such as pending certificates, planning suspensions, and disputes, which hinder their eligibility for loans. Additionally, some businesses fail to meet the requirements for transparent financial conditions, making it difficult for banks to assess their creditworthiness.

To address these issues, Dr. Hung emphasizes the need for decisive restructuring in strategy, organization, operations, finance, and governance to enhance competitiveness, asset growth, financial transparency, and operational clarity. These improvements will provide a solid foundation for credit institutions to evaluate and extend loans to businesses.

The Early Redemption of Hung Thinh Quy Nhon’s Two Bond Issues Totals VND 4,000 Billion

“Hưng Thịnh Quy Nhơn proudly announces the full redemption of two bond lots, HQNCH2124003 and HQNCH2124004, with a total issuance value of VND 4,000 billion, ahead of their maturity dates. This significant milestone underscores our financial strength and commitment to meeting our obligations.”

Wealth of Funds: OCBS’s Strategic Investments in Securities and Deposits

On August 5th, OCBS Securities Joint Stock Company purchased government bonds worth nearly VND 154 billion, accounting for 11.1% of total assets on the reviewed financial statements for the first half of 2025. However, just a day later, the company sold a slightly higher value of government bonds. In recent times, the company has also approved numerous other large-scale investments in deposits and stocks, worth hundreds of billions of dong.

“Securities Lending Makes Up 1.5% of Total Outstanding Credit in the Economy”

Amid concerns of surging credit growth funneling into risky sectors such as real estate and securities, the Governor of the State Bank of Vietnam has assured that the authority remains vigilant. The central bank is closely monitoring key safety indicators, proactively steering interest rates, and keeping a watchful eye on exchange rate movements to safeguard macroeconomic stability.

The Contrasting Shades of the 2025 Corporate Landscape

The business landscape in the first seven months of the year presented a picture of stark contrasts. While there was a notable increase in new business formations and a resurgence of previously dormant enterprises, the number of businesses exiting the market also raised warning signs of significant challenges ahead.