VPBank – One of the four banks freed from capital constraints as Circular 23 takes effect on October 1st, 2025. Photo: LE VU |

A Relaxation of Monetary Policy?

Circular 23/2025/TT-NHNN (Circular 23), which amends and supplements a number of articles in Circular 30/2019/TT-NHNN dated December 27th, 2019, on the implementation of mandatory reserves for credit institutions and branches of foreign banks, is seen by many experts as a significant relaxation of monetary policy. According to Circular 23, credit institutions that are mandated to take over a commercial bank under special control as stipulated in the Law on Credit Institutions shall have their mandatory reserve ratio reduced by 50% in accordance with the approved scheme for the compulsory transfer of the commercial bank under special control.

This means that instead of being required to hold mandatory reserves equivalent to 3% of non-term deposits and deposits with a term of less than 12 months, and 1% for deposits with a term of 12 months or more (for VND deposits), this group of banks will only need to hold reserves at a ratio of 1.5% and 0.5%, respectively. For every 100 VND of non-term or under-12-month term deposits, the four commercial banks that are mandated to take over the bank under special control will only need to set aside 1.5 VND instead of 3 VND, allowing them to lend up to 98.5 VND, compared to 97 VND previously. Similarly, for every 100 VND of over-12-month term deposits, these four commercial banks can now lend up to 99.5 VND, instead of the previous limit of 99 VND.

|

This represents a significant boost in liquidity, enabling banks to expand credit without increasing deposits, stimulating the economy, and facilitating the restructuring of weak banks. |

In a discussion with our reporters, Dr. Nguyen Huu Huan from the University of Economics Ho Chi Minh City estimated that when Circular 23 takes effect on October 1st, 2025, the four banks could see their capital constraints loosened by an estimated VND 17,200 billion to VND 51,700 billion, depending on the actual structure of their term deposits.

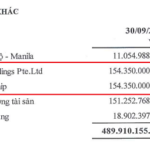

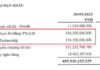

Specifically, for Vietcombank, based on its Q2 2025 financial report, customer deposits totaled over VND 1,580,000 billion as of June 30th, 2025. With the implementation of Circular 23, the bank could reduce its mandatory reserves by approximately VND 7,900 billion to VND 23,800 billion.

For MBBank, with customer deposits of VND 783,300 billion in the same period, the reduction in the mandatory reserve ratio could free up VND 3,900 billion to VND 11,700 billion.

As for HDBank, the respective figures are VND 478,300 billion and VND 2,400 billion to VND 7,200 billion.

In the case of VPBank, with customer deposits of VND 600,700 billion, the bank could gain an additional VND 3,000 billion to VND 9,000 billion in lending capacity.

According to Dr. Huan, this represents a significant boost in liquidity, enabling banks to expand credit without increasing deposits, stimulating the economy, and facilitating the restructuring of weak banks.

Unraveling the Guilt Trip

From the perspective of restructuring weak banks, Mr. Nguyen Hoang Linh, Head of Analysis and Research at Vietcombank Fund Management Company (VCBF), opined that the State Bank of Vietnam’s (SBV) issuance of Circular 23, allowing a 50% reduction in the mandatory reserve ratio for commercial banks mandated to take over weak banks, is a decision of great importance. Mr. Linh explained that this mechanism not only boosts the liquidity of the banks taking over weak banks but also facilitates the faster and more effective implementation of the restructuring process for these banks.

The expert analyzed that, in terms of the legal framework, the Law on Credit Institutions 2024 (effective from July 1st, 2025) has perfected the support mechanism, providing a clearer legal basis for the compulsory transfer process. Accordingly, the taking-over bank (parent bank) can support the weak bank (subsidiary bank) in two crucial aspects:

First is liquidity and operating capital: the parent bank can lend to the subsidiary bank at preferential interest rates to enable it to meet its payment obligations and have the necessary capital for lending activities. The Law on Credit Institutions 2024 stipulates that these loans are classified as Group 1 debts and are subject to a 0% risk weight when calculating the capital adequacy ratio (CAR), thereby helping to ensure the quality of assets and lending capacity of the parent bank.

|

Secondly, the parent bank can provide business support by not only assigning personnel to participate in the management of the subsidiary bank but also transferring good-quality debts to the subsidiary bank. |

This approach enables the subsidiary bank to quickly generate stable income while its business capacity is still limited and helps it save significantly on customer acquisition and lending-related costs. More importantly, the profits generated from these debts will provide the subsidiary bank with additional resources to handle bad debts and gradually eliminate accumulated losses.

“For example, the parent bank sells a debt worth VND 1,000 billion to the subsidiary bank at an interest rate of 8%. The subsidiary bank purchases this debt using VND 500 billion borrowed from the SBV at a 0% interest rate and VND 500 billion borrowed from the parent bank at a preferential interest rate of 4%. Thus, this debt brings about a net interest margin (NIM) of approximately 6% for the subsidiary bank, which is significantly higher than the system’s average NIM, not to mention the subsidiary bank’s savings on customer development and lending-related costs. These profits will be used by the subsidiary bank to handle bad debts and gradually eliminate accumulated losses,” the expert explained.

However, according to Mr. Linh, despite the Law on Credit Institutions 2024 introducing many supportive mechanisms for parent banks, such as allowing the classification of loans to subsidiary banks as Group 1 debts and applying a 0% risk weight when calculating the CAR, the biggest challenge remains in the source of capital. The parent bank has to actively mobilize capital from the market to have the resources to provide preferential loans to the subsidiary bank. In the context of low-interest rates to support economic growth, commercial banks are facing difficulties in attracting deposits. After the first five months of 2025, system-wide deposits increased by only 2.4% while credit grew by 6.7%. Additionally, converting cash into loans for the subsidiary bank also means a reduction in the parent bank’s highly liquid assets, directly affecting the requirement to maintain a minimum liquidity reserve ratio of 10% as stipulated in Circular 22/2019.

“Therefore, the 50% reduction in the mandatory reserve ratio according to Circular 23 has helped to release a significant amount of capital, enabling the parent bank to further support the subsidiary bank. As of the end of Q2 2025, the total deposits at the SBV of the four banks mandated to take over weak banks (VCB, MBB, VPB, HDB) were approximately VND 80,000 billion. Thus, when Circular 23 takes effect on October 1st, 2025, about VND 40,000 billion in mandatory reserves will be released, allowing these banks to provide additional preferential loans to the subsidiary banks of up to VND 400,000 billion while still maintaining the minimum liquidity reserve ratio of 10%,” Mr. Linh stated.

To Avoid an Increase in Non-Performing Loans

Addressing concerns about potential risks if lending policies are relaxed, Mr. Nguyen Hoang Linh analyzed that according to Article 182 of the Law on Credit Institutions 2024, the parent bank is only allowed to sell good-quality debts (Group 1 debts) to the subsidiary bank. In the event that these debts subsequently deteriorate into bad debts, the parent bank has the obligation to buy them back. This regulation makes the parent bank directly responsible for the quality of the debts, thereby enhancing risk management awareness throughout the restructuring process of the subsidiary bank.

However, according to the VCBF expert, in reality, there are still risks if the parent bank wants to boost the profitability of the subsidiary bank to speed up the elimination of accumulated losses. For instance, the parent bank may encourage the subsidiary bank to use preferential loan capital to lend to high-interest rate sectors with high risks. Essentially, this is a form of indirect lending to high-risk areas, while the loans between the parent and subsidiary banks are subject to a 0% risk weight when calculating the capital adequacy ratio for the parent bank. This could create a discrepancy between the actual risk and the risk reflected in the capital adequacy report. In this case, the key factor in minimizing the risk associated with this policy lies in the SBV’s supervision and regulation capabilities.

“It is necessary to ensure that the application of the support mechanism is not abused for the sole purpose of generating short-term profits for the weak bank. Providing resources to handle bad debts, eliminate accumulated losses, and accelerate the restructuring process is essential, but it is more important to maintain the safety and sustainable development of the entire system during this process. This means that the SBV needs to supervise not only the scale of profits but also the quality and sustainability of profits at the subsidiary bank,” Mr. Linh noted.

Additionally, according to Mr. Linh, to achieve a successful restructuring, the most important factor is for the parent bank to help improve the intrinsic capacity of the subsidiary bank, including management capabilities, business development, and risk management skills. Only when these core elements are strengthened can the subsidiary bank achieve sustainable development after the support phase and avoid the risk of reverting to a weak position in the future.

By Khanh Nguyen

– 07:00 22/08/2025

Market Beat: Pulling Major Stocks, VN-Index Makes a Strong Comeback at the End of the Session.

The trading session concluded with the VN-Index climbing 10.16 points (+0.61%), reaching 1,664.36. In contrast, the HNX-Index witnessed a decline of 2.72 points (-0.95%), settling at 283.73. The market breadth tilted towards decliners, as 569 stocks closed in the red, while 238 stocks ended in the green. Within the VN30 basket, 17 stocks fell, 12 advanced, and 1 remained unchanged, resulting in a slightly bearish sentiment.

The Stock Market Embraces a New Growth Cycle

The Vietnamese stock market is at a pivotal crossroads, where macro policy drivers, upgrade expectations, and international capital converge to shape a new era of quantitative and qualitative growth. While short-term challenges persist, the long-term outlook is clearer than ever, promising a transformative phase in the country’s economic landscape.

Market Pulse for August 22: Pessimism Prevails as Foreign Investors Heavily Sell Off HPG

The market closed with notable losses, as the VN-Index dipped by 42.53 points (-2.52%), settling at 1,645.47. Likewise, the HNX-Index witnessed a decline of 11.91 points (-4.19%), ending the day at 272.48. The overall market breadth was dominated by decliners, with 647 stocks trading lower against 180 gainers. This bearish sentiment was echoed in the VN30 basket, where 26 stocks closed in the red versus just 4 in the green.

“NCB’s Solution to Large-Scale Travel Agencies’ Liquidity Issues”

“National Commercial Joint Stock Bank (NCB) has unveiled a range of tailored credit solutions exclusively for large enterprises in the securities and entertainment tourism industries. These innovative financial offerings are designed to empower businesses with enhanced cash flow management, bolstered competitive advantage, and the ability to seize emerging growth opportunities.”