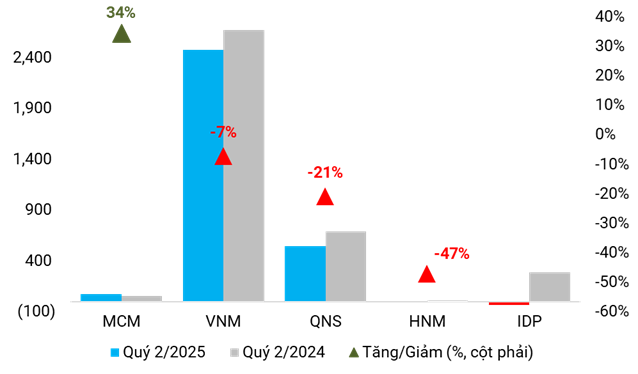

The combined net revenue of the top five dairy companies listed on HOSE, HNX, and UPCoM reached nearly VND 22.8 trillion, up 1.7% year-on-year. However, net profit declined by 18%, reaching VND 3 trillion.

|

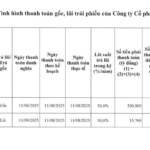

Q2 profit decline for the dairy sector compared to the same period last year (in VND billion)

Source: Author’s compilation

|

IDP reported its first loss since its listing

International Dairy Products (UPCoM: IDP) grabbed attention as its revenue hit a record high of VND 2.1 trillion, a 9.5% increase, but the company incurred a loss of over VND 36 billion. This was mainly due to a doubling of selling expenses to VND 758 billion, causing the selling expense ratio to soar to 35.8%, the highest since its listing on UPCoM in 2021.

The gross profit margin decreased from 40.9% to 36.6%, and combined with rising interest and management expenses, led to a sharp decline in business results. This was the third consecutive quarter of declining profits for IDP before it fell into the loss zone.

| IDP’s soaring selling expenses resulted in a loss |

Vinamilk reported the highest profit among the last four quarters

Vietnam Dairy Products (Vinamilk, HOSE: VNM) recorded a revenue of VND 16.7 trillion, a slight increase from the previous year, setting a new record.

The selling expense ratio increased from 21.5% to 22.2%, causing net profit to decrease by 7.3% to VND 2.47 trillion. Nevertheless, this remains the highest profit among the last four quarters thanks to an improved gross profit margin.

| VNM’s selling expense ratio remains high compared to the last three years |

QNS’s gross profit exceeded VND 1 trillion, but net profit declined

Quang Ngai Sugar Joint Stock Company (UPCoM: QNS) recorded revenue of nearly VND 3 trillion, a 4.8% increase, and for the first time, its gross profit exceeded VND 1 trillion.

However, selling expenses surged by 92% to VND 350 billion. Among these expenses, agency fees and sales support amounted to more than VND 64 billion, ten times higher than the previous year, pushing the selling expense ratio to 11.8%, the highest in two years. As a result, net profit decreased by 21% to VND 546 billion.

Nonetheless, QNS’s dairy segment is believed to have maintained a 7% growth in output thanks to marketing campaigns and sales policies implemented since 2024.

| QNS’s profit decline due to increased selling expenses |

Hanoimilk’s profit significantly declined due to financial burdens

Hanoi Milk Joint Stock Company (UPCoM: HNM) reported stable revenue of VND 182 billion, a 1.8% increase, while the selling expense ratio remained at 9.9%.

However, interest expenses quadrupled, causing profit to drop by nearly half to VND 5 billion. In the first half of the year, long-term debt had reached VND 100 billion, while no such debt was recorded in the same period in 2024.

| HNM’s profit decline due to increased interest expenses |

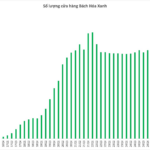

Moc Chau Milk was a bright spot

Moc Chau Milk (HOSE: MCM) was the only company to report an increase in profit in the second quarter, reaching VND 76 billion, a 35% increase. This positive result was achieved by maintaining selling expenses at 20.9% of revenue, significantly lower than the 24% recorded in Q2 2024, while revenue remained stable at VND 806 billion.

SMP prices may stabilize or slightly decrease

According to Vietcombank Securities (VCBS), skimmed milk powder (SMP) prices are likely to stabilize in the coming period as consumption demand remains steady, while supply is expected to decrease in the EU and Australia.

In contrast, whole milk powder (WMP) prices may slightly adjust downward due to increased milk production in New Zealand, fueled by favorable weather conditions, resulting in a surplus of supply, while import demand from China shows signs of slowing down.

This could lead to improved gross profit margins, especially for companies with a high proportion of imported raw materials. However, the sector’s overall profitability still heavily depends on controlling selling and financial expenses, which have eroded business results in the first half of the year.

– 08:06 21/08/2025

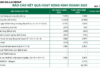

“CMC Repays Over 300 Billion VND in Principal and Interest on Bonds”

CMC has just made a significant payment of over VND 300 billion in principal and nearly VND 16 billion in interest on the CVTB2125003 bond lot.