On August 19, 20, and 21, Mr. Le Duy Hung, Chairman of the Board of Directors of DFF Joint Stock Company (UPCoM: DFF), had over 14.7 million shares sold by a securities company to recover loans, reducing his ownership from 42.16% to 23.73%, equivalent to nearly 19 million shares.

Based on the average closing price of the above three sessions at VND 1,567 per share, the estimated value of the Chairman’s DFF shares sold for loan recovery was over VND 23 billion.

Previously, in the two sessions of February 18 and 19, 2025, Mr. Hung also had more than 4 million shares sold by a securities company to recover loans, reducing his ownership from over 47% to over 42%. During this period, Mr. Hung’s younger brother, Mr. Le Van Thinh, also had nearly 780,000 shares (0.97%) sold, thereby no longer holding any DFF shares. Thus, since the beginning of the year, the Chairman of DFF has had more than 18.7 million shares sold for loan recovery, equivalent to more than 23% of capital.

Mr. Le Duy Hung, Chairman of the Board of Directors of DFF Joint Stock Company

|

The sale of the Chairman’s shares took place amid a continued downward trend in the share price, which closed at VND 1,300 per share on August 22, down 24% from the beginning of the year and more than 50% over the past year, with an average liquidity of more than 577,000 shares per session.

| Share price movement of DFF in the past year |

The poor share price performance is partly due to DFF‘s deep entanglement in a vortex of losses. In the second quarter, the company extended its losing streak to the eighth consecutive quarter with a loss of over VND 203 billion, bringing accumulated losses to over VND 882 billion – a worrying figure considering the charter capital of VND 800 billion, despite a 32% increase in revenue to over VND 44 billion.

DFF’s business results from Q1/2022 – Q2/2025

The enterprise attributed these results to the challenging economic situation in the country, particularly in the real estate sector, which directly impacted its business operations.

– 09:25 23/08/2025

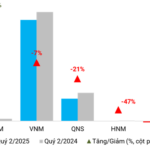

The Dairy Industry’s Second Quarter: A Tale of Contrasting Fortunes

The second quarter of 2025 proved challenging for the dairy industry as soaring selling costs pressured profits, despite many businesses boasting record-breaking revenues.

The Ultimate Guide to Writing Compelling Ads: “Top Insider Sells Shares After a 60% Surge in Four Months”

The DBC stock of Dabaco Vietnam has witnessed a remarkable surge from April 9 to August 11, 2025, skyrocketing by 61.6%. This significant climb took the stock price from VND 19,090 to VND 30,850 per share, capturing the attention of investors and marking a notable milestone for the company.