I. MARKET ANALYSIS OF SECURITIES ON AUGUST 20, 2025

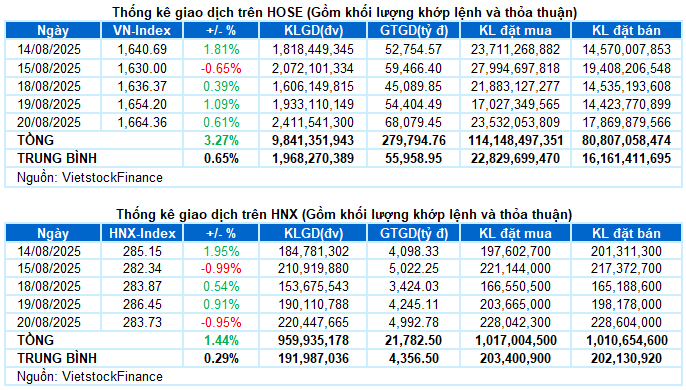

– The main indices showed mixed performance during the trading session on August 20. Specifically, the VN-Index increased by 0.61%, reaching 1,664.36 points. In contrast, the HNX-Index decreased by 0.95% to 283.73 points.

– Matching volume on the HOSE increased by 27.5%, surpassing 2.2 billion units. Over 219 million units were traded on the HNX, representing a 17.6% increase compared to the previous session.

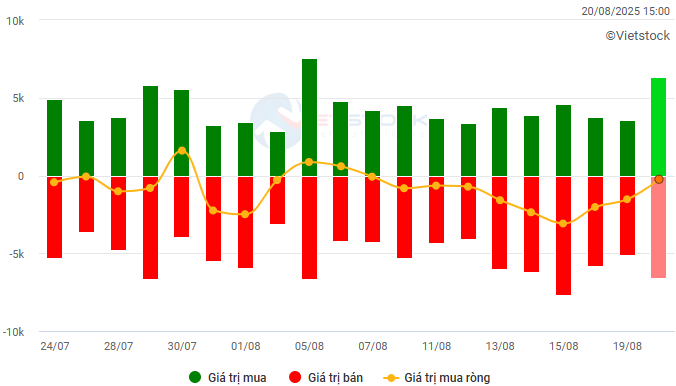

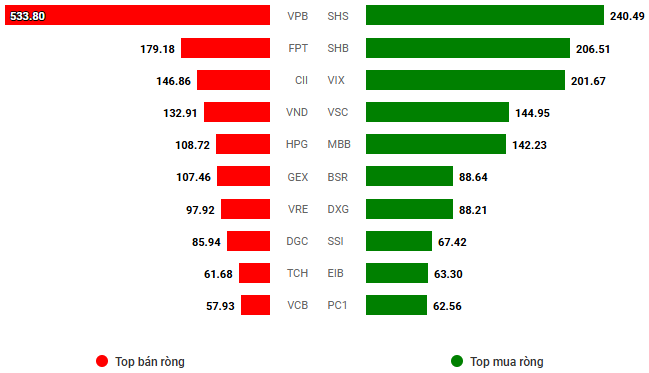

– Foreign investors continued to sell off, with a net sell value of more than VND 433 billion on the HOSE, but net bought nearly VND 207 billion on the HNX.

Trading value of foreign investors on the HOSE, HNX, and UPCOM. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– The market experienced strong fluctuations during the trading session on August 20. After more than an hour of fluctuating around the 1,660-point threshold, increasing selling pressure caused the VN-Index to plunge, losing nearly 40 points and dropping to 1,615 points. Despite the dominance of red across the market, the strong performance of large-cap stocks helped the index recover impressively, even turning green in the afternoon session. At the close, the VN-Index stood at 1,664.36 points, up 0.61% from the previous session.

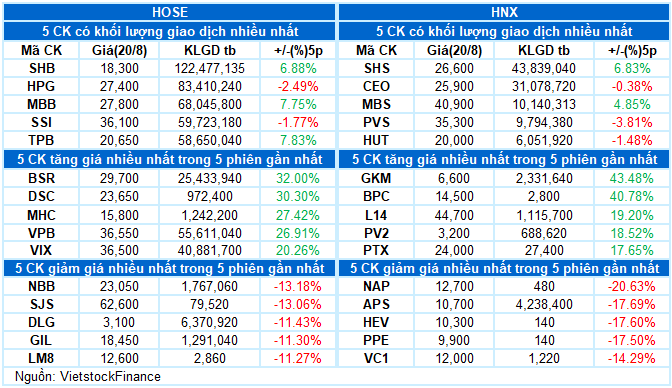

– In terms of impact, the duo of VIC and VHM contributed the most to the impressive reversal of the VN-Index, bringing the index up by nearly 11 points. Following were VPB, TCB, and LPB, which collectively added more than 9 points to the overall gain. On the other hand, VCB and HPG were the two stocks with the most negative influence, causing the index to lose 3.6 points.

– The VN30-Index closed with an increase of 18 points, reaching 1,828.46 points. However, the number of declining stocks slightly outnumbered the advancing ones, with 17 stocks decreasing, 12 increasing, and 1 remaining unchanged. Among the gainers, LPB, VPB, and VIB stood out with their strong performance. VHM and VIC also broke out, surging more than 5%. Conversely, stocks such as PLX, DGC, TPB, HPG, and FPT witnessed notable corrections, falling around 3%.

There was a clear divergence among industry groups. The real estate sector led the gains, with prominent names including VIC (+5.08%), VHM (+5.43%), SSH (+1.63%), IDC (+2.51%), TCH (+2.78%), TAL (+5.13%), and KBC, which hit the daily limit-up. However, several stocks in this sector also underwent deep corrections, such as PDR (-4.67%), CEO (-4.07%), NVL (-3.33%), NLG (-4.65%), HDC (-5.54%), SCR (-5%), and NHA (-6.69%), among others.

Similarly, the financial sector saw many stocks continue their strong momentum, including VPB, VIB, LPB, and OCB, which hit the daily limit-up, along with SHS (+2.31%), STB (+1.69%), CTG (+2.02%), MSB (+3.81%), TCB (+3.32%), SSB (+4.35%), VDS (+6.73%), and BVB (+8%). Nevertheless, red also appeared interspersed with notable decliners, such as SHB (-1.08%), EIB (-2.89%), TPB (-2.82%), HDB (-2%), MBB (-1.42%), VCB (-1.87%), SSI (-1.77%), VND (-2.63%), and MBS (-3.99%).

Information technology and media & telecommunications were the two groups at the bottom today, falling more than 2% each. Most stocks in these sectors plunged into red territory, including FPT (-2.59%), CMG (-3.9%), ELC (-3.34%), DLG (-4.32%); YEG (-5%), CTR (-2.49%), VGI (-2.72%), FOX (-2.35%), MFS (-3.13%), and TTN (-3.47%), to name a few.

The VN-Index experienced strong fluctuations but managed to recover towards the end of the session, with trading volume increasing above the 20-day average. The uptrend remains intact as the MACD indicator stays above the signal line without any signs of weakness. However, the risk of fluctuations in the coming sessions persists as the index is at a historical peak. In case selling pressure increases, the middle line of the Bollinger Bands will act as a crucial support level.

II. TREND AND PRICE MOVEMENT ANALYSIS

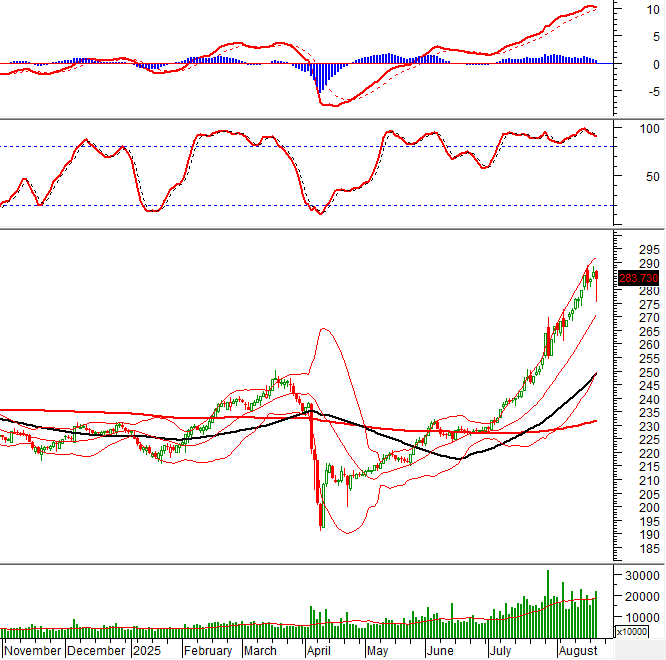

VN-Index – Strong fluctuations with trading volume increasing above the 20-day average

The VN-Index experienced strong fluctuations but managed to recover towards the end of the session, with trading volume increasing above the 20-day average.

The uptrend remains intact as the MACD indicator continues to stay above the signal line without showing any signs of weakness. However, the risk of fluctuations in the upcoming sessions persists as the index is at a historical peak. Should selling pressure intensify, the middle line of the Bollinger Bands will serve as a crucial support level.

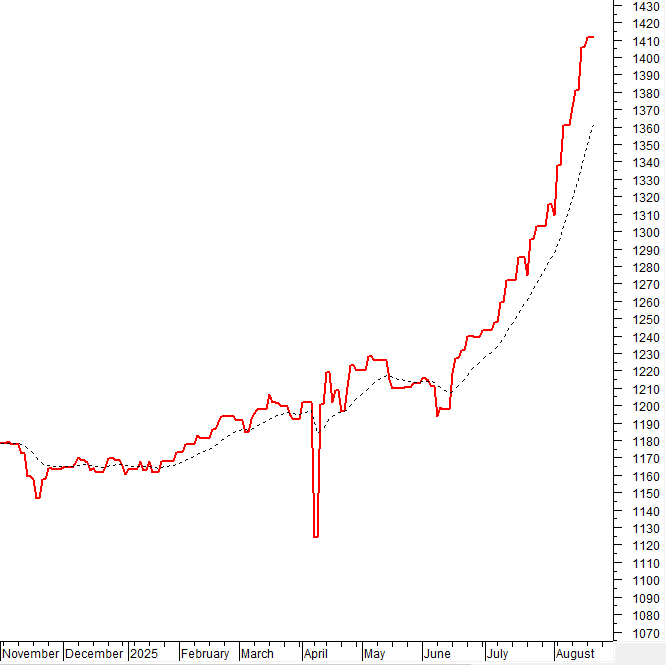

HNX-Index – Stochastic Oscillator continues to decline after giving a sell signal

The HNX-Index declined with trading volume above the 20-day average, indicating increasing selling pressure.

At present, the Stochastic Oscillator continues to move downward after providing a sell signal, while the MACD is gradually narrowing the gap with the signal line. Investors should be cautious as the risk of a correction may increase if the MACD confirms a sell signal in the upcoming sessions.

Money Flow Analysis

Changes in smart money flow: The Negative Volume Index indicator of the VN-Index is currently above the 20-day EMA. If this condition persists in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Changes in foreign capital flow: Foreign investors continued to offload holdings during the trading session on August 20, 2025. If this trend persists in the coming sessions, the situation may turn more pessimistic.

III. MARKET STATISTICS ON AUGUST 20, 2025

Economics & Market Strategy Division, Vietstock Consulting

– 17:13 08/20/2025

Market Beat: Pulling Major Stocks, VN-Index Makes a Strong Comeback at the End of the Session.

The trading session concluded with the VN-Index climbing 10.16 points (+0.61%), reaching 1,664.36. In contrast, the HNX-Index witnessed a decline of 2.72 points (-0.95%), settling at 283.73. The market breadth tilted towards decliners, as 569 stocks closed in the red, while 238 stocks ended in the green. Within the VN30 basket, 17 stocks fell, 12 advanced, and 1 remained unchanged, resulting in a slightly bearish sentiment.

“VN-Index: A Clear Path to Conquer the 1,700-Point Threshold?”

The VN-Index climbed for the fourth consecutive session, closely hugging the upper band of the Bollinger Bands. While trading volume has been volatile in recent sessions, indicating investor sentiment is not yet firmly established, the rally has been largely driven by large-cap stocks. Nonetheless, the MACD indicator continues to trend upward without showing any signs of weakness, suggesting the VN-Index could soon breach the 1,700-point threshold in upcoming sessions.

“Vietstock Daily 20/08/2025: Sustaining the Uptrend”

The VN-Index reached new heights, with trading volume recovering above the 20-session average. The upward trend of the index remains robust as the MACD indicator continues to widen the gap with the signal line, providing a strong buy signal. However, investors should be cautious of potential short-term volatility if the Stochastic Oscillator indicator continues to weaken.

Market Pulse for August 22: Pessimism Prevails as Foreign Investors Heavily Sell Off HPG

The market closed with notable losses, as the VN-Index dipped by 42.53 points (-2.52%), settling at 1,645.47. Likewise, the HNX-Index witnessed a decline of 11.91 points (-4.19%), ending the day at 272.48. The overall market breadth was dominated by decliners, with 647 stocks trading lower against 180 gainers. This bearish sentiment was echoed in the VN30 basket, where 26 stocks closed in the red versus just 4 in the green.