New Decree on Land Use Fee Credit Regulations for Red Book Issuance

The Government has recently issued Decree No. 226, amending and supplementing several articles of the decrees detailing the implementation of the Land Law. This decree came into effect on August 15, 2025.

Decree 226 amends and supplements Decree 101, dated July 29, 2024, which pertains to land surveys, registration, and the issuance of land-use rights and ownership certificates (known as “red books”).

Decree 226 amends regulations on land-use fee credit for red book issuance. Illustrative image.

|

Specifically, it modifies points a and c of Clause 11, Article 18 of Decree 101, which pertain to land-use fee credit when issuing land-use rights and ownership certificates for the first time.

According to the new regulations, individuals and households who are using land and wish to have their land-use fees credited are eligible for this scheme. The procedures for recording, paying off, and clearing the land-use fee debt shall follow the regulations governing land-use fee collection and land leasing.

The debt period for those specified in point a of this Clause will last until the land user exercises their right to convert, transfer, donate, or mortgage their land-use rights or use them as capital contribution. In such cases, they must pay off the remaining land-use fee debt before proceeding. However, if the land is donated or inherited, and the recipient belongs to a poor or near-poor household, they may continue to have the debt recorded.

The amount and duration of the credit remain unchanged from Decree 101. Specifically, the entire land-use fee that must be paid at the time of certificate issuance is eligible for credit under point a of this Clause.

The land-use fee credit scheme for those specified in point a of this Clause will be implemented from August 1, 2024, to July 31, 2029. The repayment and clearance of the land-use fee debt shall follow the regulations on land-use fee collection and land leasing.

New Regulations on Appraisal and Approval of Land Auction Plans

Decree 226 also amends and supplements Article 55 of Decree 102, which pertains to land auctions when the State allocates land with a land-use fee or land lease.

Specifically, Clause 4 of Article 55, concerning the appraisal and approval of land auction plans, has been modified. In the case of land auctions that fall under the authority of the Chairman of the Commune-level People’s Committee, the commune-level land management agency shall examine and finalize the dossier before submitting it to the Chairman for approval.

If the land auction falls under the authority of the Provincial People’s Committee Chairman, the provincial land management agency shall examine and finalize the dossier before submitting it to the Chairman for approval.

Compensation for Land Requisition: An Additional Case

The decree also inserts Article 14a after Article 14 of Decree 88, dated July 15, 2024, which pertains to compensation, support, and resettlement when the State requisitions land. The new article stipulates that in cases of compensation for long-term trees that bear fruit multiple times, as mentioned in Clause 2, Article 103 of the Land Law, if the unharvested yield of the garden corresponding to the remaining years in the harvest cycle cannot be determined, the compensation amount shall be equal to the actual damage value of the garden.

In situations where the Provincial People’s Committee is considering issuing compensation rates for crop damage, as mentioned in Clause 6, Article 103 of the Land Law, and there is no production process for crops and livestock issued by the competent authority, it shall base its decision on the actual situation of the locality…

Phan Thiên

– 18:57 17/08/2025

The Ultimate Real Estate Opportunity: A Prime Lot in Hanoi Fetching an Astonishing 30 Billion VND per Square Meter at Auction

The three auction plots in Dong Lai village, Quang Tien commune, Soc Son district (Hanoi) attracted bids of up to 30 billion VND per square meter, only to be met with silence in the following round.

The Master Wordsmith’s Craft: Crafting a Captivating Headline

“Unveiling the Expert’s Land Auction Deposit Reduction Strategies: A Comprehensive Guide”

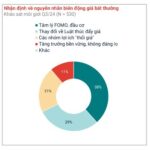

The proposed real estate tax reforms are designed to address the issues of land speculation and contract flipping. By increasing taxes on properties that are sold shortly after being acquired, or on land that remains undeveloped, the reforms aim to discourage speculative practices and reduce instances of price gouging and contract abandonment.