Meanwhile,

The total value of the shares traded was over VND 11.33 billion, corresponding to an average price of nearly VND 11,000 per share, which was 11% lower than the closing price of VND 12,400 per share on the same day. No matched transactions were recorded during this period.

Prior to this transaction, GTD’s share price had increased for two consecutive sessions, including one ceiling session. Following the transaction, the code continued to surge with four consecutive gaining sessions, including three ceiling sessions from August 18-20.

By August 21, GTD’s reference price stood at VND 19,600 per share, the highest level since mid-June 2022, representing a 58% increase within just one week. Over a three-month period, the share price rose by more than 92% and showed a 53% increase compared to the same period last year. The average trading volume for the year was approximately 850 shares per session.

| GTD Share Price Movement over the Past Year |

During this time, Commercial Investment Thai Binh JSC also registered to sell all of its 930,000 GTD shares, equivalent to 10% of the capital. The expected trading period is from August 21 to September 15 through matched transactions for portfolio restructuring. If successful, the organization will withdraw from the list of shareholders.

Commercial Investment Thai Binh JSC is an organization related to several high-ranking leaders at GTD, including two members of the Board of Directors, Ms. Tran Thi Giang Thuy and Ms. Tran Thi Hong Sam, and a member of the Supervisory Board, Mr. Nguyen Quoc Cuong. However, none of them directly own any shares.

In addition, GTD also has Ms. Tran Thi Thanh, an unrelated major individual shareholder, holding 5.35% of the capital. Previously, Ms. Thanh owned 6.27% but reduced her ownership in mid-June 2025.

Prolonged Business Challenges

Once known as a “national” shoe brand,

|

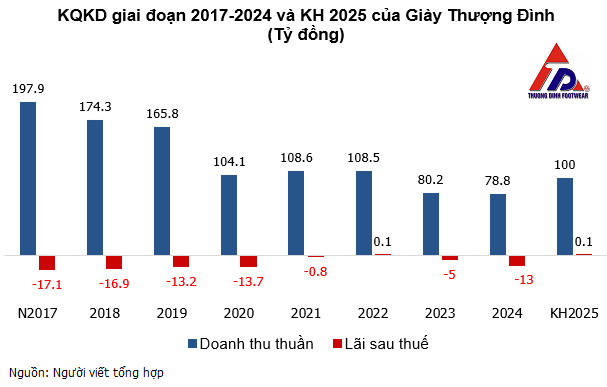

For 2025, GTD set a target to produce 700,000-900,000 pairs of shoes, with approximately one-third for export. The company aims to achieve a revenue of VND 100 billion and a modest profit of VND 100 million. The management emphasized that despite the small figure, it marks an important step after years of losses.

Another key focus is the plan for state capital divestment. The Hanoi People’s Committee currently represents 68.67% of GTD’s capital. The management warned that if the divestment is delayed, there is a significant risk of state capital loss.

Can Vietnam’s Oldest Shoe Brand Survive?

The Mighty

– 17:44 21/08/2025

The Privatization of the Cienco: How Did Cienco 6 End Up Under the Control of the Thuân Vietnam Group Without Finding a Strategic Investor?

In 2014, among the various Cienco companies that went public, Cienco 6 struggled the most to attract investors and failed to secure a strategic shareholder. It was not until 2018 that the company found its footing when Vo Van Be, the founder of Thuân Viet, officially took on the role of Chairman of the Board of Cienco 6.