The Vietnamese National Assembly’s passage of Resolution 222/2025/QH15 on the International Financial Center in Vietnam and, more recently, Prime Minister Pham Minh Chinh’s chairmanship of the conference on the establishment of the country’s International Financial Center (IFC) demonstrate Vietnam’s strong determination to turn this vision into a reality.

Additionally, the government has set a target for the Vietnam IFC to be established and operational by the end of this year, with the aspiration of ranking among the top 75 global financial centers by 2035.

However, as Prime Minister Pham Minh Chinh has described the endeavor as “new, challenging, sensitive, and unprecedented,” the crucial question now is how to ensure success in establishing the Vietnam IFC.

The degree of openness in the “institutional gateway” is of utmost importance.

Mr. Mai Huy Tuan, CEO of SSI Digital, a domestic enterprise, shared his perspective with the press. He believes that the first and most critical factor in establishing an international financial center is having open policies. Once the legal framework is in place, highly skilled professionals with a deep understanding and practical experience in global finance will be attracted to Vietnam, provided they have a solid legal foundation. These experts will develop business models, connect with traditional and non-traditional financial systems, and manage diverse financial flows, thereby fostering the emergence of a genuine financial hub.

In today’s world, the concept of a financial center is no longer confined to a physical location. With the advent of the digital age in finance, cross-border activities are facilitated by technologies such as blockchain, AI, and cryptocurrency.

Mr. Tuan also emphasized that the development of an international financial center is not measured by the number of buildings or hectares of land, but by its ability to attract and unite a global community of financial experts.

This entails creating an environment that empowers individuals to explore innovative ideas and experiment with new models. It also necessitates a supportive stance from central and municipal leaders and relevant ministries, who must be willing to open the “institutional gateway” to accommodate these novel approaches.

The effectiveness of the Vietnam IFC hinges on the degree of openness in the “institutional gateway” toward novel models. |

A Breakthrough, Innovative Business Environment Is Essential

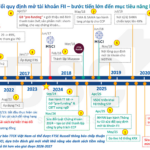

While acknowledging the significance of the short-term goal of launching the Vietnam IFC, Associate Professor and Doctor Nguyen Huu Huan, a lecturer at the University of Economics Ho Chi Minh City’s Banking Faculty, emphasized that a well-prepared implementation roadmap is necessary for the center to operate smoothly and efficiently.

Dr. Huan pointed out that, in addition to the resolution, there will soon be a decree and subsequent guiding circulars, which will provide a crucial legal basis for the IFC’s operations. Simultaneously, the development of hardware and software infrastructure and organizational structures should proceed in tandem.

On a deeper level, Dr. Huan suggested that establishing a bona fide international financial center is a long-term endeavor. Building the requisite financial infrastructure cannot be rushed, especially considering Vietnam’s relative inexperience in this domain compared to other nations.

By learning from the successes and challenges faced by established financial centers in other countries, Vietnam can expedite its progress. However, it is imperative to strike a unique path rather than merely emulating existing models.

For instance, if it typically takes 7–10 years for prominent international financial centers to establish themselves, Vietnam may aim to shorten this timeframe to 3–5 years or even less by adopting innovative, fast-track approaches.

According to Dr. Huan, offering solely traditional financial products will not suffice to attract investors. While competitive tax incentives are necessary, they are not sufficient. Vietnam’s IFC model must be creative and distinctive in terms of organizational structure, exchange operations, and the range of products and services offered.

“Creating a breakthrough business environment with flexible mechanisms to foster the development of novel financial and technological models is of paramount importance,” asserted Dr. Huan. He emphasized that the IFC should serve as an epicenter of innovation…

Mr. Thuat Nguyen, the Vietnamese-American founder and director of Kyros Ventures, a venture capital fund, attested to the exceptional talent of Vietnamese professionals based on his extensive experience in the global financial industry.

Mr. Nguyen emphasized the need for a unique mechanism to establish an appealing, transparent, and welcoming environment within the Vietnam IFC. This will facilitate the repatriation of talented Vietnamese individuals, encouraging them to return to Vietnam to work, invest, and contribute to the growth of this community.

|

The Legal System Requires Heightened Transparency According to Associate Professor and Doctor Nguyen Thuong Lang, a senior lecturer at the National Economics University, banks must take the lead in driving the integration of the financial system into the international arena with depth and effectiveness. By harnessing the advancements in global financial technology and swiftly adapting them to new contexts, a modern financial system can be established. Moreover, Dr. Lang asserted that a prerequisite for successfully attracting international financial institutions to the Vietnam IFC is a legal system that is clear, concise, forward-thinking, and attractive. This system should also exhibit a high level of transparency, adhere to market principles, and meet international credibility standards. Additionally, a competent workforce capable of managing and developing the market is essential. |

MINH TRÚC

– 10:46 18/08/2025

The Private IPO Platform and Open-source Custody Certificates: Unlocking Capital for Businesses?

In a booming economic landscape, with the VN-Index surpassing 1,600 points and the government targeting double-digit GDP growth, new avenues for capital raising are emerging for Vietnamese businesses. A standout development is the introduction of dedicated IPO platforms operated by securities firms, along with the advent of international depositary receipts, which are expected to serve as game-changers. These innovative tools offer businesses a more flexible and streamlined approach to accessing capital, bypassing traditional complex processes.

The Financial Hub: It’s Not About the Number of Skyscrapers or Acres of Land

“Vietnamese enterprises believe that the first and most crucial factor is an open-door policy. Economic experts emphasize that while tax incentives are necessary, they are not sufficient for fostering true competition. Instead, the key lies in creating a revolutionary business environment, one that fosters flexibility and encourages the development of novel financial and technological models.”