A Solid Foundation: Macroeconomic and Policy Support

The market’s growth momentum is being bolstered by three key pillars.

Firstly, the global monetary environment is becoming more favorable. The anticipated rate cut by the US Federal Reserve in the coming months will put pressure on the US dollar, easing domestic exchange rate pressures and curbing foreign outflows. This creates an opportunity for international investment flows to return to emerging markets such as Vietnam.

Secondly, the story of Vietnam’s market upgrade from frontier to emerging status is entering a crucial phase. This is seen as a historic boost, potentially attracting billions of dollars from large investment funds, especially global index funds. More importantly, this process will catalyze improvements in transparency, corporate governance, and trading infrastructure.

Thirdly, supportive domestic policies remain a crucial backbone. The pilot credit room expansion, maintained low-interest rates, and improved access to capital will directly bolster businesses’ financial health, benefiting the capital market.

Post-Upgrade Landscape: From Capital to Quality

After the initial excitement driven by foreign capital, the market will enter a new phase, focusing on the core elements of quality and diversity in listed “products.”

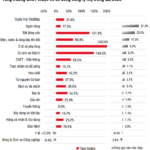

Both international and domestic investors will delve deeper into companies’ fundamentals, including revenue, profitability, sustainable growth rates, and capital efficiency. The market will witness a strong differentiation, moving away from uniform growth.

The emergence of large-scale IPOs from leading enterprises will enhance the market’s depth and appeal, aligning the VN-Index more closely with the economy’s true health. This marks a shift from “growth by capital” to “growth by enterprise resilience.”

Short-Term Challenges and “Trial by Fire”

However, the path ahead is not without obstacles. After a prolonged growth cycle, the market is trading at historical highs, and technical indicators are signaling “overbought” conditions. This increases the likelihood of corrective phases to absorb short-term profit-taking.

The 1,600-point mark is not just a technical resistance level but also a significant psychological barrier. Failing to sustain this level with high volume could lead to a deeper correction before finding a new equilibrium. Such fluctuations are inevitable and should be viewed as part of the upward journey.

Investment Strategies: Navigating the Short-Term Swells and Long-Term Potential

In the context of “short-term fervor intertwined with long-term potential,” investors need a flexible yet consistent strategy.

In the near term, be mentally prepared for market fluctuations and corrections. These are not indicative of a trend reversal but necessary setbacks to fortify the foundation for a more sustainable growth cycle.

Over the medium to long term, the fundamental factors remain supportive of an upward trajectory. Favorable macroeconomic prospects, the clear path toward market upgrade, and enhanced quality of listed companies will be the main narratives driving the market.

Market corrections present not only challenges but also golden opportunities to restructure portfolios, channeling capital into fundamentally strong stocks with distinct growth stories that benefit directly from foreign capital inflows and the market’s quality enhancement drive. The prudent strategy now is to blend short-term risk management with a long-term vision, turning the upcoming waves into opportunities to embrace a new cycle of robust and high-quality growth.

Nguyễn Quang Huy – CEO of Finance and Banking, Nguyen Trai University

The Race to the Top: How Vietcombank, MB, VPBank, and HDBank Soar After a 50% Cut in Reserve Requirements

The decision by the State Bank of Vietnam to reduce the mandatory reserve ratio by 50% for credit institutions participating in the restructuring process has provided a significant liquidity boost for the four banks involved in the transfer. This policy move has had a multifaceted impact, simultaneously reducing funding costs, directly enhancing liquidity, and promoting credit growth.

Does Loosening Credit Room Affect Savings Deposits?

The credit growth landscape is set for a potential surge, however, we shouldn’t expect a rush to increase lending rates. This surge won’t spark a rate race, and it’s important to note that deposit savings of the public remain secure and unaffected.

The Art of Monetary Policy: Navigating Interest Rates and Exchange Rates with Agile Governance.

The government has requested that the State Bank of Vietnam proactively undertake research, evaluation, and forecasting within the scope of its functions, tasks, and authority. This includes developing monetary policy scenarios and orientations from now until the end of 2025 and for 2026. A report is to be submitted to the Government’s Standing Committee for consideration and feedback no later than August 20, 2025.