On August 22, HFIC announced the sale of nearly 5.4 million subscription rights, equivalent to nearly 2.7 million HCM shares, generating proceeds of nearly VND 37 billion (VND 6,875 per subscription right). This sale was part of the company’s registered offering during the period of August 12-18. Notably, this amount only achieved 4.4% of HFIC’s target, as investors did not fully subscribe to the auctioned subscription rights.

On the same day, the organization immediately registered to sell the remaining nearly 116.3 million subscription rights at the same price of VND 6,875 per right, expecting to collect the remaining amount of over VND 799 billion. This time, HFIC changed the method to direct negotiated sales to investors, scheduled for the period of August 27 – September 5.

HFIC continues to register to sell all subscription rights for HCM shares, expecting proceeds of nearly VND 800 billion – Illustrative image

|

It is known that this is the offering of shares to existing shareholders announced by HCM not long ago, with the ex-rights date set as June 24.

According to the plan, HCM will offer nearly 360 million shares to existing shareholders through the exercise of subscription rights, corresponding to a ratio of 2:1 (1 share enjoys 1 subscription right, and 2 subscription rights can buy 1 new share). If successful, the company will increase its charter capital from VND 7,208 billion to VND 10,808 billion.

As stipulated by HCM, shareholders are allowed to transfer subscription rights once to other entities, and domestic shareholders are not permitted to transfer subscription rights to foreign investors.

With a sale price of VND 10,000 per share, HCM could raise nearly VND 3,600 billion, of which 70% will be used to supplement capital for margin lending and 30% for proprietary trading.

Initially, the subscription right transfer period was set from July 14 to August 8, and the registration and payment period was from July 14 to August 13. However, the company later adjusted its plans due to the extension of the share distribution period, with the subscription right transfer period extended to September 9 and the registration and payment deadline extended to September 12.

Holding over 121.6 million HCM shares (a 16.88% stake), HFIC received more than 121.6 million subscription rights, corresponding to the potential ownership of an additional 60.8 million shares.

On August 5, HFIC announced the transfer of all subscription rights at a starting price of VND 6,875 per right, expecting to raise over VND 836 billion. As a result, the organization was unable to sell all the rights in the first attempt and proceeded to register for the sale of the remaining rights as mentioned above.

Notably, with the expected proceeds and the corresponding number of more than 60.8 million HCM shares from the subscription rights, it can be inferred that HFIC is valuing HCM shares at VND 13,750 per share, higher than the offering price of VND 10,000 per share set by HCM.

In the stock market, HCM shares have recently witnessed a strong upward momentum, setting new milestones after experiencing a decline due to the tariff shock that impacted the entire Vietnamese stock market.

At the close of August 22, HCM was trading at VND 26,700 per share, up 17% since the beginning of the year, accompanied by an average liquidity of nearly 12.8 million shares per day.

| HCM share price has reached a new milestone |

Regarding HFIC, a founding shareholder of HCM in 2003 (then known as the Ho Chi Minh City Urban Development Investment Fund – HIFU), in addition to directly holding a 16.88% stake and being the second largest shareholder after Dragon Capital (holding 31.51%), there are also close connections at this securities company.

Specifically, Tran Quoc Tu, Head of Legal, and Phan Quynh Anh, Deputy Head of Finance and Accounting, are members of the Board of Directors of HCM; Tran Thai Phuong, Deputy Head of Capital Management and Trading, is a member of the Supervisory Board of HCM. At the same time, these three individuals also represent HFIC’s capital contribution at HCM, with ratios of 8%, 6%, and 2.88%, respectively.

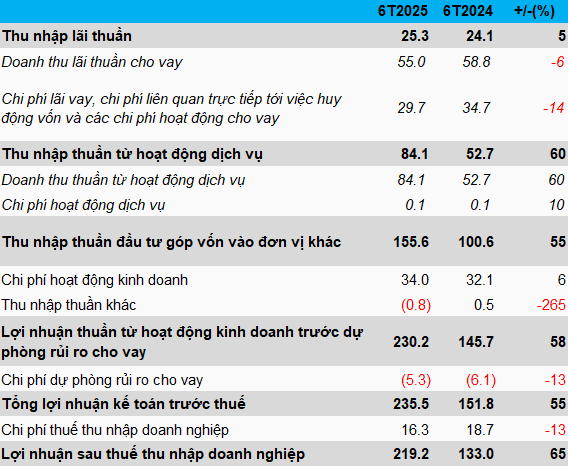

In the first half of 2025, HFIC recorded a net profit of over VND 219 billion, up 65% from the first half of 2024 and achieving 60% of the yearly plan. This performance was mainly driven by a surge in dividends and profit sharing during the period.

Specifically, for investment in capital contribution to other entities – HFIC’s main source of income – there was a significant increase of 55% in net income, reaching nearly VND 156 billion. The income structure underwent a significant change, with the entire amount derived from dividends and profit sharing during this period, 2.7 times higher than the previous year, while there was no longer any income recorded from the transfer of HCM shares.

In terms of net interest income, HFIC earned more than VND 25 billion in the first six months of the year, up 5% from the same period last year. Despite a 6% decline in lending interest revenue, a 14% reduction in interest expenses and costs directly related to capital mobilization positively impacted the results of this segment.

Net income from service activities amounted to over VND 84 billion, a growth of 60%. Service revenue mainly came from deposit interest, recording nearly VND 83 billion in the first half of the year, up 63%.

In 2025, HFIC targets a net profit of over VND 363 billion. Thus, after the first half of 2025, the company has achieved 60% of its yearly plan.

|

Financial results for the first half of 2025 of HFIC

(Unit: Billion VND)

Source: Author’s compilation

|

As of the end of the second quarter of 2025, HFIC’s total assets exceeded VND 11,973 billion, slightly higher than at the beginning of the year. Investments accounted for 86% of the structure, equivalent to more than VND 10,248 billion, a decrease of 5% compared to the beginning of the year.

HFIC invested more than VND 6,399 billion, including over VND 2,619 billion in subsidiaries, over VND 1,917 billion in joint ventures and associates, and nearly VND 1,863 billion in other entities. However, the company has to make impairment provisions for investment of nearly VND 449 billion.

In the portfolio, there are two investments with a scale of thousands of billions, including nearly VND 1,297 billion in Ho Chi Minh City Lottery One-Member Limited Liability Company; nearly VND 1,178 billion in Ho Chi Minh City Housing Management and Trading One-Member Limited Liability Company; and nearly VND 1,011 billion in HCM, with a fair value of over VND 2,345 billion, 2.3 times the book value but down 27% from the beginning of the year.

– 11:37 23/08/2025

The Dairy Industry’s Second Quarter: A Tale of Contrasting Fortunes

The second quarter of 2025 proved challenging for the dairy industry as soaring selling costs pressured profits, despite many businesses boasting record-breaking revenues.